Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

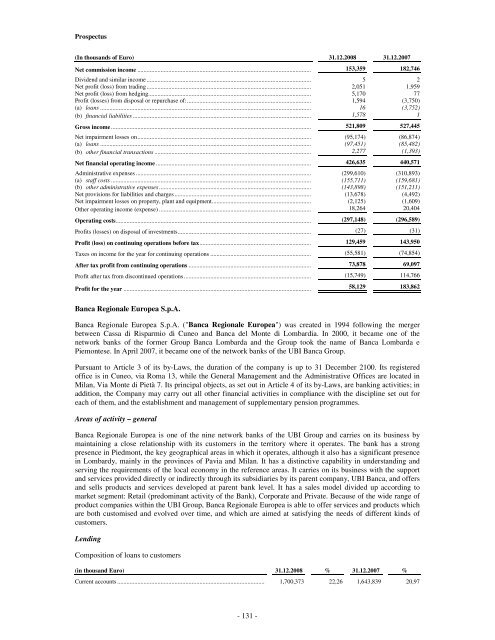

(In thousands of Euro) 31.12.2008 31.12.2007<br />

Net commission income ................................................................................................................ 153,359 182,746<br />

Dividend and similar income .......................................................................................................... 5 2<br />

Net profit (loss) from trading.......................................................................................................... 2,051 1,959<br />

Net profit (loss) from hedging......................................................................................................... 5,170 77<br />

Profit (losses) from disposal or repurchase of:................................................................................ 1,594 (3,750)<br />

(a) loans ........................................................................................................................................ 16 (3,752)<br />

(b) financial liabilities ................................................................................................................... 1,578 1<br />

Gross income ................................................................................................................................. 521,809 527,445<br />

Net impairment losses on................................................................................................................ (95,174) (86,874)<br />

(a) loans ........................................................................................................................................ (97,451) (85,482)<br />

(b) other financial transactions ..................................................................................................... 2,277 (1,393)<br />

Net financial operating income .................................................................................................... 426,635 440,571<br />

Administrative expenses ................................................................................................................. (299,610) (310,893)<br />

(a) staff costs ................................................................................................................................. (155,711) (159,681)<br />

(b) other administrative expenses .................................................................................................. (143,898) (151,211)<br />

Net provisions for liabilities and charges ........................................................................................ (13,678) (4,492)<br />

Net impairment losses on property, plant and equipment................................................................ (2,125) (1,609)<br />

Other operating income (expense) .................................................................................................. 18,264 20,404<br />

Operating costs.............................................................................................................................. (297,148) (296,589)<br />

Profits (losses) on disposal of investments...................................................................................... (27) (31)<br />

Profit (loss) on continuing operations before tax........................................................................ 129,459 143,950<br />

Taxes on income for the year for continuing operations ................................................................. (55,581) (74,854)<br />

After tax profit from continuing operations ............................................................................... 73,878 69,097<br />

Profit after tax from discontinued operations.................................................................................. (15,749) 114,766<br />

Profit for the year ......................................................................................................................... 58,129 183,862<br />

<strong>Banca</strong> Regionale Europea S.p.A.<br />

<strong>Banca</strong> Regionale Europea S.p.A. ("<strong>Banca</strong> Regionale Europea") was created in 1994 following the merger<br />

between Cassa di Risparmio di Cuneo and <strong>Banca</strong> del Monte di Lombardia. In 2000, it became one of the<br />

network banks of the former Group <strong>Banca</strong> Lombarda and the Group took the name of <strong>Banca</strong> Lombarda e<br />

Piemontese. In April 2007, it became one of the network banks of the <strong>UBI</strong> <strong>Banca</strong> Group.<br />

Pursuant to Article 3 of its by-Laws, the duration of the company is up to 31 December 2100. Its registered<br />

office is in Cuneo, via Roma 13, while the General Management and the Administrative Offices are located in<br />

Milan, Via Monte di Pietà 7. Its principal objects, as set out in Article 4 of its by-Laws, are banking activities; in<br />

addition, the Company may carry out all other financial activities in compliance with the discipline set out for<br />

each of them, and the establishment and management of supplementary pension programmes.<br />

Areas of activity – general<br />

<strong>Banca</strong> Regionale Europea is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by<br />

maintaining a close relationship with its customers in the territory where it operates. The bank has a strong<br />

presence in Piedmont, the key geographical areas in which it operates, although it also has a significant presence<br />

in Lombardy, mainly in the provinces of Pavia and Milan. It has a distinctive capability in understanding and<br />

serving the requirements of the local economy in the reference areas. It carries on its business with the support<br />

and services provided directly or indirectly through its subsidiaries by its parent company, <strong>UBI</strong> <strong>Banca</strong>, and offers<br />

and sells products and services developed at parent bank level. It has a sales model divided up according to<br />

market segment: Retail (predominant activity of the Bank), Corporate and Private. Because of the wide range of<br />

product companies within the <strong>UBI</strong> Group, <strong>Banca</strong> Regionale Europea is able to offer services and products which<br />

are both customised and evolved over time, and which are aimed at satisfying the needs of different kinds of<br />

customers.<br />

Lending<br />

Composition of loans to customers<br />

(in thousand Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts ............................................................................................... 1,700,373 22,26 1,643,839 20,97<br />

- 131 -