1qGLG9p

1qGLG9p

1qGLG9p

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Case studies 69<br />

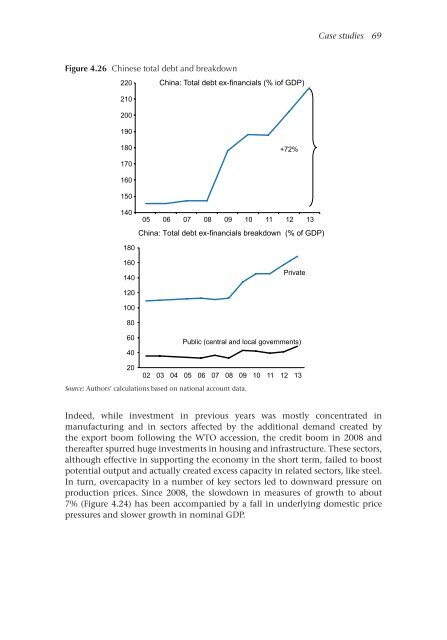

Figure 4.26 Chinese total debt and breakdown<br />

220 China: Total debt ex-financials (% iof GDP)<br />

210<br />

200<br />

190<br />

180<br />

+72%<br />

170<br />

160<br />

150<br />

140<br />

05 06 07 08 09 10 11 12 13<br />

China: Total debt ex-financials breakdown (% of GDP)<br />

180<br />

160<br />

140<br />

Private<br />

120<br />

100<br />

80<br />

60<br />

40<br />

Public (central and local governments)<br />

20<br />

02 03 04 05 06 07 08 09 10 11 12 13<br />

Source: Authors’ calculations based on national account data.<br />

Indeed, while investment in previous years was mostly concentrated in<br />

manufacturing and in sectors affected by the additional demand created by<br />

the export boom following the WTO accession, the credit boom in 2008 and<br />

thereafter spurred huge investments in housing and infrastructure. These sectors,<br />

although effective in supporting the economy in the short term, failed to boost<br />

potential output and actually created excess capacity in related sectors, like steel.<br />

In turn, overcapacity in a number of key sectors led to downward pressure on<br />

production prices. Since 2008, the slowdown in measures of growth to about<br />

7% (Figure 4.24) has been accompanied by a fall in underlying domestic price<br />

pressures and slower growth in nominal GDP.