Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

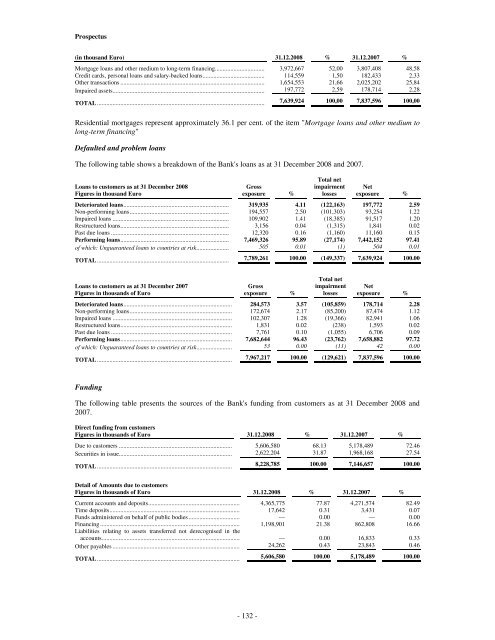

(in thousand Euro) 31.12.2008 % 31.12.2007 %<br />

Mortgage loans and other medium to long-term financing................................ 3,972,667 52,00 3,807,408 48,58<br />

Credit cards, personal loans and salary-backed loans........................................ 114,559 1,50 182,433 2,33<br />

Other transactions ............................................................................................. 1,654,553 21,66 2,025,202 25,84<br />

Impaired assets.................................................................................................. 197,772 2,59 178,714 2,28<br />

TOTAL ............................................................................................................ 7,639,924 100,00 7,837,596 100,00<br />

Residential mortgages represent approximately 36.1 per cent. of the item "Mortgage loans and other medium to<br />

long-term financing"<br />

Defaulted and problem loans<br />

The following table shows a breakdown of the Bank's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

Figures in thousand Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans.................................................................... 319,935 4.11 (122,163) 197,772 2.59<br />

Non-performing loans................................................................ 194,557 2.50 (101,303) 93,254 1.22<br />

Impaired loans ........................................................................... 109,902 1.41 (18,385) 91,517 1.20<br />

Restructured loans...................................................................... 3,156 0.04 (1,315) 1,841 0.02<br />

Past due loans ............................................................................ 12,320 0.16 (1,160) 11,160 0.15<br />

Performing loans...................................................................... 7,469,326 95.89 (27,174) 7,442,152 97.41<br />

of which: Unguaranteed loans to countries at risk..................... 505 0.01 (1) 504 0.01<br />

TOTAL ..................................................................................... 7,789,261 100.00 (149,337) 7,639,924 100.00<br />

Loans to customers as at 31 December 2007<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans...................................................................... 284,573 3.57 (105,859) 178,714 2.28<br />

Non-performing loans.................................................................. 172,674 2.17 (85,200) 87,474 1.12<br />

Impaired loans ............................................................................. 102,307 1.28 (19,366) 82,941 1.06<br />

Restructured loans........................................................................ 1,831 0.02 (238) 1,593 0.02<br />

Past due loans .............................................................................. 7,761 0.10 (1,055) 6,706 0.09<br />

Performing loans........................................................................ 7,682,644 96.43 (23,762) 7,658,882 97.72<br />

of which: Unguaranteed loans to countries at risk....................... 53 0.00 (11) 42 0.00<br />

TOTAL ....................................................................................... 7,967,217 100.00 (129,621) 7,837,596 100.00<br />

Funding<br />

The following table presents the sources of the Bank's funding from customers as at 31 December 2008 and<br />

2007.<br />

Direct funding from customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Due to customers ......................................................................... 5,606,580 68.13 5,178,489 72.46<br />

Securities in issue......................................................................... 2,622,204 31.87 1,968,168 27.54<br />

TOTAL ....................................................................................... 8,228,785 100.00 7,146,657 100.00<br />

Detail of Amounts due to customers<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Current accounts and deposits........................................................... 4,365,775 77.87 4,271,574 82.49<br />

Time deposits.................................................................................... 17,642 0.31 3,431 0.07<br />

Funds administered on behalf of public bodies ................................. — 0.00 — 0.00<br />

Financing .......................................................................................... 1,198,901 21.38 862,808 16.66<br />

Liabilities relating to assets transferred not derecognised in the<br />

accounts......................................................................................... — 0.00 16,833 0.33<br />

Other payables .................................................................................. 24,262 0.43 23,843 0.46<br />

TOTAL ............................................................................................ 5,606,580 100.00 5,178,489 100.00<br />

- 132 -