CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

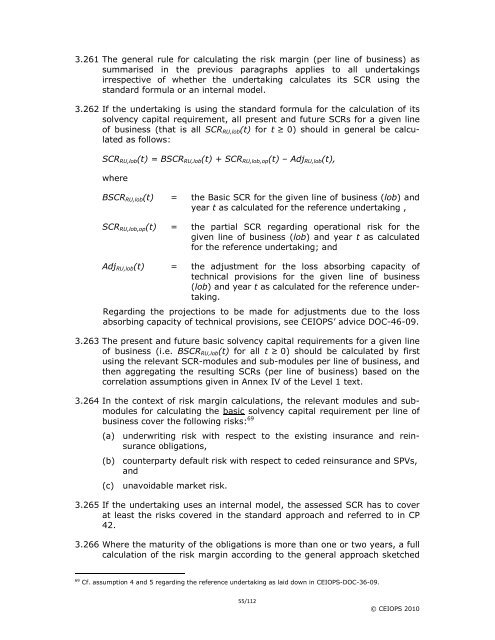

3.261 The general rule <strong>for</strong> calculating the risk margin (per line of business) as<br />

summarised in the previous paragraphs applies to all undertakings<br />

irrespective of whether the undertaking calculates its SCR using the<br />

standard <strong>for</strong>mula or an internal model.<br />

3.262 If the undertaking is using the standard <strong>for</strong>mula <strong>for</strong> the calculation of its<br />

solvency capital requirement, all present and future SCRs <strong>for</strong> a given line<br />

of business (that is all SCRRU,lob(t) <strong>for</strong> t ≥ 0) should in general be calculated<br />

as follows:<br />

SCRRU,lob(t) = BSCRRU,lob(t) + SCRRU,lob,op(t) – AdjRU,lob(t),<br />

where<br />

BSCRRU,lob(t) = the Basic SCR <strong>for</strong> the given line of business (lob) and<br />

year t as calculated <strong>for</strong> the reference undertaking ,<br />

SCRRU,lob,op(t) = the partial SCR regarding operational risk <strong>for</strong> the<br />

given line of business (lob) and year t as calculated<br />

<strong>for</strong> the reference undertaking; and<br />

AdjRU,lob(t) = the adjustment <strong>for</strong> the loss absorbing capacity of<br />

technical provisions <strong>for</strong> the given line of business<br />

(lob) and year t as calculated <strong>for</strong> the reference undertaking.<br />

Regarding the projections to be made <strong>for</strong> adjustments due to the loss<br />

absorbing capacity of technical provisions, see CEIOPS’ advice DOC-46-09.<br />

3.263 The present and future basic solvency capital requirements <strong>for</strong> a given line<br />

of business (i.e. BSCRRU,lob(t) <strong>for</strong> all t ≥ 0) should be calculated by first<br />

using the relevant SCR-modules and sub-modules per line of business, and<br />

then aggregating the resulting SCRs (per line of business) based on the<br />

correlation assumptions given in Annex IV of the <strong>Level</strong> 1 text.<br />

3.264 In the context of risk margin calculations, the relevant modules and submodules<br />

<strong>for</strong> calculating the basic solvency capital requirement per line of<br />

business cover the following risks: 69<br />

(a) underwriting risk with respect to the existing insurance and reinsurance<br />

obligations,<br />

(b) counterparty default risk with respect to ceded reinsurance and SPVs,<br />

and<br />

(c) unavoidable market risk.<br />

3.265 If the undertaking uses an internal model, the assessed SCR has to cover<br />

at least the risks covered in the standard approach and referred to in CP<br />

42.<br />

3.266 Where the maturity of the obligations is more than one or two years, a full<br />

calculation of the risk margin according to the general approach sketched<br />

69 Cf. assumption 4 and 5 regarding the reference undertaking as laid down in CEIOPS-DOC-36-09.<br />

55/112<br />

© CEIOPS 2010