CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

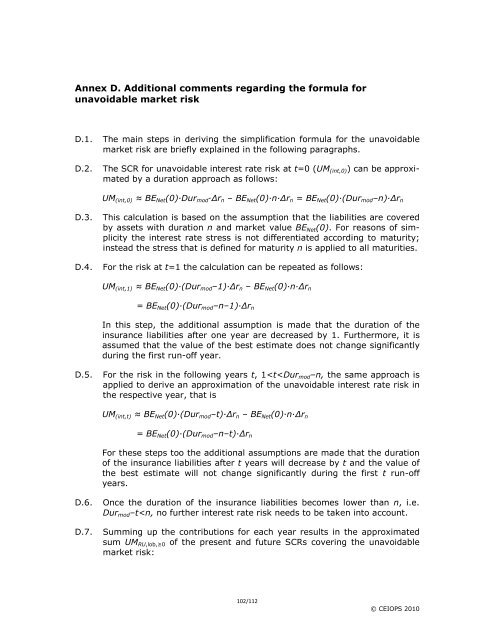

Annex D. Additional comments regarding the <strong>for</strong>mula <strong>for</strong><br />

unavoidable market risk<br />

D.1. The main steps in deriving the simplification <strong>for</strong>mula <strong>for</strong> the unavoidable<br />

market risk are briefly explained in the following paragraphs.<br />

D.2. The SCR <strong>for</strong> unavoidable interest rate risk at t=0 (UM(int,0)) can be approximated<br />

by a duration approach as follows:<br />

UM(int,0) ≈ BENet(0)·Durmod·∆rn – BENet(0)·n·∆rn = BENet(0)·(Durmod–n)·∆rn<br />

D.3. This calculation is based on the assumption that the liabilities are covered<br />

by assets with duration n and market value BENet(0). For reasons of simplicity<br />

the interest rate stress is not differentiated according to maturity;<br />

instead the stress that is defined <strong>for</strong> maturity n is applied to all maturities.<br />

D.4. For the risk at t=1 the calculation can be repeated as follows:<br />

UM(int,1) ≈ BENet(0)·(Durmod–1)·∆rn – BENet(0)·n·∆rn<br />

= BENet(0)·(Durmod–n–1)·∆rn<br />

In this step, the additional assumption is made that the duration of the<br />

insurance liabilities after one year are decreased by 1. Furthermore, it is<br />

assumed that the value of the best estimate does not change significantly<br />

during the first run-off year.<br />

D.5. For the risk in the following years t, 1