Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

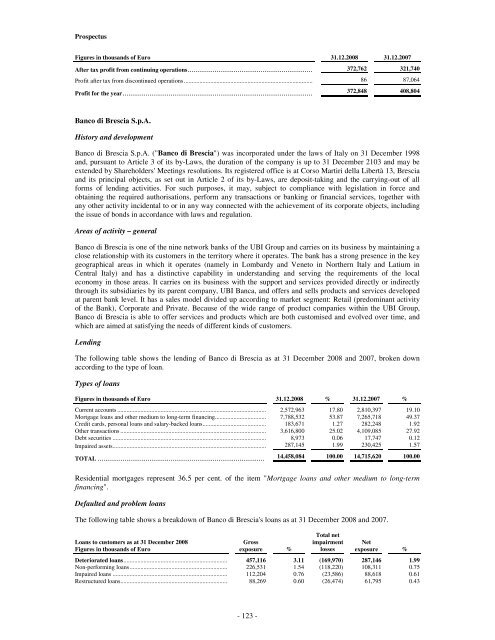

Figures in thousands of Euro 31.12.2008 31.12.2007<br />

After tax profit from continuing operations................................................................. 372,762 321,740<br />

Profit after tax from discontinued operations................................................................................... 86 87,064<br />

Profit for the year................................................................................................... 372,848 408,804<br />

Banco di Brescia S.p.A.<br />

History and development<br />

Banco di Brescia S.p.A. ("Banco di Brescia") was incorporated under the laws of Italy on 31 December 1998<br />

and, pursuant to Article 3 of its by-Laws, the duration of the company is up to 31 December 2103 and may be<br />

extended by Shareholders' Meetings resolutions. Its registered office is at Corso Martiri della Libertà 13, Brescia<br />

and its principal objects, as set out in Article 2 of its by-Laws, are deposit-taking and the carrying-out of all<br />

forms of lending activities. For such purposes, it may, subject to compliance with legislation in force and<br />

obtaining the required authorisations, perform any transactions or banking or financial services, together with<br />

any other activity incidental to or in any way connected with the achievement of its corporate objects, including<br />

the issue of bonds in accordance with laws and regulation.<br />

Areas of activity – general<br />

Banco di Brescia is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by maintaining a<br />

close relationship with its customers in the territory where it operates. The bank has a strong presence in the key<br />

geographical areas in which it operates (namely in Lombardy and Veneto in Northern Italy and Latium in<br />

Central Italy) and has a distinctive capability in understanding and serving the requirements of the local<br />

economy in those areas. It carries on its business with the support and services provided directly or indirectly<br />

through its subsidiaries by its parent company, <strong>UBI</strong> <strong>Banca</strong>, and offers and sells products and services developed<br />

at parent bank level. It has a sales model divided up according to market segment: Retail (predominant activity<br />

of the Bank), Corporate and Private. Because of the wide range of product companies within the <strong>UBI</strong> Group,<br />

Banco di Brescia is able to offer services and products which are both customised and evolved over time, and<br />

which are aimed at satisfying the needs of different kinds of customers.<br />

Lending<br />

The following table shows the lending of Banco di Brescia as at 31 December 2008 and 2007, broken down<br />

according to the type of loan.<br />

Types of loans<br />

Figures in thousands of Euro 31.12.2008 % 31.12.2007 %<br />

Current accounts ................................................................................................ 2,572,963 17.80 2,810,397 19.10<br />

Mortgage loans and other medium to long-term financing................................. 7,788,532 53.87 7,265,718 49.37<br />

Credit cards, personal loans and salary-backed loans......................................... 183,671 1.27 282,248 1.92<br />

Other transactions .............................................................................................. 3,616,800 25.02 4,109,085 27.92<br />

Debt securities ................................................................................................... 8,973 0.06 17,747 0.12<br />

Impaired assets................................................................................................... 287,145 1.99 230,425 1.57<br />

TOTAL ....................................................................................... 14,458,084 100.00 14,715,620 100.00<br />

Residential mortgages represent 36.5 per cent. of the item "Mortgage loans and other medium to long-term<br />

financing".<br />

Defaulted and problem loans<br />

The following table shows a breakdown of Banco di Brescia's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

Figures in thousands of Euro<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans................................................................... 457,116 3.11 (169,970) 287,146 1.99<br />

Non-performing loans............................................................... 226,531 1.54 (118,220) 108,311 0.75<br />

Impaired loans .......................................................................... 112,204 0.76 (23,586) 88,618 0.61<br />

Restructured loans..................................................................... 88,269 0.60 (26,474) 61,795 0.43<br />

- 123 -