CARGO BUSINESS 1-10.indd - ZSSK Cargo

CARGO BUSINESS 1-10.indd - ZSSK Cargo

CARGO BUSINESS 1-10.indd - ZSSK Cargo

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>CARGO</strong><br />

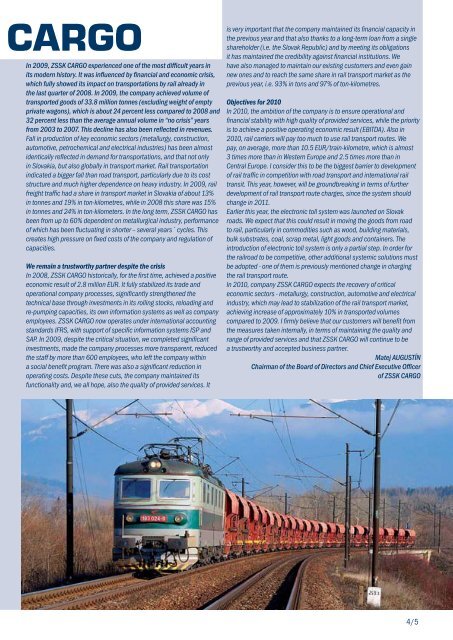

In 2009, <strong>ZSSK</strong> <strong>CARGO</strong> experienced one of the most difficult years in<br />

its modern history. It was influenced by financial and economic crisis,<br />

which fully showed its impact on transportations by rail already in<br />

the last quarter of 2008. In 2009, the company achieved volume of<br />

transported goods of 33.8 million tonnes (excluding weight of empty<br />

private wagons), which is about 24 percent less compared to 2008 and<br />

32 percent less than the average annual volume in “no crisis” years<br />

from 2003 to 2007. This decline has also been reflected in revenues.<br />

Fall in production of key economic sectors (metallurgy, construction,<br />

automotive, petrochemical and electrical industries) has been almost<br />

identically reflected in demand for transportations, and that not only<br />

in Slovakia, but also globally in transport market. Rail transportation<br />

indicated a bigger fall than road transport, particularly due to its cost<br />

structure and much higher dependence on heavy industry. In 2009, rail<br />

freight traffic had a share in transport market in Slovakia of about 13%<br />

in tonnes and 19% in ton-kilometres, while in 2008 this share was 15%<br />

in tonnes and 24% in ton-kilometers. In the long term, <strong>ZSSK</strong> <strong>CARGO</strong> has<br />

been from up to 60% dependent on metallurgical industry, performance<br />

of which has been fluctuating in shorter – several years´ cycles. This<br />

creates high pressure on fixed costs of the company and regulation of<br />

capacities.<br />

We remain a trustworthy partner despite the crisis<br />

In 2008, <strong>ZSSK</strong> <strong>CARGO</strong> historically, for the first time, achieved a positive<br />

economic result of 2.8 million EUR. It fully stabilized its trade and<br />

operational company processes, significantly strengthened the<br />

technical base through investments in its rolling stocks, reloading and<br />

re-pumping capacities, its own information systems as well as company<br />

employees. <strong>ZSSK</strong> <strong>CARGO</strong> now operates under international accounting<br />

standards IFRS, with support of specific information systems ISP and<br />

SAP. In 2009, despite the critical situation, we completed significant<br />

investments, made the company processes more transparent, reduced<br />

the staff by more than 600 employees, who left the company within<br />

a social benefit program. There was also a significant reduction in<br />

operating costs. Despite these cuts, the company maintained its<br />

functionality and, we all hope, also the quality of provided services. It<br />

is very important that the company maintained its financial capacity in<br />

the previous year and that also thanks to a long-term loan from a single<br />

shareholder (i.e. the Slovak Republic) and by meeting its obligations<br />

it has maintained the credibility against financial institutions. We<br />

have also managed to maintain our existing customers and even gain<br />

new ones and to reach the same share in rail transport market as the<br />

previous year, i.e. 93% in tons and 97% of ton-kilometres.<br />

Objectives for 2010<br />

In 2010, the ambition of the company is to ensure operational and<br />

financial stability with high quality of provided services, while the priority<br />

is to achieve a positive operating economic result (EBITDA). Also in<br />

2010, rail carriers will pay too much to use rail transport routes. We<br />

pay, on average, more than 10.5 EUR/train-kilometre, which is almost<br />

3 times more than in Western Europe and 2.5 times more than in<br />

Central Europe. I consider this to be the biggest barrier to development<br />

of rail traffic in competition with road transport and international rail<br />

transit. This year, however, will be groundbreaking in terms of further<br />

development of rail transport route charges, since the system should<br />

change in 2011.<br />

Earlier this year, the electronic toll system was launched on Slovak<br />

roads. We expect that this could result in moving the goods from road<br />

to rail, particularly in commodities such as wood, building materials,<br />

bulk substrates, coal, scrap metal, light goods and containers. The<br />

introduction of electronic toll system is only a partial step. In order for<br />

the railroad to be competitive, other additional systemic solutions must<br />

be adopted - one of them is previously mentioned change in charging<br />

the rail transport route.<br />

In 2010, company <strong>ZSSK</strong> <strong>CARGO</strong> expects the recovery of critical<br />

economic sectors - metallurgy, construction, automotive and electrical<br />

industry, which may lead to stabilization of the rail transport market,<br />

achieving increase of approximately 10% in transported volumes<br />

compared to 2009. I firmly believe that our customers will benefit from<br />

the measures taken internally, in terms of maintaining the quality and<br />

range of provided services and that <strong>ZSSK</strong> <strong>CARGO</strong> will continue to be<br />

a trustworthy and accepted business partner.<br />

Matej AUGUSTÍN<br />

Chairman of the Board of Directors and Chief Executive Officer<br />

of <strong>ZSSK</strong> <strong>CARGO</strong><br />

4/5