Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

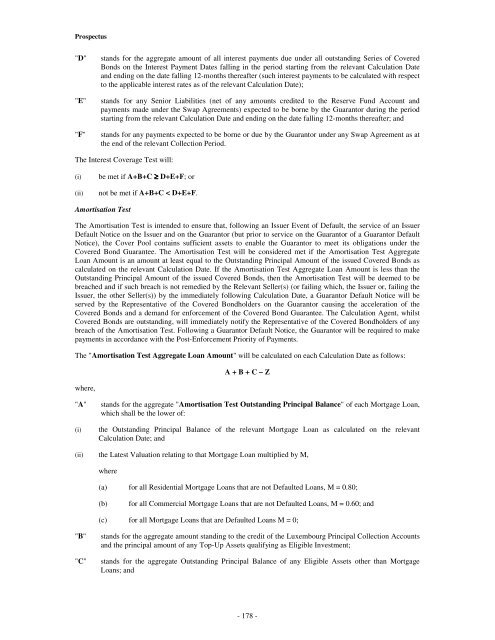

<strong>Prospectus</strong><br />

"D"<br />

"E"<br />

"F"<br />

stands for the aggregate amount of all interest payments due under all outstanding Series of <strong>Covered</strong><br />

<strong>Bond</strong>s on the Interest Payment Dates falling in the period starting from the relevant Calculation Date<br />

and ending on the date falling 12-months thereafter (such interest payments to be calculated with respect<br />

to the applicable interest rates as of the relevant Calculation Date);<br />

stands for any Senior Liabilities (net of any amounts credited to the Reserve Fund Account and<br />

payments made under the Swap Agreements) expected to be borne by the Guarantor during the period<br />

starting from the relevant Calculation Date and ending on the date falling 12-months thereafter; and<br />

stands for any payments expected to be borne or due by the Guarantor under any Swap Agreement as at<br />

the end of the relevant Collection Period.<br />

The Interest Coverage Test will:<br />

(i)<br />

(ii)<br />

be met if A+B+C ≥ D+E+F; or<br />

not be met if A+B+C < D+E+F.<br />

Amortisation Test<br />

The Amortisation Test is intended to ensure that, following an Issuer Event of Default, the service of an Issuer<br />

Default Notice on the Issuer and on the Guarantor (but prior to service on the Guarantor of a Guarantor Default<br />

Notice), the Cover Pool contains sufficient assets to enable the Guarantor to meet its obligations under the<br />

<strong>Covered</strong> <strong>Bond</strong> Guarantee. The Amortisation Test will be considered met if the Amortisation Test Aggregate<br />

Loan Amount is an amount at least equal to the Outstanding Principal Amount of the issued <strong>Covered</strong> <strong>Bond</strong>s as<br />

calculated on the relevant Calculation Date. If the Amortisation Test Aggregate Loan Amount is less than the<br />

Outstanding Principal Amount of the issued <strong>Covered</strong> <strong>Bond</strong>s, then the Amortisation Test will be deemed to be<br />

breached and if such breach is not remedied by the Relevant Seller(s) (or failing which, the Issuer or, failing the<br />

Issuer, the other Seller(s)) by the immediately following Calculation Date, a Guarantor Default Notice will be<br />

served by the Representative of the <strong>Covered</strong> <strong>Bond</strong>holders on the Guarantor causing the acceleration of the<br />

<strong>Covered</strong> <strong>Bond</strong>s and a demand for enforcement of the <strong>Covered</strong> <strong>Bond</strong> Guarantee. The Calculation Agent, whilst<br />

<strong>Covered</strong> <strong>Bond</strong>s are outstanding, will immediately notify the Representative of the <strong>Covered</strong> <strong>Bond</strong>holders of any<br />

breach of the Amortisation Test. Following a Guarantor Default Notice, the Guarantor will be required to make<br />

payments in accordance with the Post-Enforcement Priority of Payments.<br />

The "Amortisation Test Aggregate Loan Amount" will be calculated on each Calculation Date as follows:<br />

where,<br />

A + B + C – Z<br />

"A"<br />

(i)<br />

stands for the aggregate "Amortisation Test Outstanding Principal Balance" of each Mortgage Loan,<br />

which shall be the lower of:<br />

the Outstanding Principal Balance of the relevant Mortgage Loan as calculated on the relevant<br />

Calculation Date; and<br />

(ii) the Latest Valuation relating to that Mortgage Loan multiplied by M,<br />

where<br />

(a) for all Residential Mortgage Loans that are not Defaulted Loans, M = 0.80;<br />

(b)<br />

for all Commercial Mortgage Loans that are not Defaulted Loans, M = 0.60; and<br />

(c) for all Mortgage Loans that are Defaulted Loans M = 0;<br />

"B"<br />

"C"<br />

stands for the aggregate amount standing to the credit of the Luxembourg Principal Collection Accounts<br />

and the principal amount of any Top-Up Assets qualifying as Eligible Investment;<br />

stands for the aggregate Outstanding Principal Balance of any Eligible Assets other than Mortgage<br />

Loans; and<br />

- 178 -