Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

Auditors<br />

The current independent auditors of Banco di San Giorgio are Reconta Ernst & Young S.p.A., who have been<br />

appointed to audit the bank's financial statements for a period ending 31 December 2012.<br />

Subsidiaries and associated companies<br />

Banco di San Giorgio has a 2 per cent. stake in <strong>UBI</strong> Sistemi e Servizi S.c.p.A. and no other significant<br />

shareholdings in other companies.<br />

Share capital and shareholders<br />

On 11 February 2009 the Board of Directors of Banco di San Giorgio approved a capitalisation operation for a<br />

total of 75 million Euro in relation to the purchase of operations from Intesa Sanpaolo, consisting of 13 branches<br />

located in the province of La Spezia. The operation, consisting of two increases in the share capital by payment<br />

in tranches with limited option rights within the meaning of paragraph 5 of Art. 2441 of the Italian Civil Code,<br />

was performed with an issue price for the new shares of 5.38 Euro of which 1.50 Euro nominal and 3.88 Euro as<br />

the issue premium. The first increase in the share capital, totalling 68,385,750.28 Euro, was reserved to the <strong>UBI</strong><br />

<strong>Banca</strong> and to <strong>Banca</strong> Regionale Europea and took place on 13th March 2009 before the operations were acquired<br />

(16 March 2009). The second increase in the share capital, for a maximum of 6,627,885.62 Euro will be a rights<br />

issued for all the other registered shareholders, except for those registered shareholders to whom the first<br />

increase was destined, to be performed by 30 September 2009. In order to guarantee the successful outcome of<br />

the operation the shareholders, <strong>UBI</strong> <strong>Banca</strong> and BRE, have agreed to subscribe the residual new shares of the<br />

second increase not taken up by those with option rights on them.<br />

As a result of the operations just mentioned and of further purchases from minority shareholders performed by<br />

the Parent Bank, Banco di San Giorgio was 93.1235 per cent. controlled as at 31 March 2009 (35.5806 per cent.<br />

by <strong>UBI</strong> <strong>Banca</strong> and 57.5429 per cent. by BRE), while the share capital rose to 85,993,326 Euro. As at 31<br />

December 2008 the bank had share capital of 66,926,667 Euro and was 91.1557 per cent. controlled.<br />

Employees<br />

As at 31 December 2008, Banco di San Giorgio had 259 employees, compared to 254 employees as at the<br />

previous year end.<br />

Financial information<br />

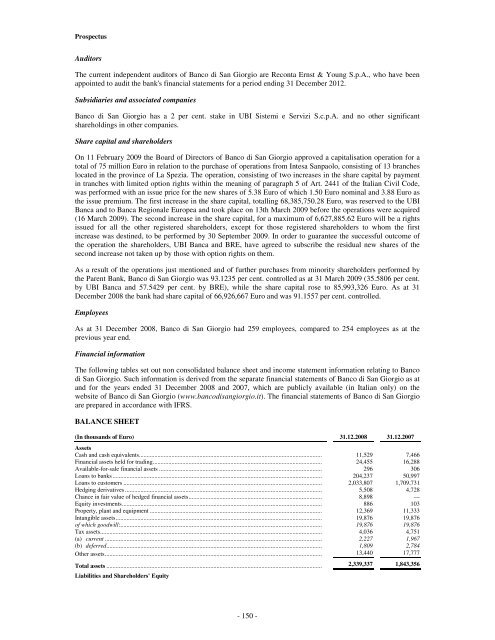

The following tables set out non consolidated balance sheet and income statement information relating to Banco<br />

di San Giorgio. Such information is derived from the separate financial statements of Banco di San Giorgio as at<br />

and for the years ended 31 December 2008 and 2007, which are publicly available (in Italian only) on the<br />

website of Banco di San Giorgio (www.bancodisangiorgio.it). The financial statements of Banco di San Giorgio<br />

are prepared in accordance with IFRS.<br />

BALANCE SHEET<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Assets<br />

Cash and cash equivalents...................................................................................................................... 11,529 7,466<br />

Financial assets held for trading............................................................................................................. 24,455 16,288<br />

Available-for-sale financial assets ......................................................................................................... 296 306<br />

Loans to banks ....................................................................................................................................... 204,237 50,997<br />

Loans to customers ................................................................................................................................ 2,033,807 1,709,731<br />

Hedging derivatives ............................................................................................................................... 5,508 4,728<br />

Chance in fair value of hedged financial assets...................................................................................... 8,898 —<br />

Equity investments................................................................................................................................. 886 103<br />

Property, plant and equipment ............................................................................................................... 12,369 11,333<br />

Intangible assets..................................................................................................................................... 19,876 19,876<br />

of which goodwill:.................................................................................................................................. 19,876 19,876<br />

Tax assets............................................................................................................................................... 4,036 4,751<br />

(a) current ............................................................................................................................................ 2,227 1,967<br />

(b) deferred........................................................................................................................................... 1,809 2,784<br />

Other assets............................................................................................................................................ 13,440 17,777<br />

Total assets ........................................................................................................................................... 2,339,337 1,843,356<br />

Liabilities and Shareholders' Equity<br />

- 150 -