Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

Piazza della Repubblica 2, and its principal objects, as set out in Article 4 of its by-Laws, are deposit-taking and<br />

the carrying-out of all forms of lending activities. Its aim is to generate value for shareholders and to promote<br />

activities for moral and economic improvement. For such purposes, it may, subject to compliance with<br />

legislation in force and obtaining the required authorisations and the approval from the supervisory authority,<br />

perform any transactions or banking services, together with any other activity incidental to or in any way<br />

connected with the achievement of its corporate objects, including the issue of bonds.<br />

Areas of activity – general<br />

<strong>Banca</strong> di Valle Camonica is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by<br />

maintaining a close relationship with its customers in the territory where it operates. The bank is present in<br />

Lombardy and has a distinctive capability in understanding and serving the requirements of the local economy in<br />

that area. It carries on its business with the support and services provided directly or indirectly through its<br />

subsidiaries by its parent company, <strong>UBI</strong> <strong>Banca</strong>, and offers and sells products and services developed at parent<br />

bank level. It has a sales model divided up according to market segment: Retail (predominant activity of the<br />

Bank), Corporate and Private. Because of the wide range of product companies within the <strong>UBI</strong> Group, <strong>Banca</strong> di<br />

Valle Camonica is able to offer services and products which are both customised and evolved over time, and<br />

which are aimed at satisfying the needs of different kinds of customers.<br />

Lending<br />

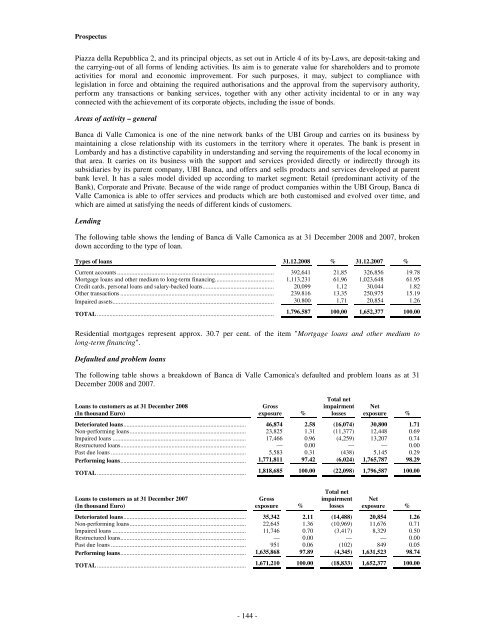

The following table shows the lending of <strong>Banca</strong> di Valle Camonica as at 31 December 2008 and 2007, broken<br />

down according to the type of loan.<br />

Types of loans 31.12.2008 % 31.12.2007 %<br />

Current accounts ..................................................................................................... 392,641 21,85 326,856 19.78<br />

Mortgage loans and other medium to long-term financing...................................... 1,113,231 61,96 1,023,648 61.95<br />

Credit cards, personal loans and salary-backed loans.............................................. 20,099 1,12 30,044 1.82<br />

Other transactions ................................................................................................... 239.816 13,35 250,975 15.19<br />

Impaired assets........................................................................................................ 30.800 1,71 20,854 1.26<br />

TOTAL .................................................................................................................. 1.796.587 100,00 1,652,377 100.00<br />

Residential mortgages represent approx. 30.7 per cent. of the item "Mortgage loans and other medium to<br />

long-term financing".<br />

Defaulted and problem loans<br />

The following table shows a breakdown of <strong>Banca</strong> di Valle Camonica's defaulted and problem loans as at 31<br />

December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans............................................................................... 46,874 2.58 (16,074) 30,800 1.71<br />

Non-performing loans........................................................................... 23,825 1.31 (11,377) 12,448 0.69<br />

Impaired loans ...................................................................................... 17,466 0.96 (4,259) 13,207 0.74<br />

Restructured loans................................................................................. — 0.00 — — 0.00<br />

Past due loans ....................................................................................... 5,583 0.31 (438) 5,145 0.29<br />

Performing loans................................................................................. 1,771,811 97.42 (6,024) 1,765,787 98.29<br />

TOTAL ................................................................................................ 1,818,685 100.00 (22,098) 1,796,587 100.00<br />

Loans to customers as at 31 December 2007<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans............................................................................... 35,342 2.11 (14,488) 20,854 1.26<br />

Non-performing loans........................................................................... 22,645 1.36 (10,969) 11,676 0.71<br />

Impaired loans ...................................................................................... 11,746 0.70 (3,417) 8,329 0.50<br />

Restructured loans................................................................................. — 0.00 — — 0.00<br />

Past due loans ....................................................................................... 951 0.06 (102) 849 0.05<br />

Performing loans................................................................................. 1,635,868 97.89 (4,345) 1,631,523 98.74<br />

TOTAL ................................................................................................ 1,671,210 100.00 (18,833) 1,652,377 100.00<br />

- 144 -