CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

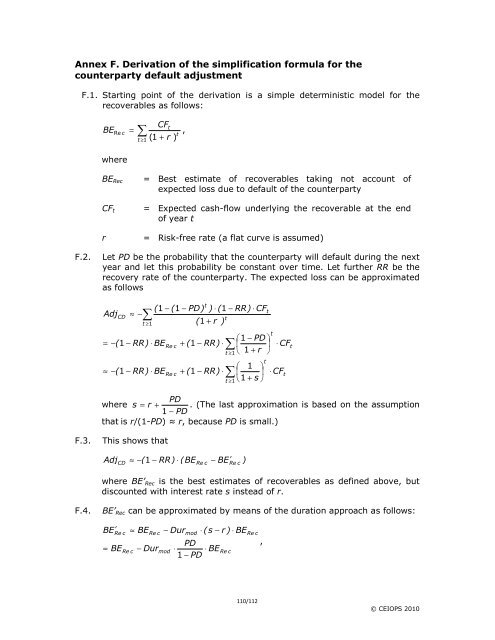

Annex F. Derivation of the simplification <strong>for</strong>mula <strong>for</strong> the<br />

counterparty default adjustment<br />

F.1. Starting point of the derivation is a simple deterministic model <strong>for</strong> the<br />

recoverables as follows:<br />

CFt<br />

BE Re c =<br />

, t<br />

( 1 + r )<br />

where<br />

BERec<br />

CFt<br />

∑<br />

t ≥ 1<br />

= Best estimate of recoverables taking not account of<br />

expected loss due to default of the counterparty<br />

= Expected cash-flow underlying the recoverable at the end<br />

of year t<br />

r = Risk-free rate (a flat curve is assumed)<br />

F.2. Let PD be the probability that the counterparty will default during the next<br />

year and let this probability be constant over time. Let further RR be the<br />

recovery rate of the counterparty. The expected loss can be approximated<br />

as follows<br />

Adj<br />

CD<br />

≈ −<br />

∑<br />

t ≥1<br />

= −(<br />

1 − RR)<br />

≈ −(<br />

1 − RR)<br />

( 1 − ( 1 − PD)<br />

) ⋅ ( 1 − RR)<br />

⋅ CF<br />

⋅ BE<br />

⋅ BE<br />

Re c<br />

Re c<br />

+ ( 1 − RR)<br />

+ ( 1 − RR)<br />

t<br />

( 1 + r )<br />

⋅<br />

⋅<br />

t<br />

∑<br />

t ≥1<br />

∑<br />

t ≥1<br />

⎛1<br />

− PD ⎞<br />

⎜ ⎟ ⋅ CFt<br />

⎝ 1 + r ⎠<br />

⎛ 1 ⎞<br />

⎜ ⎟<br />

⎝1<br />

+ s ⎠<br />

110/112<br />

t<br />

t<br />

t<br />

⋅ CF<br />

PD<br />

where s = r + . (The last approximation is based on the assumption<br />

1 − PD<br />

that is r/(1-PD) ≈ r, because PD is small.)<br />

F.3. This shows that<br />

AdjCD ≈ −(<br />

1 − RR)<br />

⋅ ( BERe<br />

c − BERe<br />

′ c )<br />

where BE’Rec is the best estimates of recoverables as defined above, but<br />

discounted with interest rate s instead of r.<br />

F.4. BE’Rec can be approximated by means of the duration approach as follows:<br />

BE<br />

′<br />

Re c<br />

= BE<br />

Re c<br />

≈ BE<br />

Re c<br />

− Dur<br />

− Dur<br />

mod<br />

mod<br />

PD<br />

⋅ ⋅ BE<br />

1 − PD<br />

⋅ ( s − r ) ⋅ BE<br />

Re c<br />

Re c<br />

,<br />

t<br />

© CEIOPS 2010