Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

Financial information<br />

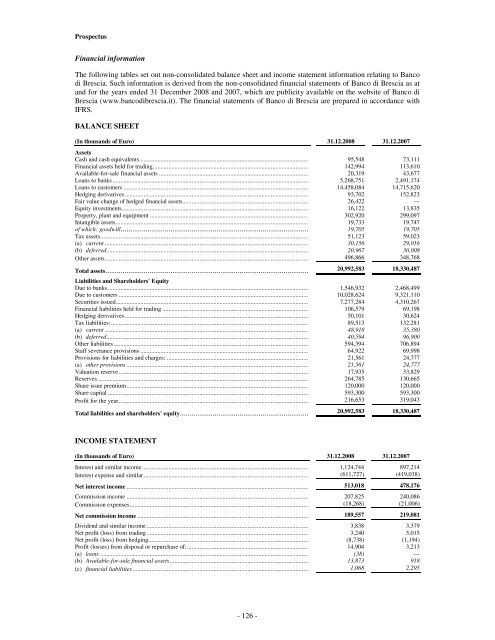

The following tables set out non-consolidated balance sheet and income statement information relating to Banco<br />

di Brescia. Such information is derived from the non-consolidated financial statements of Banco di Brescia as at<br />

and for the years ended 31 December 2008 and 2007, which are publicity available on the website of Banco di<br />

Brescia (www.bancodibrescia.it). The financial statements of Banco di Brescia are prepared in accordance with<br />

IFRS.<br />

BALANCE SHEET<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Assets<br />

Cash and cash equivalents............................................................................................................. 95,548 73,111<br />

Financial assets held for trading.................................................................................................... 142,994 113,610<br />

Available-for-sale financial assets ................................................................................................ 20,319 43,677<br />

Loans to banks .............................................................................................................................. 5,268,751 2,491,174<br />

Loans to customers ....................................................................................................................... 14,458,084 14,715,620<br />

Hedging derivatives ...................................................................................................................... 93,702 152,823<br />

Fair value change of hedged financial assets................................................................................. 26,422 —<br />

Equity investments........................................................................................................................ 16,122 13,835<br />

Property, plant and equipment ...................................................................................................... 302,920 299,097<br />

Intangible assets............................................................................................................................ 19,733 19,747<br />

of which: goodwill.................................................................................................. 19,705 19,705<br />

Tax assets...................................................................................................................................... 51,123 59,023<br />

(a) current ................................................................................................................................... 30,156 29,016<br />

(b) deferred.................................................................................................................................. 20,967 30,008<br />

Other assets................................................................................................................................... 496,866 348,768<br />

Total assets.......................................................................................................... 20,992,583 18,330,487<br />

Liabilities and Shareholders' Equity<br />

Due to banks ................................................................................................................................. 1,546,932 2,468,499<br />

Due to customers .......................................................................................................................... 10,028,624 9,321,110<br />

Securities issued............................................................................................................................ 7,277,284 4,310,267<br />

Financial liabilities held for trading .............................................................................................. 106,579 69,198<br />

Hedging derivatives ...................................................................................................................... 50,101 30,624<br />

Tax liabilities:............................................................................................................................... 89,513 132,281<br />

(a) current ................................................................................................................................... 48,918 35,380<br />

(b) deferred.................................................................................................................................. 40,594 96,900<br />

Other liabilities ............................................................................................................................. 594,394 706,894<br />

Staff severance provisions ............................................................................................................ 64,922 69,998<br />

Provisions for liabilities and charges: ........................................................................................... 21,561 24,777<br />

(a) other provisions ..................................................................................................................... 21,561 24,777<br />

Valuation reserve .......................................................................................................................... 17,935 33,829<br />

Reserves........................................................................................................................................ 264,785 130,665<br />

Share issue premium..................................................................................................................... 120,000 120,000<br />

Share capital ................................................................................................................................. 593,300 593,300<br />

Profit for the year.......................................................................................................................... 216,653 319,043<br />

Total liabilities and shareholders' equity................................................................... 20,992,583 18,330,487<br />

INCOME STATEMENT<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Interest and similar income........................................................................................................... 1,124,744 897,214<br />

Interest expense and similar.......................................................................................................... (611,727) (419,038)<br />

Net interest income ..................................................................................................................... 513,018 478,176<br />

Commission income ..................................................................................................................... 207,825 240,086<br />

Commission expenses................................................................................................................... (18,268) (21,006)<br />

Net commission income .............................................................................................................. 189,557 219,081<br />

Dividend and similar income ........................................................................................................ 3,838 3,379<br />

Net profit (loss) from trading........................................................................................................ 3,240 5,015<br />

Net profit (loss) from hedging....................................................................................................... (8,738) (1,194)<br />

Profit (losses) from disposal or repurchase of:.............................................................................. 14,904 3,213<br />

(a) loans ...................................................................................................................................... (38) —<br />

(b) Available-for-sale financial assets ......................................................................................... 13,873 918<br />

(c) financial liabilities ................................................................................................................. 1,068 2,295<br />

- 126 -