1qGLG9p

1qGLG9p

1qGLG9p

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Case studies 39<br />

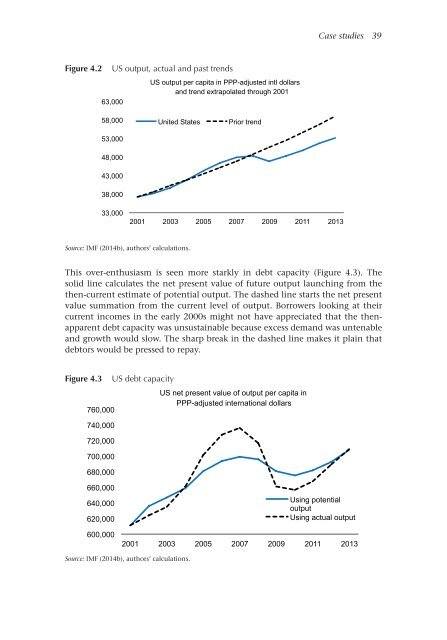

Figure 4.2<br />

US output, actual and past trends<br />

63,000<br />

US output per capita in PPP-adjusted intl dollars<br />

and trend extrapolated through 2001<br />

58,000<br />

53,000<br />

United States<br />

Prior trend<br />

48,000<br />

43,000<br />

38,000<br />

33,000<br />

2001 2003 2005 2007 2009 2011 2013<br />

Source: IMF (2014b), authors’ calculations.<br />

This over-enthusiasm is seen more starkly in debt capacity (Figure 4.3). The<br />

solid line calculates the net present value of future output launching from the<br />

then-current estimate of potential output. The dashed line starts the net present<br />

value summation from the current level of output. Borrowers looking at their<br />

current incomes in the early 2000s might not have appreciated that the thenapparent<br />

debt capacity was unsustainable because excess demand was untenable<br />

and growth would slow. The sharp break in the dashed line makes it plain that<br />

debtors would be pressed to repay.<br />

Figure 4.3<br />

760,000<br />

740,000<br />

720,000<br />

700,000<br />

680,000<br />

US debt capacity<br />

US net present value of output per capita in<br />

PPP-adjusted international dollars<br />

660,000<br />

640,000<br />

620,000<br />

600,000<br />

Using potential<br />

output<br />

Using actual output<br />

2001 2003 2005 2007 2009 2011 2013<br />

Source: IMF (2014b), authors’ calculations.