Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

that area. It carries on its business with the support and services provided directly or indirectly through its<br />

subsidiaries by its parent company, <strong>UBI</strong> <strong>Banca</strong>, and offers and sells products and services developed at parent<br />

bank level. It has a sales model divided up according to market segment: Retail, Corporate and Private. Because<br />

of the wide range of product companies within the <strong>UBI</strong> Group, Banco di San Giorgio is able to offer services and<br />

products which are both customised and evolved over time, and which are aimed at satisfying the needs of<br />

different kinds of customers.<br />

Lending<br />

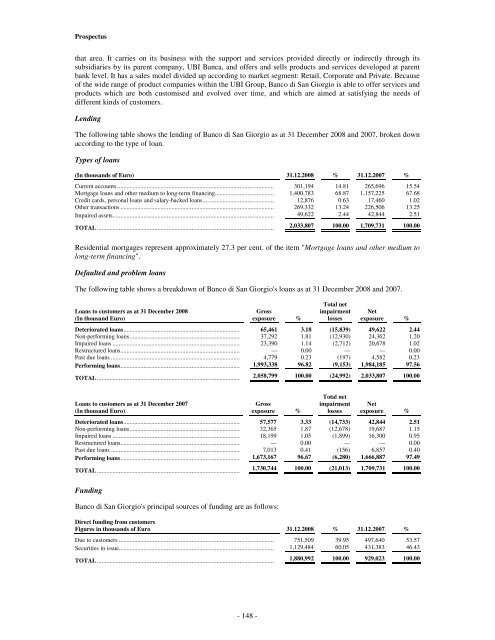

The following table shows the lending of Banco di San Giorgio as at 31 December 2008 and 2007, broken down<br />

according to the type of loan.<br />

Types of loans<br />

(In thousands of Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts ..................................................................................................... 301,194 14.81 265,696 15.54<br />

Mortgage loans and other medium to long-term financing...................................... 1,400,783 68.87 1,157,225 67.68<br />

Credit cards, personal loans and salary-backed loans.............................................. 12,876 0.63 17,460 1.02<br />

Other transactions ................................................................................................... 269,332 13.24 226,506 13.25<br />

Impaired assets........................................................................................................ 49,622 2.44 42,844 2.51<br />

TOTAL .................................................................................................................. 2,033,807 100.00 1,709,731 100.00<br />

Residential mortgages represent approximately 27.3 per cent. of the item "Mortgage loans and other medium to<br />

long-term financing".<br />

Defaulted and problem loans<br />

The following table shows a breakdown of Banco di San Giorgio's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans........................................................................... 65,461 3.18 (15,839) 49,622 2.44<br />

Non-performing loans....................................................................... 37,292 1.81 (12,930) 24,362 1.20<br />

Impaired loans .................................................................................. 23,390 1.14 (2,712) 20,678 1.02<br />

Restructured loans............................................................................. — 0.00 — — 0.00<br />

Past due loans ................................................................................... 4,779 0.23 (197) 4,582 0.23<br />

Performing loans............................................................................. 1,993,338 96.82 (9,153) 1,984,185 97.56<br />

TOTAL ............................................................................................ 2,058,799 100.00 (24,992) 2,033,807 100.00<br />

Loans to customers as at 31 December 2007<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans........................................................................... 57,577 3.33 (14,733) 42,844 2.51<br />

Non-performing loans....................................................................... 32,365 1.87 (12,678) 19,687 1.15<br />

Impaired loans .................................................................................. 18,199 1.05 (1,899) 16,300 0.95<br />

Restructured loans............................................................................. — 0.00 — — 0.00<br />

Past due loans ................................................................................... 7,013 0.41 (156) 6,857 0.40<br />

Performing loans............................................................................. 1,673,167 96.67 (6,280) 1,666,887 97.49<br />

TOTAL ............................................................................................ 1,730,744 100.00 (21,013) 1,709,731 100.00<br />

Funding<br />

Banco di San Giorgio's principal sources of funding are as follows:<br />

Direct funding from customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Due to customers .................................................................................................... 751,509 39.95 497,640 53.57<br />

Securities in issue.................................................................................................... 1,129,484 60.05 431,383 46.43<br />

TOTAL .................................................................................................................. 1,880,992 100.00 929,023 100.00<br />

- 148 -