CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

• assume independency between assets, <strong>for</strong> instance, between equity<br />

rate of return and interest rate.<br />

3.2.3. Non-life insurance specific<br />

3.2.3.1. Outstanding reported claim provision. First simplification<br />

3.224 Description. This simplification applies to the calculation of the best<br />

estimate of reported claims by means of consider the number of claims<br />

reported and the average cost thereof. There<strong>for</strong>e is a simplification<br />

applicable when it does not deliver material model error in the estimate<br />

of frequency, severity and its combination. This simplification can be<br />

used to calculate outstanding claims provision and provision <strong>for</strong> incurred<br />

but not reported claims as a whole, adding to Ni the IBNR claims<br />

calculated as Nt in 3.233.<br />

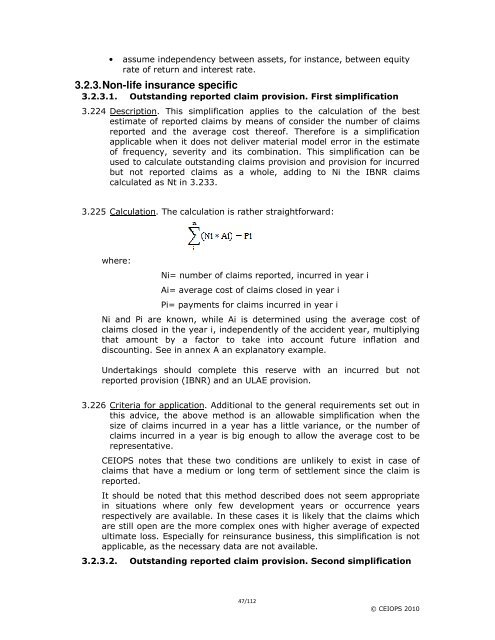

3.225 Calculation. The calculation is rather straight<strong>for</strong>ward:<br />

where:<br />

Ni= number of claims reported, incurred in year i<br />

Ai= average cost of claims closed in year i<br />

Pi= payments <strong>for</strong> claims incurred in year i<br />

Ni and Pi are known, while Ai is determined using the average cost of<br />

claims closed in the year i, independently of the accident year, multiplying<br />

that amount by a factor to take into account future inflation and<br />

discounting. See in annex A an explanatory example.<br />

Undertakings should complete this reserve with an incurred but not<br />

reported provision (IBNR) and an ULAE provision.<br />

3.226 Criteria <strong>for</strong> application. Additional to the general requirements set out in<br />

this advice, the above method is an allowable simplification when the<br />

size of claims incurred in a year has a little variance, or the number of<br />

claims incurred in a year is big enough to allow the average cost to be<br />

representative.<br />

CEIOPS notes that these two conditions are unlikely to exist in case of<br />

claims that have a medium or long term of settlement since the claim is<br />

reported.<br />

It should be noted that this method described does not seem appropriate<br />

in situations where only few development years or occurrence years<br />

respectively are available. In these cases it is likely that the claims which<br />

are still open are the more complex ones with higher average of expected<br />

ultimate loss. Especially <strong>for</strong> reinsurance business, this simplification is not<br />

applicable, as the necessary data are not available.<br />

3.2.3.2. Outstanding reported claim provision. Second simplification<br />

47/112<br />

© CEIOPS 2010