CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

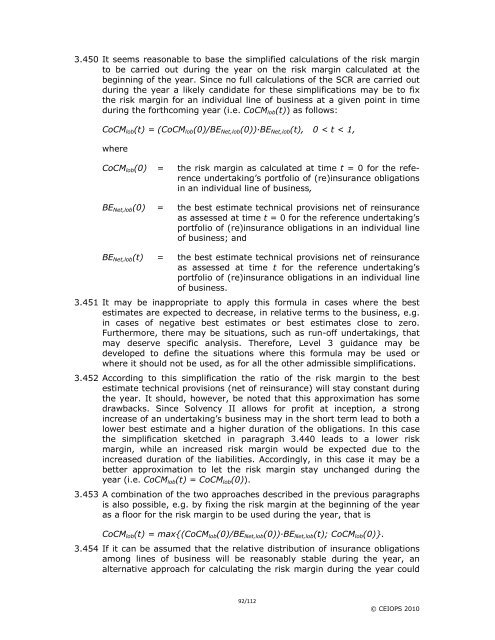

3.450 It seems reasonable to base the simplified calculations of the risk margin<br />

to be carried out during the year on the risk margin calculated at the<br />

beginning of the year. Since no full calculations of the SCR are carried out<br />

during the year a likely candidate <strong>for</strong> these simplifications may be to fix<br />

the risk margin <strong>for</strong> an individual line of business at a given point in time<br />

during the <strong>for</strong>thcoming year (i.e. CoCMlob(t)) as follows:<br />

CoCMlob(t) = (CoCMlob(0)/BENet,lob(0))·BENet,lob(t), 0 < t < 1,<br />

where<br />

CoCMlob(0) = the risk margin as calculated at time t = 0 <strong>for</strong> the reference<br />

undertaking’s portfolio of (re)insurance obligations<br />

in an individual line of business,<br />

BENet,lob(0) = the best estimate technical provisions net of reinsurance<br />

as assessed at time t = 0 <strong>for</strong> the reference undertaking’s<br />

portfolio of (re)insurance obligations in an individual line<br />

of business; and<br />

BENet,lob(t) = the best estimate technical provisions net of reinsurance<br />

as assessed at time t <strong>for</strong> the reference undertaking’s<br />

portfolio of (re)insurance obligations in an individual line<br />

of business.<br />

3.451 It may be inappropriate to apply this <strong>for</strong>mula in cases where the best<br />

estimates are expected to decrease, in relative terms to the business, e.g.<br />

in cases of negative best estimates or best estimates close to zero.<br />

Furthermore, there may be situations, such as run-off undertakings, that<br />

may deserve specific analysis. There<strong>for</strong>e, <strong>Level</strong> 3 guidance may be<br />

developed to define the situations where this <strong>for</strong>mula may be used or<br />

where it should not be used, as <strong>for</strong> all the other admissible simplifications.<br />

3.452 According to this simplification the ratio of the risk margin to the best<br />

estimate technical provisions (net of reinsurance) will stay constant during<br />

the year. It should, however, be noted that this approximation has some<br />

drawbacks. Since Solvency II allows <strong>for</strong> profit at inception, a strong<br />

increase of an undertaking’s business may in the short term lead to both a<br />

lower best estimate and a higher duration of the obligations. In this case<br />

the simplification sketched in paragraph 3.440 leads to a lower risk<br />

margin, while an increased risk margin would be expected due to the<br />

increased duration of the liabilities. Accordingly, in this case it may be a<br />

better approximation to let the risk margin stay unchanged during the<br />

year (i.e. CoCMlob(t) = CoCMlob(0)).<br />

3.453 A combination of the two approaches described in the previous paragraphs<br />

is also possible, e.g. by fixing the risk margin at the beginning of the year<br />

as a floor <strong>for</strong> the risk margin to be used during the year, that is<br />

CoCMlob(t) = max{(CoCMlob(0)/BENet,lob(0))·BENet,lob(t); CoCMlob(0)}.<br />

3.454 If it can be assumed that the relative distribution of insurance obligations<br />

among lines of business will be reasonably stable during the year, an<br />

alternative approach <strong>for</strong> calculating the risk margin during the year could<br />

92/112<br />

© CEIOPS 2010