CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.4.6. Simplified calculation of the adjustment <strong>for</strong> counterparty<br />

default<br />

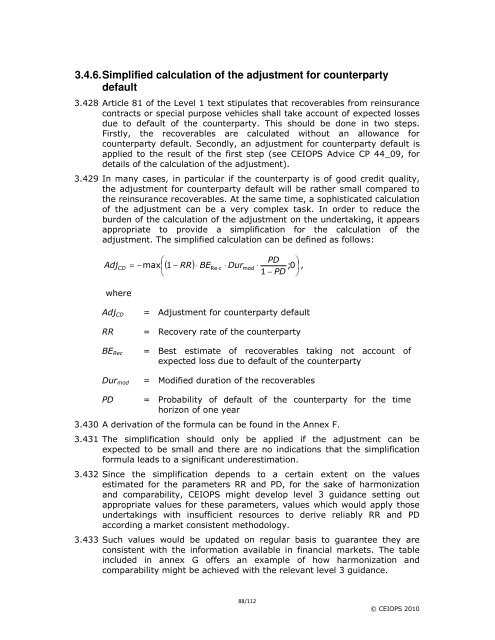

3.428 Article 81 of the <strong>Level</strong> 1 text stipulates that recoverables from reinsurance<br />

contracts or special purpose vehicles shall take account of expected losses<br />

due to default of the counterparty. This should be done in two steps.<br />

Firstly, the recoverables are calculated without an allowance <strong>for</strong><br />

counterparty default. Secondly, an adjustment <strong>for</strong> counterparty default is<br />

applied to the result of the first step (see CEIOPS <strong>Advice</strong> CP 44_09, <strong>for</strong><br />

details of the calculation of the adjustment).<br />

3.429 In many cases, in particular if the counterparty is of good credit quality,<br />

the adjustment <strong>for</strong> counterparty default will be rather small compared to<br />

the reinsurance recoverables. At the same time, a sophisticated calculation<br />

of the adjustment can be a very complex task. In order to reduce the<br />

burden of the calculation of the adjustment on the undertaking, it appears<br />

appropriate to provide a simplification <strong>for</strong> the calculation of the<br />

adjustment. The simplified calculation can be defined as follows:<br />

⎛<br />

PD ⎞<br />

= − max⎜( 1 − RR)<br />

⋅ BERe<br />

⋅ Durmod<br />

⋅ ; 0⎟<br />

,<br />

⎝<br />

1 − PD ⎠<br />

AdjCD c<br />

where<br />

AdjCD<br />

= Adjustment <strong>for</strong> counterparty default<br />

RR = Recovery rate of the counterparty<br />

BERec<br />

Durmod<br />

= Best estimate of recoverables taking not account of<br />

expected loss due to default of the counterparty<br />

= Modified duration of the recoverables<br />

PD = Probability of default of the counterparty <strong>for</strong> the time<br />

horizon of one year<br />

3.430 A derivation of the <strong>for</strong>mula can be found in the Annex F.<br />

3.431 The simplification should only be applied if the adjustment can be<br />

expected to be small and there are no indications that the simplification<br />

<strong>for</strong>mula leads to a significant underestimation.<br />

3.432 Since the simplification depends to a certain extent on the values<br />

estimated <strong>for</strong> the parameters RR and PD, <strong>for</strong> the sake of harmonization<br />

and comparability, CEIOPS might develop level 3 guidance setting out<br />

appropriate values <strong>for</strong> these parameters, values which would apply those<br />

undertakings with insufficient resources to derive reliably RR and PD<br />

according a market consistent methodology.<br />

3.433 Such values would be updated on regular basis to guarantee they are<br />

consistent with the in<strong>for</strong>mation available in financial markets. The table<br />

included in annex G offers an example of how harmonization and<br />

comparability might be achieved with the relevant level 3 guidance.<br />

88/112<br />

© CEIOPS 2010