CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

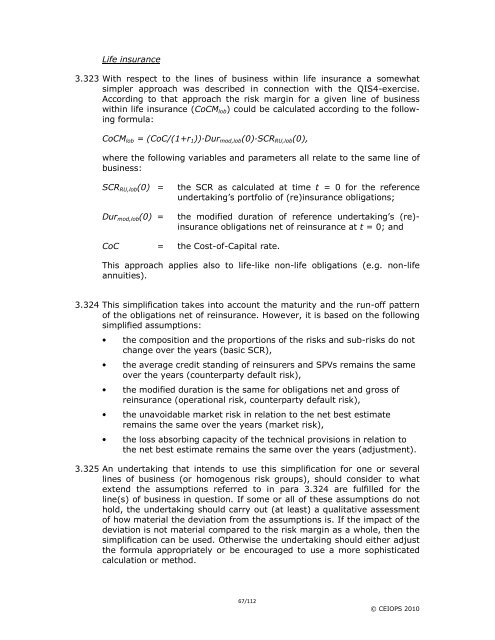

Life insurance<br />

3.323 With respect to the lines of business within life insurance a somewhat<br />

simpler approach was described in connection with the QIS4-exercise.<br />

According to that approach the risk margin <strong>for</strong> a given line of business<br />

within life insurance (CoCMlob) could be calculated according to the following<br />

<strong>for</strong>mula:<br />

CoCMlob = (CoC/(1+r1))·Durmod,lob(0)·SCRRU,lob(0),<br />

where the following variables and parameters all relate to the same line of<br />

business:<br />

SCRRU,lob(0) = the SCR as calculated at time t = 0 <strong>for</strong> the reference<br />

undertaking’s portfolio of (re)insurance obligations;<br />

Durmod,lob(0) = the modified duration of reference undertaking’s (re)insurance<br />

obligations net of reinsurance at t = 0; and<br />

CoC = the Cost-of-Capital rate.<br />

This approach applies also to life-like non-life obligations (e.g. non-life<br />

annuities).<br />

3.324 This simplification takes into account the maturity and the run-off pattern<br />

of the obligations net of reinsurance. However, it is based on the following<br />

simplified assumptions:<br />

• the composition and the proportions of the risks and sub-risks do not<br />

change over the years (basic SCR),<br />

• the average credit standing of reinsurers and SPVs remains the same<br />

over the years (counterparty default risk),<br />

• the modified duration is the same <strong>for</strong> obligations net and gross of<br />

reinsurance (operational risk, counterparty default risk),<br />

• the unavoidable market risk in relation to the net best estimate<br />

remains the same over the years (market risk),<br />

• the loss absorbing capacity of the technical provisions in relation to<br />

the net best estimate remains the same over the years (adjustment).<br />

3.325 An undertaking that intends to use this simplification <strong>for</strong> one or several<br />

lines of business (or homogenous risk groups), should consider to what<br />

extend the assumptions referred to in para 3.324 are fulfilled <strong>for</strong> the<br />

line(s) of business in question. If some or all of these assumptions do not<br />

hold, the undertaking should carry out (at least) a qualitative assessment<br />

of how material the deviation from the assumptions is. If the impact of the<br />

deviation is not material compared to the risk margin as a whole, then the<br />

simplification can be used. Otherwise the undertaking should either adjust<br />

the <strong>for</strong>mula appropriately or be encouraged to use a more sophisticated<br />

calculation or method.<br />

67/112<br />

© CEIOPS 2010