Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

out, in addition to banking activities, all other financial activities in compliance with the discipline set out for<br />

each of them, including the purchase and management of equity investments and the establishment and<br />

management of supplementary pension programmes, either open or closed.<br />

Areas of activity – general<br />

<strong>Banca</strong> Carime is one of the nine network banks of the <strong>UBI</strong> Group and carries on its business by maintaining a<br />

close relationship with its customers in the territory where it operates. The bank has a strong presence in the key<br />

geographical areas in which it operates (namely Southern Italy, and, in particular, the Calabria, Apulia,<br />

Basilicata and Campania regions) and considers that it has a distinctive capability in understanding and serving<br />

the requirements of the local economy in those areas. It carries on its business with the support and services<br />

provided directly or indirectly through its subsidiaries by its parent company, <strong>UBI</strong> <strong>Banca</strong>, and offers and sells<br />

products and services developed at parent bank level. It has a sales model divided up according to market<br />

segment: Retail (predominant activity of the Bank), Corporate and Private. Because of the wide range of product<br />

companies within the <strong>UBI</strong> Group, <strong>Banca</strong> Carime is able to offer services and products which are both<br />

customised and evolved over time, and which are aimed at satisfying the needs of different kinds of customers.<br />

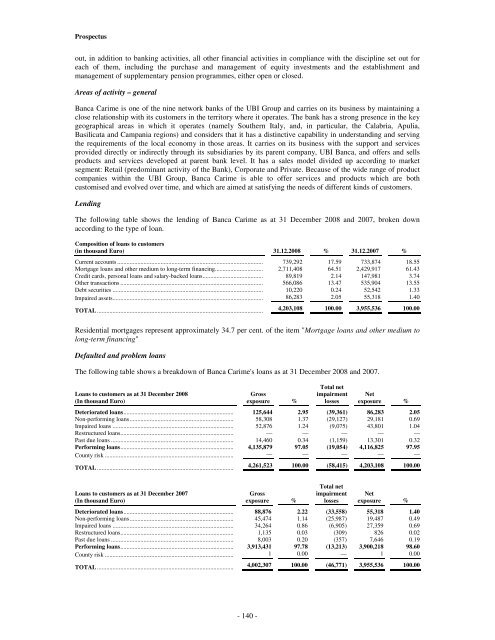

Lending<br />

The following table shows the lending of <strong>Banca</strong> Carime as at 31 December 2008 and 2007, broken down<br />

according to the type of loan.<br />

Composition of loans to customers<br />

(in thousand Euro) 31.12.2008 % 31.12.2007 %<br />

Current accounts .............................................................................................. 739,292 17.59 733,874 18.55<br />

Mortgage loans and other medium to long-term financing............................... 2,711,408 64.51 2,429,917 61.43<br />

Credit cards, personal loans and salary-backed loans....................................... 89,819 2.14 147,981 3.74<br />

Other transactions ............................................................................................ 566,086 13.47 535,904 13.55<br />

Debt securities ................................................................................................. 10,220 0.24 52,542 1.33<br />

Impaired assets................................................................................................. 86,283 2.05 55,318 1.40<br />

TOTAL ........................................................................................................... 4,203,108 100.00 3,955,536 100.00<br />

Residential mortgages represent approximately 34.7 per cent. of the item "Mortgage loans and other medium to<br />

long-term financing"<br />

Defaulted and problem loans<br />

The following table shows a breakdown of <strong>Banca</strong> Carime's loans as at 31 December 2008 and 2007.<br />

Loans to customers as at 31 December 2008<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans....................................................................... 125,644 2.95 (39,361) 86,283 2.05<br />

Non-performing loans................................................................... 58,308 1.37 (29,127) 29,181 0.69<br />

Impaired loans .............................................................................. 52,876 1.24 (9,075) 43,801 1.04<br />

Restructured loans......................................................................... — — — — —<br />

Past due loans ............................................................................... 14,460 0.34 (1,159) 13,301 0.32<br />

Performing loans......................................................................... 4,135,879 97.05 (19,054) 4,116,825 97.95<br />

County risk ................................................................................... — — — — —<br />

TOTAL ........................................................................................ 4,261,523 100.00 (58,415) 4,203,108 100.00<br />

Loans to customers as at 31 December 2007<br />

(In thousand Euro)<br />

Gross<br />

exposure %<br />

Total net<br />

impairment<br />

losses<br />

Net<br />

exposure %<br />

Deteriorated loans....................................................................... 88,876 2.22 (33,558) 55,318 1.40<br />

Non-performing loans................................................................... 45,474 1.14 (25,987) 19,487 0.49<br />

Impaired loans .............................................................................. 34,264 0.86 (6,905) 27,359 0.69<br />

Restructured loans......................................................................... 1,135 0.03 (309) 826 0.02<br />

Past due loans ............................................................................... 8,003 0.20 (357) 7,646 0.19<br />

Performing loans......................................................................... 3,913,431 97.78 (13,213) 3,900,218 98.60<br />

County risk ................................................................................... 1 0.00 — 1 0.00<br />

TOTAL ........................................................................................ 4,002,307 100.00 (46,771) 3,955,536 100.00<br />

- 140 -