CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

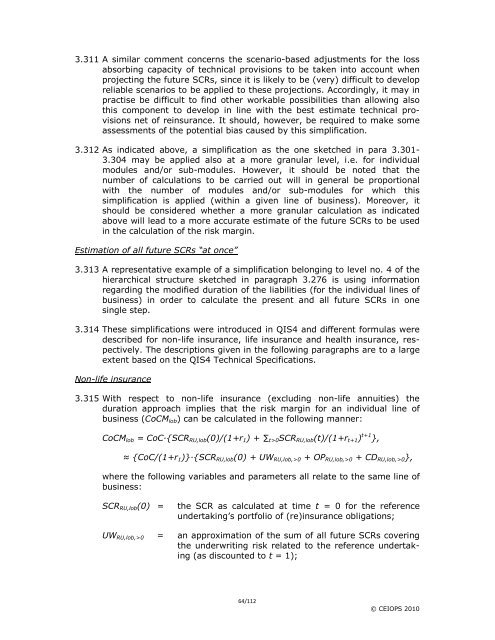

3.311 A similar comment concerns the scenario-based adjustments <strong>for</strong> the loss<br />

absorbing capacity of technical provisions to be taken into account when<br />

projecting the future SCRs, since it is likely to be (very) difficult to develop<br />

reliable scenarios to be applied to these projections. Accordingly, it may in<br />

practise be difficult to find other workable possibilities than allowing also<br />

this component to develop in line with the best estimate technical provisions<br />

net of reinsurance. It should, however, be required to make some<br />

assessments of the potential bias caused by this simplification.<br />

3.312 As indicated above, a simplification as the one sketched in para 3.301-<br />

3.304 may be applied also at a more granular level, i.e. <strong>for</strong> individual<br />

modules and/or sub-modules. However, it should be noted that the<br />

number of calculations to be carried out will in general be proportional<br />

with the number of modules and/or sub-modules <strong>for</strong> which this<br />

simplification is applied (within a given line of business). Moreover, it<br />

should be considered whether a more granular calculation as indicated<br />

above will lead to a more accurate estimate of the future SCRs to be used<br />

in the calculation of the risk margin.<br />

Estimation of all future SCRs “at once”<br />

3.313 A representative example of a simplification belonging to level no. 4 of the<br />

hierarchical structure sketched in paragraph 3.276 is using in<strong>for</strong>mation<br />

regarding the modified duration of the liabilities (<strong>for</strong> the individual lines of<br />

business) in order to calculate the present and all future SCRs in one<br />

single step.<br />

3.314 These simplifications were introduced in QIS4 and different <strong>for</strong>mulas were<br />

described <strong>for</strong> non-life insurance, life insurance and health insurance, respectively.<br />

The descriptions given in the following paragraphs are to a large<br />

extent based on the QIS4 Technical Specifications.<br />

Non-life insurance<br />

3.315 With respect to non-life insurance (excluding non-life annuities) the<br />

duration approach implies that the risk margin <strong>for</strong> an individual line of<br />

business (CoCMlob) can be calculated in the following manner:<br />

CoCMlob = CoC·{SCRRU,lob(0)/(1+r1) + ∑t>0SCRRU,lob(t)/(1+rt+1) t+1 },<br />

≈ {CoC/(1+r1)}·{SCRRU,lob(0) + UWRU,lob,>0 + OPRU,lob,>0 + CDRU,lob,>0},<br />

where the following variables and parameters all relate to the same line of<br />

business:<br />

SCRRU,lob(0) = the SCR as calculated at time t = 0 <strong>for</strong> the reference<br />

undertaking’s portfolio of (re)insurance obligations;<br />

UWRU,lob,>0 = an approximation of the sum of all future SCRs covering<br />

the underwriting risk related to the reference undertaking<br />

(as discounted to t = 1);<br />

64/112<br />

© CEIOPS 2010