1qGLG9p

1qGLG9p

1qGLG9p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Case studies 61<br />

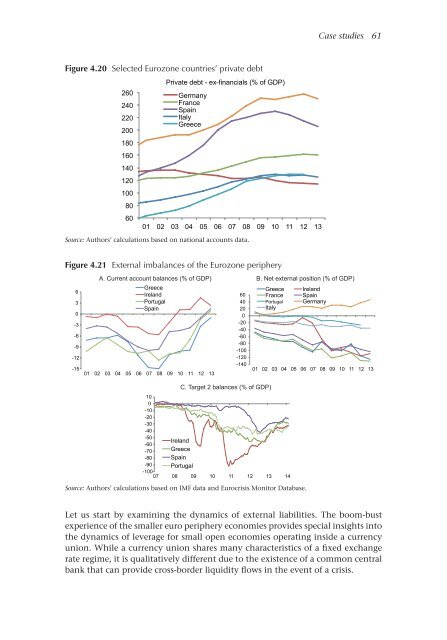

Figure 4.20 Selected Eurozone countries’ private debt<br />

260<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

Private debt - ex-financials (% of GDP)<br />

Germany<br />

France<br />

Spain<br />

Italy<br />

Greece<br />

01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Authors’ calculations based on national accounts data.<br />

Figure 4.21 External imbalances of the Eurozone periphery<br />

6<br />

3<br />

0<br />

-3<br />

-6<br />

-9<br />

-12<br />

-15<br />

A. Current account balances (% of GDP) B. Net external position (% of GDP)<br />

Greece<br />

Ireland<br />

Portugal<br />

Spain<br />

01 02 03 04 05 06 07 08 09 10 11 12 13<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

-60<br />

-80<br />

-100<br />

-120<br />

-140<br />

Greece<br />

France<br />

Portugal<br />

Italy<br />

Ireland<br />

Spain<br />

Germany<br />

01 02 03 04 05 06 07 08 09 10 11 12 13<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

-70<br />

-80<br />

-90<br />

-100<br />

C. Target 2 balances (% of GDP)<br />

Ireland<br />

Greece<br />

Spain<br />

Portugal<br />

07 08 09 10 11 12 13 14<br />

Source: Authors’ calculations based on IMF data and Eurocrisis Monitor Database.<br />

Let us start by examining the dynamics of external liabilities. The boom-bust<br />

experience of the smaller euro periphery economies provides special insights into<br />

the dynamics of leverage for small open economies operating inside a currency<br />

union. While a currency union shares many characteristics of a fixed exchange<br />

rate regime, it is qualitatively different due to the existence of a common central<br />

bank that can provide cross-border liquidity flows in the event of a crisis.