Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

Prospectus UBI Banca Covered Bond Programme

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Prospectus</strong><br />

The issuing bank<br />

The Bank of Italy Instructions provide that covered bonds may only be issued by banks which individually<br />

satisfy, or which belong to banking groups which, on a consolidated basis:<br />

• have regulatory capital of at least Euro500,000,000; and<br />

• have a minimum total capital ratio of 9 per cent.<br />

The Bank of Italy Instructions specify that the requirements above also apply to the bank acting as cover pool<br />

provider (in the case of structures in which separate entities act respectively as issuing bank and as cover pool<br />

provider).<br />

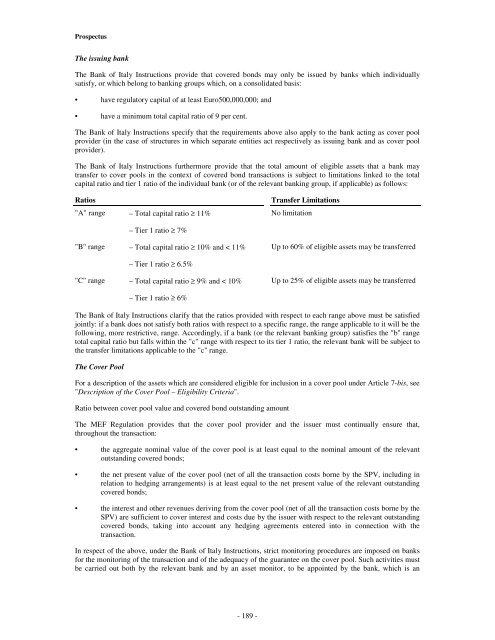

The Bank of Italy Instructions furthermore provide that the total amount of eligible assets that a bank may<br />

transfer to cover pools in the context of covered bond transactions is subject to limitations linked to the total<br />

capital ratio and tier 1 ratio of the individual bank (or of the relevant banking group, if applicable) as follows:<br />

Ratios<br />

Transfer Limitations<br />

"A" range – Total capital ratio ≥ 11% No limitation<br />

– Tier 1 ratio ≥ 7%<br />

"B" range – Total capital ratio ≥ 10% and < 11% Up to 60% of eligible assets may be transferred<br />

– Tier 1 ratio ≥ 6.5%<br />

"C" range – Total capital ratio ≥ 9% and < 10% Up to 25% of eligible assets may be transferred<br />

– Tier 1 ratio ≥ 6%<br />

The Bank of Italy Instructions clarify that the ratios provided with respect to each range above must be satisfied<br />

jointly: if a bank does not satisfy both ratios with respect to a specific range, the range applicable to it will be the<br />

following, more restrictive, range. Accordingly, if a bank (or the relevant banking group) satisfies the "b" range<br />

total capital ratio but falls within the "c" range with respect to its tier 1 ratio, the relevant bank will be subject to<br />

the transfer limitations applicable to the "c" range.<br />

The Cover Pool<br />

For a description of the assets which are considered eligible for inclusion in a cover pool under Article 7-bis, see<br />

"Description of the Cover Pool – Eligibility Criteria".<br />

Ratio between cover pool value and covered bond outstanding amount<br />

The MEF Regulation provides that the cover pool provider and the issuer must continually ensure that,<br />

throughout the transaction:<br />

• the aggregate nominal value of the cover pool is at least equal to the nominal amount of the relevant<br />

outstanding covered bonds;<br />

• the net present value of the cover pool (net of all the transaction costs borne by the SPV, including in<br />

relation to hedging arrangements) is at least equal to the net present value of the relevant outstanding<br />

covered bonds;<br />

• the interest and other revenues deriving from the cover pool (net of all the transaction costs borne by the<br />

SPV) are sufficient to cover interest and costs due by the issuer with respect to the relevant outstanding<br />

covered bonds, taking into account any hedging agreements entered into in connection with the<br />

transaction.<br />

In respect of the above, under the Bank of Italy Instructions, strict monitoring procedures are imposed on banks<br />

for the monitoring of the transaction and of the adequacy of the guarantee on the cover pool. Such activities must<br />

be carried out both by the relevant bank and by an asset monitor, to be appointed by the bank, which is an<br />

- 189 -