CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annex B. Some technical aspects regarding the discount factors to<br />

be used in the calculation of the risk margin<br />

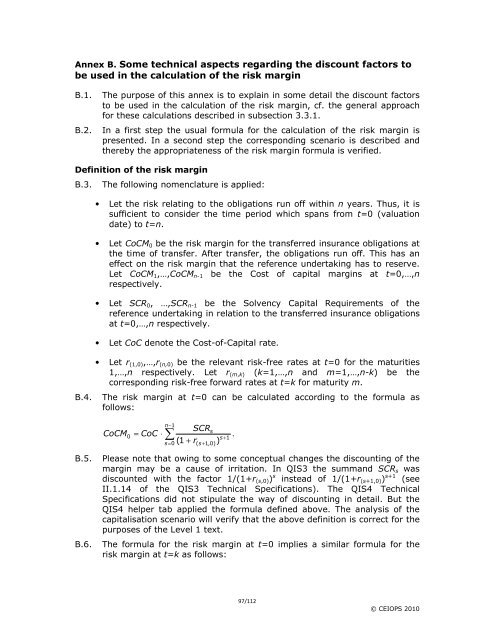

B.1. The purpose of this annex is to explain in some detail the discount factors<br />

to be used in the calculation of the risk margin, cf. the general approach<br />

<strong>for</strong> these calculations described in subsection 3.3.1.<br />

B.2. In a first step the usual <strong>for</strong>mula <strong>for</strong> the calculation of the risk margin is<br />

presented. In a second step the corresponding scenario is described and<br />

thereby the appropriateness of the risk margin <strong>for</strong>mula is verified.<br />

Definition of the risk margin<br />

B.3. The following nomenclature is applied:<br />

• Let the risk relating to the obligations run off within n years. Thus, it is<br />

sufficient to consider the time period which spans from t=0 (valuation<br />

date) to t=n.<br />

• Let CoCM0 be the risk margin <strong>for</strong> the transferred insurance obligations at<br />

the time of transfer. After transfer, the obligations run off. This has an<br />

effect on the risk margin that the reference undertaking has to reserve.<br />

Let CoCM1,…,CoCMn-1 be the Cost of capital margins at t=0,…,n<br />

respectively.<br />

• Let SCR0, …,SCRn-1 be the Solvency Capital Requirements of the<br />

reference undertaking in relation to the transferred insurance obligations<br />

at t=0,…,n respectively.<br />

• Let CoC denote the Cost-of-Capital rate.<br />

• Let r(1,0),…,r(n,0) be the relevant risk-free rates at t=0 <strong>for</strong> the maturities<br />

1,…,n respectively. Let r(m,k) (k=1,…,n and m=1,…,n-k) be the<br />

corresponding risk-free <strong>for</strong>ward rates at t=k <strong>for</strong> maturity m.<br />

B.4. The risk margin at t=0 can be calculated according to the <strong>for</strong>mula as<br />

follows:<br />

∑ − n 1<br />

s=<br />

0<br />

SCR<br />

CoCM 0 = CoC ⋅<br />

.<br />

( 1 + r<br />

s<br />

s+<br />

1<br />

( s+<br />

1,<br />

0)<br />

)<br />

B.5. Please note that owing to some conceptual changes the discounting of the<br />

margin may be a cause of irritation. In QIS3 the summand SCRs was<br />

discounted with the factor 1/(1+r(s,0)) s instead of 1/(1+r(s+1,0)) s+1 (see<br />

II.1.14 of the QIS3 Technical Specifications). The QIS4 Technical<br />

Specifications did not stipulate the way of discounting in detail. But the<br />

QIS4 helper tab applied the <strong>for</strong>mula defined above. The analysis of the<br />

capitalisation scenario will verify that the above definition is correct <strong>for</strong> the<br />

purposes of the <strong>Level</strong> 1 text.<br />

B.6. The <strong>for</strong>mula <strong>for</strong> the risk margin at t=0 implies a similar <strong>for</strong>mula <strong>for</strong> the<br />

risk margin at t=k as follows:<br />

97/112<br />

© CEIOPS 2010