1qGLG9p

1qGLG9p

1qGLG9p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global debt analysis: Deleveraging What deleveraging 13<br />

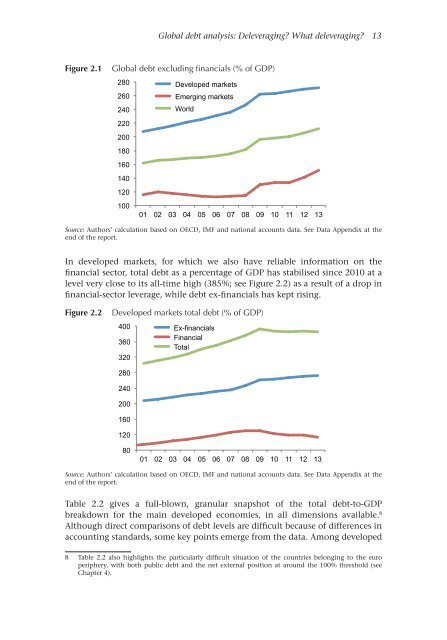

Figure 2.1<br />

Global debt excluding financials (% of GDP)<br />

280<br />

Developed markets<br />

260<br />

Emerging markets<br />

240<br />

World<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Authors’ calculation based on OECD, IMF and national accounts data. See Data Appendix at the<br />

end of the report.<br />

In developed markets, for which we also have reliable information on the<br />

financial sector, total debt as a percentage of GDP has stabilised since 2010 at a<br />

level very close to its all-time high (385%; see Figure 2.2) as a result of a drop in<br />

financial-sector leverage, while debt ex-financials has kept rising.<br />

Figure 2.2<br />

Developed markets total debt (% of GDP)<br />

400<br />

360<br />

320<br />

Ex-financials<br />

Financial<br />

Total<br />

280<br />

240<br />

200<br />

160<br />

120<br />

80<br />

01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Authors’ calculation based on OECD, IMF and national accounts data. See Data Appendix at the<br />

end of the report.<br />

Table 2.2 gives a full-blown, granular snapshot of the total debt-to-GDP<br />

breakdown for the main developed economies, in all dimensions available. 8<br />

Although direct comparisons of debt levels are difficult because of differences in<br />

accounting standards, some key points emerge from the data. Among developed<br />

8 Table 2.2 also highlights the particularly difficult situation of the countries belonging to the euro<br />

periphery, with both public debt and the net external position at around the 100% threshold (see<br />

Chapter 4).