1qGLG9p

1qGLG9p

1qGLG9p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

52 Deleveraging, What Deleveraging<br />

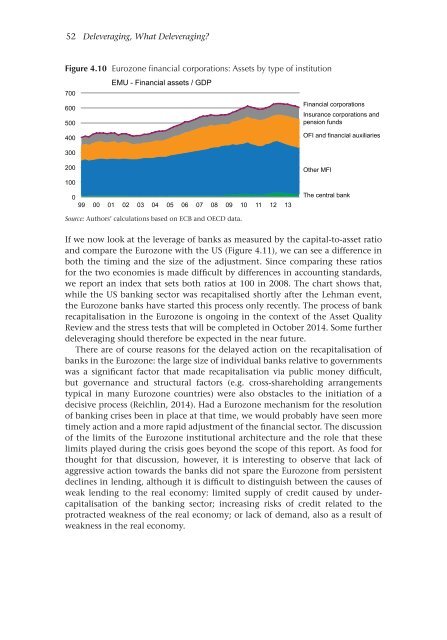

Figure 4.10 Eurozone financial corporations: Assets by type of institution<br />

700<br />

600<br />

500<br />

400<br />

300<br />

EMU - Financial assets / GDP<br />

Financial corporations<br />

Insurance corporations and<br />

pension funds<br />

OFI and financial auxiliaries<br />

200<br />

Other MFI<br />

100<br />

0<br />

99 00 01 02 03 04 05 06 07 08 09 10 11 12 13<br />

The central bank<br />

Source: Authors’ calculations based on ECB and OECD data.<br />

If we now look at the leverage of banks as measured by the capital-to-asset ratio<br />

and compare the Eurozone with the US (Figure 4.11), we can see a difference in<br />

both the timing and the size of the adjustment. Since comparing these ratios<br />

for the two economies is made difficult by differences in accounting standards,<br />

we report an index that sets both ratios at 100 in 2008. The chart shows that,<br />

while the US banking sector was recapitalised shortly after the Lehman event,<br />

the Eurozone banks have started this process only recently. The process of bank<br />

recapitalisation in the Eurozone is ongoing in the context of the Asset Quality<br />

Review and the stress tests that will be completed in October 2014. Some further<br />

deleveraging should therefore be expected in the near future.<br />

There are of course reasons for the delayed action on the recapitalisation of<br />

banks in the Eurozone: the large size of individual banks relative to governments<br />

was a significant factor that made recapitalisation via public money difficult,<br />

but governance and structural factors (e.g. cross-shareholding arrangements<br />

typical in many Eurozone countries) were also obstacles to the initiation of a<br />

decisive process (Reichlin, 2014). Had a Eurozone mechanism for the resolution<br />

of banking crises been in place at that time, we would probably have seen more<br />

timely action and a more rapid adjustment of the financial sector. The discussion<br />

of the limits of the Eurozone institutional architecture and the role that these<br />

limits played during the crisis goes beyond the scope of this report. As food for<br />

thought for that discussion, however, it is interesting to observe that lack of<br />

aggressive action towards the banks did not spare the Eurozone from persistent<br />

declines in lending, although it is difficult to distinguish between the causes of<br />

weak lending to the real economy: limited supply of credit caused by undercapitalisation<br />

of the banking sector; increasing risks of credit related to the<br />

protracted weakness of the real economy; or lack of demand, also as a result of<br />

weakness in the real economy.