CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

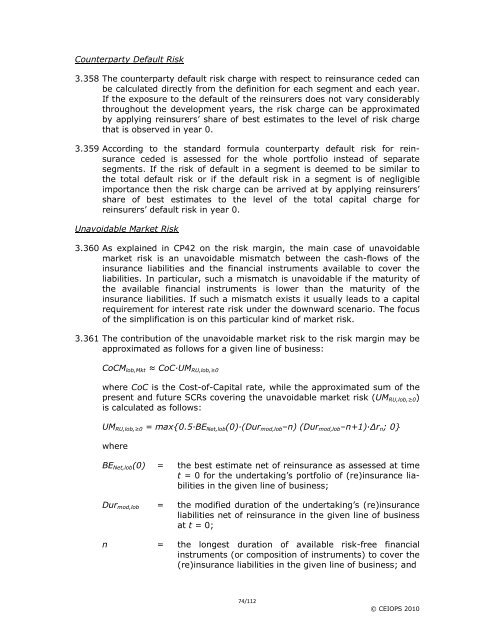

Counterparty Default Risk<br />

3.358 The counterparty default risk charge with respect to reinsurance ceded can<br />

be calculated directly from the definition <strong>for</strong> each segment and each year.<br />

If the exposure to the default of the reinsurers does not vary considerably<br />

throughout the development years, the risk charge can be approximated<br />

by applying reinsurers’ share of best estimates to the level of risk charge<br />

that is observed in year 0.<br />

3.359 According to the standard <strong>for</strong>mula counterparty default risk <strong>for</strong> reinsurance<br />

ceded is assessed <strong>for</strong> the whole portfolio instead of separate<br />

segments. If the risk of default in a segment is deemed to be similar to<br />

the total default risk or if the default risk in a segment is of negligible<br />

importance then the risk charge can be arrived at by applying reinsurers’<br />

share of best estimates to the level of the total capital charge <strong>for</strong><br />

reinsurers’ default risk in year 0.<br />

Unavoidable Market Risk<br />

3.360 As explained in CP42 on the risk margin, the main case of unavoidable<br />

market risk is an unavoidable mismatch between the cash-flows of the<br />

insurance liabilities and the financial instruments available to cover the<br />

liabilities. In particular, such a mismatch is unavoidable if the maturity of<br />

the available financial instruments is lower than the maturity of the<br />

insurance liabilities. If such a mismatch exists it usually leads to a capital<br />

requirement <strong>for</strong> interest rate risk under the downward scenario. The focus<br />

of the simplification is on this particular kind of market risk.<br />

3.361 The contribution of the unavoidable market risk to the risk margin may be<br />

approximated as follows <strong>for</strong> a given line of business:<br />

CoCMlob,Mkt ≈ CoC·UMRU,lob,≥0<br />

where CoC is the Cost-of-Capital rate, while the approximated sum of the<br />

present and future SCRs covering the unavoidable market risk (UMRU,lob,≥0)<br />

is calculated as follows:<br />

UMRU,lob,≥0 = max{0.5·BENet,lob(0)·(Durmod,lob–n) (Durmod,lob–n+1)·∆rn; 0}<br />

where<br />

BENet,lob(0) = the best estimate net of reinsurance as assessed at time<br />

t = 0 <strong>for</strong> the undertaking’s portfolio of (re)insurance liabilities<br />

in the given line of business;<br />

Durmod,lob = the modified duration of the undertaking’s (re)insurance<br />

liabilities net of reinsurance in the given line of business<br />

at t = 0;<br />

n = the longest duration of available risk-free financial<br />

instruments (or composition of instruments) to cover the<br />

(re)insurance liabilities in the given line of business; and<br />

74/112<br />

© CEIOPS 2010