Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

Business object<br />

Pursuant to Article 4 of its by-Laws, the duration of the company is up to 31 December 2070. Its principal<br />

objects, as set out in Article 2 of its by-Laws, are deposit-taking and the carrying-out of all forms of lending<br />

activities. It may perform any financial activity subject to compliance with legislation in force, and any other<br />

activity or operations incidental to or in any way connected with the achievement of its corporate objects,<br />

operating in the market of financial and credit intermediation also through the distribution of services and<br />

products and also through multimedia channels.<br />

Distribution network<br />

As concerns mortgage loans, <strong>Banca</strong> 24–7 develops business through commercial agreements with distribution<br />

networks outside the <strong>UBI</strong> <strong>Banca</strong> Group. The issuance of credit cards (both charge and revolving) for the <strong>UBI</strong><br />

Group is centralised in <strong>Banca</strong> 24–7. Personal loans and salary-backed loans are distributed both on captive and<br />

non captive customers.<br />

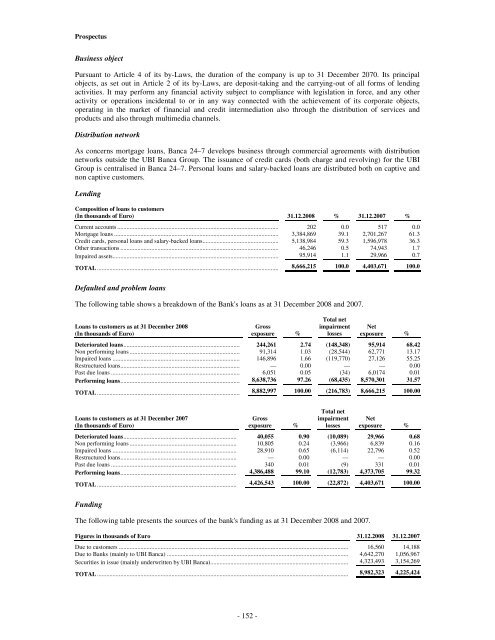

Lending<br />

Composition of loans to customers<br />

(In thousands of Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts ........................................................................................................ 202 0.0 517 0.0<br />

Mortgage loans .......................................................................................................... 3,384,869 39.1 2,701,267 61.3<br />

Credit cards, personal loans and salary-backed loans................................................. 5,138,984 59.3 1,596,978 36.3<br />

Other transactions ...................................................................................................... 46,246 0.5 74,943 1.7<br />

Impaired assets........................................................................................................... 95,914 1.1 29,966 0.7<br />

TOTAL ..................................................................................................................... 8,666,215 100.0 4,403,671 100.0<br />

Defaulted and problem loans<br />

The following table shows a breakdown of the Bank's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

(In thousands of Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans........................................................................... 244,261 2.74 (148,348) 95,914 68.42<br />

Non performing loans ....................................................................... 91,314 1.03 (28,544) 62,771 13.17<br />

Impaired loans .................................................................................. 146,896 1.66 (119,770) 27,126 55.25<br />

Restructured loans............................................................................. — 0.00 — — 0.00<br />

Past due loans ................................................................................... 6,051 0.05 (34) 6,0174 0.01<br />

Performing loans............................................................................. 8,638,736 97.26 (68,435) 8,570,301 31.57<br />

TOTAL ............................................................................................ 8,882,997 100.00 (216,783) 8,666,215 100.00<br />

Loans to customers as at 31 December 2007<br />

(In thousands of Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans......................................................................... 40,055 0.90 (10,089) 29,966 0.68<br />

Non performing loans ..................................................................... 10,805 0.24 (3,966) 6,839 0.16<br />

Impaired loans ................................................................................ 28,910 0.65 (6,114) 22,796 0.52<br />

Restructured loans........................................................................... — 0.00 — — 0.00<br />

Past due loans ................................................................................. 340 0.01 (9) 331 0.01<br />

Performing loans........................................................................... 4,386,488 99.10 (12,783) 4,373,705 99.32<br />

TOTAL .......................................................................................... 4,426,543 100.00 (22,872) 4,403,671 100.00<br />

Funding<br />

The following table presents the sources of the bank's funding as at 31 December 2008 and 2007.<br />

Figures in thousands of Euro 31.12.2008 31.12.2007<br />

Due to customers .................................................................................................................................................... 16,560 14,188<br />

Due to Banks (mainly to <strong>UBI</strong> <strong>Banca</strong>) ..................................................................................................................... 4,642,270 1,056,967<br />

Securities in issue (mainly underwritten by <strong>UBI</strong> <strong>Banca</strong>)......................................................................................... 4,323,493 3,154,269<br />

TOTAL .................................................................................................................................................................. 8,982,323 4,225,424<br />

- 152 -