Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Prospectus</strong><br />

Name<br />

Giovanni Luigi Maria Boffelli .............................................................................................................................<br />

Nicola Vito Notarnicola.......................................................................................................................................<br />

Position<br />

Alternate Auditor<br />

Alternate Auditor<br />

General Management<br />

Name<br />

Raffaele Avantaggiato .........................................................................................................................................<br />

Sergio Passoni......................................................................................................................................................<br />

Position<br />

General Manager<br />

Deputy General Manager<br />

Auditors<br />

The current independent auditors of <strong>Banca</strong> Carime are KPMG S.p.A., who have been appointed to audit the<br />

bank's financial statements for a period ending 31 December 2013.<br />

Subsidiaries and associated companies<br />

<strong>Banca</strong> Carime has a 4 per cent. stake in <strong>UBI</strong> Sistemi e Servizi S.c.p.A. and no other significant shareholdings in<br />

other companies.<br />

Share capital and shareholders<br />

As at 31 December 2008, <strong>Banca</strong> Carime had an issued and fully paid-up share capital of Euro1,468,208,505.92<br />

consisting of 1,411,738,948 ordinary shares with a nominal value of Euro1.04 each.<br />

<strong>Banca</strong> Carime's shares are unlisted and are 85.8289 per cent. owned by <strong>UBI</strong> <strong>Banca</strong>, 14.1478 per cent. by Aviva<br />

S.p.A. and the remaining part by minority shareholders.<br />

Employees<br />

As at 31 December 2008, <strong>Banca</strong> Carime had 2,475 employees, compared to 2,587 employees as at the previous<br />

year end.<br />

Financial information<br />

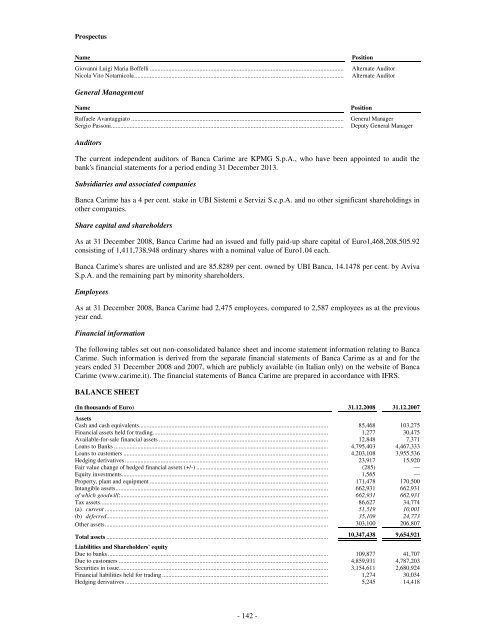

The following tables set out non-consolidated balance sheet and income statement information relating to <strong>Banca</strong><br />

Carime. Such information is derived from the separate financial statements of <strong>Banca</strong> Carime as at and for the<br />

years ended 31 December 2008 and 2007, which are publicly available (in Italian only) on the website of <strong>Banca</strong><br />

Carime (www.carime.it). The financial statements of <strong>Banca</strong> Carime are prepared in accordance with IFRS.<br />

BALANCE SHEET<br />

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Assets<br />

Cash and cash equivalents.......................................................................................................................... 85,468 103,275<br />

Financial assets held for trading................................................................................................................. 1,277 30,475<br />

Available-for-sale financial assets ............................................................................................................. 12,848 7,371<br />

Loans to Banks .......................................................................................................................................... 4,795,403 4,467,333<br />

Loans to customers .................................................................................................................................... 4,203,108 3,955,536<br />

Hedging derivatives ................................................................................................................................... 23,917 15,920<br />

Fair value change of hedged financial assets (+/-) ..................................................................................... (285) —<br />

Equity investments..................................................................................................................................... 1,565 —<br />

Property, plant and equipment ................................................................................................................... 171,478 170,500<br />

Intangible assets......................................................................................................................................... 662,931 662,931<br />

of which goodwill:...................................................................................................................................... 662,931 662,931<br />

Tax assets................................................................................................................................................... 86,627 34,774<br />

(a) current ................................................................................................................................................ 51,519 10,001<br />

(b) deferred............................................................................................................................................... 35,109 24,773<br />

Other assets................................................................................................................................................ 303,100 206,807<br />

Total assets ............................................................................................................................................... 10,347,438 9,654,921<br />

Liabilities and Shareholders' equity<br />

Due to banks .............................................................................................................................................. 109,877 41,707<br />

Due to customers ....................................................................................................................................... 4,859,931 4,787,203<br />

Securities in issue....................................................................................................................................... 3,154,611 2,680,924<br />

Financial liabilities held for trading ........................................................................................................... 1,274 30,034<br />

Hedging derivatives ................................................................................................................................... 5,245 14,418<br />

- 142 -