CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

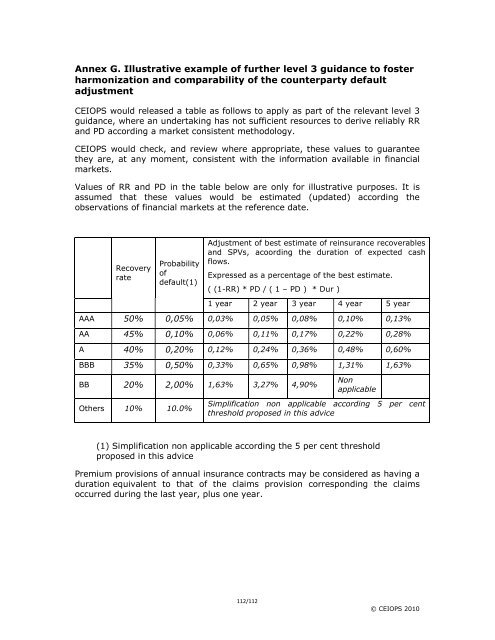

Annex G. Illustrative example of further level 3 guidance to foster<br />

harmonization and comparability of the counterparty default<br />

adjustment<br />

CEIOPS would released a table as follows to apply as part of the relevant level 3<br />

guidance, where an undertaking has not sufficient resources to derive reliably RR<br />

and PD according a market consistent methodology.<br />

CEIOPS would check, and review where appropriate, these values to guarantee<br />

they are, at any moment, consistent with the in<strong>for</strong>mation available in financial<br />

markets.<br />

Values of RR and PD in the table below are only <strong>for</strong> illustrative purposes. It is<br />

assumed that these values would be estimated (updated) according the<br />

observations of financial markets at the reference date.<br />

Recovery<br />

rate<br />

Probability<br />

of<br />

default(1)<br />

Adjustment of best estimate of reinsurance recoverables<br />

and SPVs, acoording the duration of expected cash<br />

flows.<br />

Expressed as a percentage of the best estimate.<br />

( (1-RR) * PD / ( 1 – PD ) * Dur )<br />

1 year 2 year 3 year 4 year 5 year<br />

AAA 50% 0,05% 0,03% 0,05% 0,08% 0,10% 0,13%<br />

AA 45% 0,10% 0,06% 0,11% 0,17% 0,22% 0,28%<br />

A 40% 0,20% 0,12% 0,24% 0,36% 0,48% 0,60%<br />

BBB 35% 0,50% 0,33% 0,65% 0,98% 1,31% 1,63%<br />

BB 20% 2,00% 1,63% 3,27% 4,90%<br />

Others 10% 10.0%<br />

112/112<br />

Non<br />

applicable<br />

Simplification non applicable according 5 per cent<br />

threshold proposed in this advice<br />

(1) Simplification non applicable according the 5 per cent threshold<br />

proposed in this advice<br />

Premium provisions of annual insurance contracts may be considered as having a<br />

duration equivalent to that of the claims provision corresponding the claims<br />

occurred during the last year, plus one year.<br />

© CEIOPS 2010