Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

support and services provided, directly or indirectly through its subsidiaries, by its parent company, <strong>UBI</strong> <strong>Banca</strong>,<br />

and offers and sells products and services developed at parent bank level. It has a sales model divided up<br />

according to market segment: Retail (predominant activity of the Bank), Corporate and Private. Because of the<br />

wide range of product companies within the <strong>UBI</strong> Group, <strong>Banca</strong> Popolare di Ancona is able to offer services and<br />

products which are both customised and evolved over time, and which are aimed at satisfying the needs of<br />

different kinds of customers.<br />

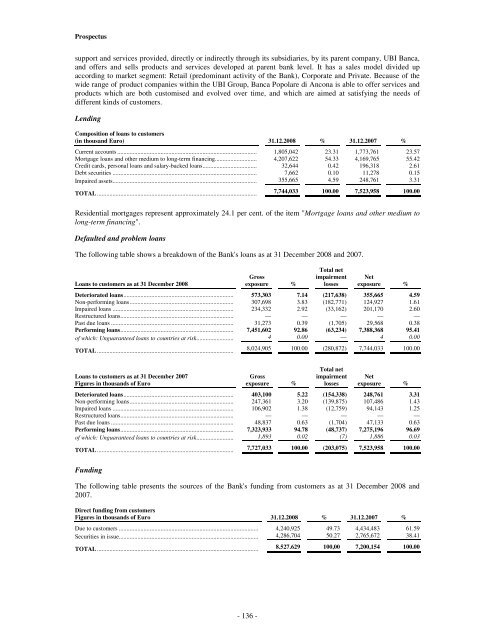

Lending<br />

Composition of loans to customers<br />

(in thousand Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts .......................................................................................... 1,805,042 23.31 1,773,761 23.57<br />

Mortgage loans and other medium to long-term financing........................... 4,207,622 54.33 4,169,765 55.42<br />

Credit cards, personal loans and salary-backed loans................................... 32,644 0.42 196,318 2.61<br />

Debt securities ............................................................................................. 7,662 0.10 11,278 0.15<br />

Impaired assets............................................................................................. 355,665 4.59 248,761 3.31<br />

TOTAL ....................................................................................................... 7,744,033 100.00 7,523,958 100.00<br />

Residential mortgages represent approximately 24.1 per cent. of the item "Mortgage loans and other medium to<br />

long-term financing".<br />

Defaulted and problem loans<br />

The following table shows a breakdown of the Bank's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans....................................................................... 573,303 7.14 (217,638) 355,665 4.59<br />

Non-performing loans................................................................... 307,698 3.83 (182,771) 124,927 1.61<br />

Impaired loans .............................................................................. 234,332 2.92 (33,162) 201,170 2.60<br />

Restructured loans......................................................................... — — — — —<br />

Past due loans ............................................................................... 31,273 0.39 (1,705) 29,568 0.38<br />

Performing loans......................................................................... 7,451,602 92.86 (63,234) 7,388,368 95.41<br />

of which: Unguaranteed loans to countries at risk........................ 4 0.00 — 4 0.00<br />

TOTAL ........................................................................................ 8,024,905 100.00 (280,872) 7,744,033 100.00<br />

Loans to customers as at 31 December 2007<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans....................................................................... 403,100 5.22 (154,338) 248,761 3.31<br />

Non-performing loans................................................................... 247,361 3.20 (139,875) 107,486 1.43<br />

Impaired loans .............................................................................. 106,902 1.38 (12,759) 94,143 1.25<br />

Restructured loans......................................................................... — — — — —<br />

Past due loans ............................................................................... 48,837 0.63 (1,704) 47,133 0.63<br />

Performing loans......................................................................... 7,323,933 94.78 (48,737) 7,275,196 96.69<br />

of which: Unguaranteed loans to countries at risk........................ 1,893 0.02 (7) 1,886 0.03<br />

TOTAL ........................................................................................ 7,727,033 100.00 (203,075) 7,523,958 100.00<br />

Funding<br />

The following table presents the sources of the Bank's funding from customers as at 31 December 2008 and<br />

2007.<br />

Direct funding from customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Due to customers .......................................................................................... 4,240,925 49.73 4,434,483 61.59<br />

Securities in issue.......................................................................................... 4,286,704 50.27 2,765,672 38.41<br />

TOTAL ........................................................................................................ 8.527.629 100,00 7,200,154 100.00<br />

- 136 -