1qGLG9p

1qGLG9p

1qGLG9p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

74 Deleveraging, What Deleveraging<br />

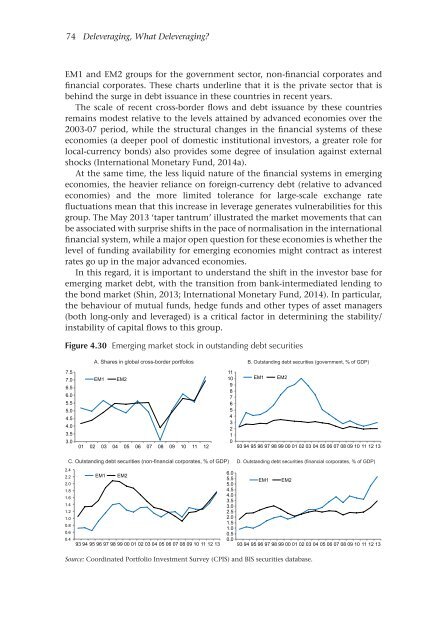

EM1 and EM2 groups for the government sector, non-financial corporates and<br />

financial corporates. These charts underline that it is the private sector that is<br />

behind the surge in debt issuance in these countries in recent years.<br />

The scale of recent cross-border flows and debt issuance by these countries<br />

remains modest relative to the levels attained by advanced economies over the<br />

2003-07 period, while the structural changes in the financial systems of these<br />

economies (a deeper pool of domestic institutional investors, a greater role for<br />

local-currency bonds) also provides some degree of insulation against external<br />

shocks (International Monetary Fund, 2014a).<br />

At the same time, the less liquid nature of the financial systems in emerging<br />

economies, the heavier reliance on foreign-currency debt (relative to advanced<br />

economies) and the more limited tolerance for large-scale exchange rate<br />

fluctuations mean that this increase in leverage generates vulnerabilities for this<br />

group. The May 2013 ‘taper tantrum’ illustrated the market movements that can<br />

be associated with surprise shifts in the pace of normalisation in the international<br />

financial system, while a major open question for these economies is whether the<br />

level of funding availability for emerging economies might contract as interest<br />

rates go up in the major advanced economies.<br />

In this regard, it is important to understand the shift in the investor base for<br />

emerging market debt, with the transition from bank-intermediated lending to<br />

the bond market (Shin, 2013; International Monetary Fund, 2014). In particular,<br />

the behaviour of mutual funds, hedge funds and other types of asset managers<br />

(both long-only and leveraged) is a critical factor in determining the stability/<br />

instability of capital flows to this group.<br />

Figure 4.30 Emerging market stock in outstanding debt securities<br />

A. Shares in global cross-border portfolios B. Outstanding debt securities (government, % of GDP)<br />

7.5<br />

7.0<br />

6.5<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

EM1<br />

EM2<br />

01 02 03 04 05 06 07 08 09 10 11 12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

EM1<br />

EM2<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

C. Outstanding debt securities (non-financial corporates, % of GDP) D. Outstanding debt securities (financial corporates, % of GDP)<br />

2.4<br />

2.2<br />

2.0<br />

1.8<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

EM1<br />

EM2<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

6.0<br />

5.5<br />

5.0<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

EM1<br />

EM2<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Coordinated Portfolio Investment Survey (CPIS) and BIS securities database.