CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.326 For the lines of business within life insurance the current SCR as calculated<br />

<strong>for</strong> the reference undertaking covers the unavoidable market risk.<br />

However, according to the approach briefly described in para 3.360-3.364<br />

the unavoidable market risk is restricted to the unavoidable mismatch<br />

between the cash-flows of the insurance liabilities and the financial<br />

instruments available to cover these liabilities. By taking this restriction<br />

into account, and especially the simplified method of calculation described<br />

in para 3.360-3.364, it may be the case that the <strong>for</strong>mula referred to in<br />

para 3.323 exaggerates the impact of unavoidable market risk on the risk<br />

margin <strong>for</strong> these lines of business. In such cases it should be allowed to<br />

adjust the <strong>for</strong>mula in para 3.323 in order to take into account the<br />

simplified calculation of unavoidable market risk in an adequate manner.<br />

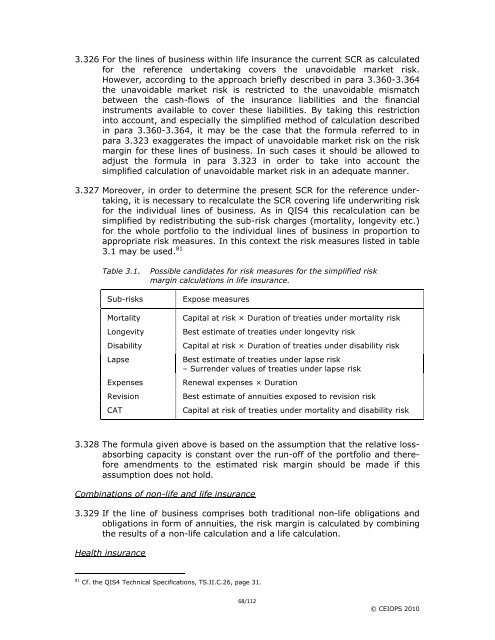

3.327 Moreover, in order to determine the present SCR <strong>for</strong> the reference undertaking,<br />

it is necessary to recalculate the SCR covering life underwriting risk<br />

<strong>for</strong> the individual lines of business. As in QIS4 this recalculation can be<br />

simplified by redistributing the sub-risk charges (mortality, longevity etc.)<br />

<strong>for</strong> the whole portfolio to the individual lines of business in proportion to<br />

appropriate risk measures. In this context the risk measures listed in table<br />

3.1 may be used. 81<br />

Table 3.1. Possible candidates <strong>for</strong> risk measures <strong>for</strong> the simplified risk<br />

margin calculations in life insurance.<br />

Sub-risks Expose measures<br />

Mortality Capital at risk × Duration of treaties under mortality risk<br />

Longevity Best estimate of treaties under longevity risk<br />

Disability Capital at risk × Duration of treaties under disability risk<br />

Lapse Best estimate of treaties under lapse risk<br />

– Surrender values of treaties under lapse risk<br />

Expenses Renewal expenses × Duration<br />

Revision Best estimate of annuities exposed to revision risk<br />

CAT Capital at risk of treaties under mortality and disability risk<br />

3.328 The <strong>for</strong>mula given above is based on the assumption that the relative lossabsorbing<br />

capacity is constant over the run-off of the portfolio and there<strong>for</strong>e<br />

amendments to the estimated risk margin should be made if this<br />

assumption does not hold.<br />

Combinations of non-life and life insurance<br />

3.329 If the line of business comprises both traditional non-life obligations and<br />

obligations in <strong>for</strong>m of annuities, the risk margin is calculated by combining<br />

the results of a non-life calculation and a life calculation.<br />

Health insurance<br />

81 Cf. the QIS4 Technical Specifications, TS.II.C.26, page 31.<br />

68/112<br />

© CEIOPS 2010