Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

General Management<br />

Name<br />

Eraldo Menconi ...........................................................................................................................................<br />

Pietro Tosana ...............................................................................................................................................<br />

Position<br />

General Manager<br />

Deputy General Manager<br />

Auditors<br />

The current independent auditors of <strong>Banca</strong> di Valle Camonica are KPMG S.p.A., who have been appointed to<br />

audit the bank's financial statements for a period ending 31 December 2015.<br />

Subsidiaries and associated companies<br />

<strong>Banca</strong> di Valle Camonica has a 2 per cent. stake in <strong>UBI</strong> Sistemi e Servizi S.c.p.A. and no other significant<br />

shareholdings in other companies.<br />

Share capital and shareholders<br />

As at 31 December 2008, <strong>Banca</strong> di Valle Camonica had an issued and fully paid-up share capital of<br />

Euro2,738,693.00 consisting of 2,738,693 ordinary shares with a nominal value of Euro1.00 each.<br />

<strong>Banca</strong> di Valle Camonica's shares are unlisted and are 82.96 per cent. owned by <strong>UBI</strong> <strong>Banca</strong>.<br />

Employees<br />

As at 31 December 2008, <strong>Banca</strong> di Valle Camonica had 341 employees, compared to 357 employees as at the<br />

previous year end.<br />

Financial information<br />

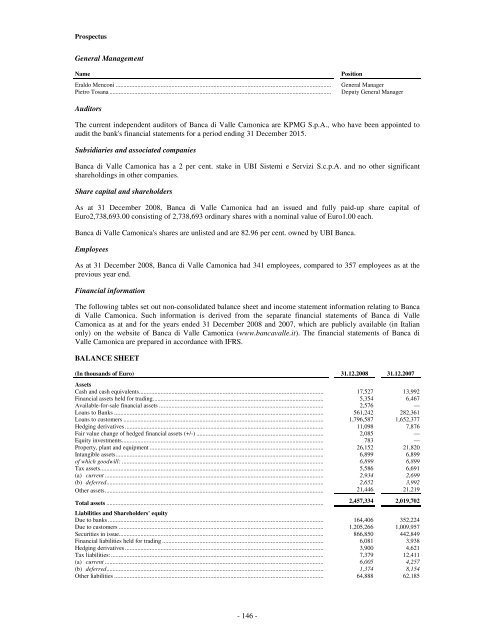

The following tables set out non-consolidated balance sheet and income statement information relating to <strong>Banca</strong><br />

di Valle Camonica. Such information is derived from the separate financial statements of <strong>Banca</strong> di Valle<br />

Camonica as at and for the years ended 31 December 2008 and 2007, which are publicly available (in Italian<br />

only) on the website of <strong>Banca</strong> di Valle Camonica (www.bancavalle.it). The financial statements of <strong>Banca</strong> di<br />

Valle Camonica are prepared in accordance with IFRS.<br />

BALANCE SHEET<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Assets<br />

Cash and cash equivalents....................................................................................................................... 17,527 13,992<br />

Financial assets held for trading.............................................................................................................. 5,354 6,467<br />

Available-for-sale financial assets .......................................................................................................... 2,576 —<br />

Loans to Banks ....................................................................................................................................... 561,242 282,361<br />

Loans to customers ................................................................................................................................. 1,796,587 1,652,377<br />

Hedging derivatives ................................................................................................................................ 11,098 7,876<br />

Fair value change of hedged financial assets (+/-) .................................................................................. 2,085 —<br />

Equity investments.................................................................................................................................. 783 —<br />

Property, plant and equipment ................................................................................................................ 26,152 21,820<br />

Intangible assets...................................................................................................................................... 6,899 6,899<br />

of which goodwill: .................................................................................................................................. 6,899 6,899<br />

Tax assets................................................................................................................................................ 5,586 6,691<br />

(a) current ............................................................................................................................................. 2,934 2,699<br />

(b) deferred............................................................................................................................................ 2,652 3,992<br />

Other assets............................................................................................................................................. 21,446 21,219<br />

Total assets ............................................................................................................................................ 2,457,334 2,019,702<br />

Liabilities and Shareholders' equity<br />

Due to banks ........................................................................................................................................... 164,406 352,224<br />

Due to customers .................................................................................................................................... 1,205,266 1,009,957<br />

Securities in issue.................................................................................................................................... 866,850 442,849<br />

Financial liabilities held for trading ........................................................................................................ 6,081 3,938<br />

Hedging derivatives ................................................................................................................................ 3,900 4,621<br />

Tax liabilities:......................................................................................................................................... 7,379 12,411<br />

(a) current ............................................................................................................................................. 6,005 4,257<br />

(b) deferred............................................................................................................................................ 1,374 8,154<br />

Other liabilities ....................................................................................................................................... 64,888 62,185<br />

- 146 -