CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

CEIOPS' Advice for Level 2 Implementing ... - EIOPA - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

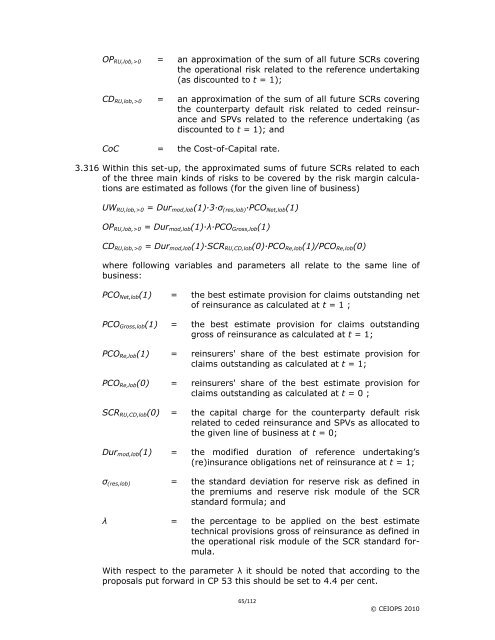

OPRU,lob,>0 = an approximation of the sum of all future SCRs covering<br />

the operational risk related to the reference undertaking<br />

(as discounted to t = 1);<br />

CDRU,lob,>0 = an approximation of the sum of all future SCRs covering<br />

the counterparty default risk related to ceded reinsurance<br />

and SPVs related to the reference undertaking (as<br />

discounted to t = 1); and<br />

CoC = the Cost-of-Capital rate.<br />

3.316 Within this set-up, the approximated sums of future SCRs related to each<br />

of the three main kinds of risks to be covered by the risk margin calculations<br />

are estimated as follows (<strong>for</strong> the given line of business)<br />

UWRU,lob,>0 = Durmod,lob(1)·3·σ(res,lob)·PCONet,lob(1)<br />

OPRU,lob,>0 = Durmod,lob(1)·λ·PCOGross,lob(1)<br />

CDRU,lob,>0 = Durmod,lob(1)·SCRRU,CD,lob(0)·PCORe,lob(1)/PCORe,lob(0)<br />

where following variables and parameters all relate to the same line of<br />

business:<br />

PCONet,lob(1) = the best estimate provision <strong>for</strong> claims outstanding net<br />

of reinsurance as calculated at t = 1 ;<br />

PCOGross,lob(1) = the best estimate provision <strong>for</strong> claims outstanding<br />

gross of reinsurance as calculated at t = 1;<br />

PCORe,lob(1) = reinsurers' share of the best estimate provision <strong>for</strong><br />

claims outstanding as calculated at t = 1;<br />

PCORe,lob(0) = reinsurers' share of the best estimate provision <strong>for</strong><br />

claims outstanding as calculated at t = 0 ;<br />

SCRRU,CD,lob(0) = the capital charge <strong>for</strong> the counterparty default risk<br />

related to ceded reinsurance and SPVs as allocated to<br />

the given line of business at t = 0;<br />

Durmod,lob(1) = the modified duration of reference undertaking’s<br />

(re)insurance obligations net of reinsurance at t = 1;<br />

σ(res,lob) = the standard deviation <strong>for</strong> reserve risk as defined in<br />

the premiums and reserve risk module of the SCR<br />

standard <strong>for</strong>mula; and<br />

λ = the percentage to be applied on the best estimate<br />

technical provisions gross of reinsurance as defined in<br />

the operational risk module of the SCR standard <strong>for</strong>mula.<br />

With respect to the parameter λ it should be noted that according to the<br />

proposals put <strong>for</strong>ward in CP 53 this should be set to 4.4 per cent.<br />

65/112<br />

© CEIOPS 2010