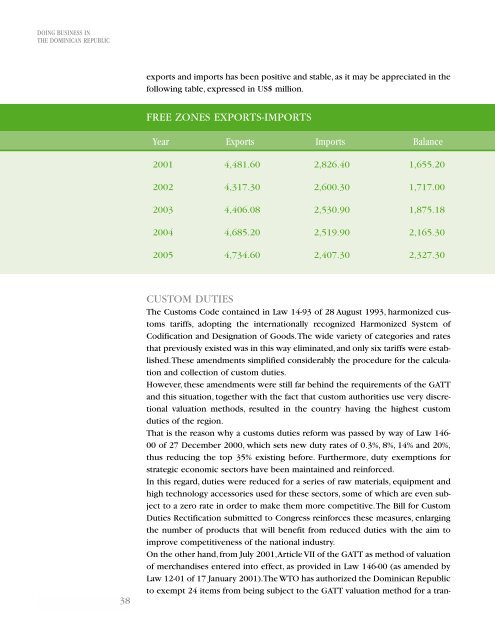

DOING BUSINESS INTHE DOMINICAN REPUBLICexports and imports has been positive and stable, as it may be appreciated <strong>in</strong> <strong>the</strong>follow<strong>in</strong>g table, expressed <strong>in</strong> US$ million.FREE ZONES EXPORTS-IMPORTSYear Exports Imports Balance2001 4,481.60 2,826.40 1,655.202002 4,317.30 2,600.30 1,717.002003 4,406.08 2,530.90 1,875.182004 4,685.20 2,519.90 2,165.302005 4,734.60 2,407.30 2,327.3038CUSTOM DUTIESThe Customs Code conta<strong>in</strong>ed <strong>in</strong> Law 14-93 of 28 August 1993, harmonized customstariffs, a<strong>do</strong>pt<strong>in</strong>g <strong>the</strong> <strong>in</strong>ternationally recognized Harmonized System ofCodification and Designation of Goods.The wide variety of categories and ratesthat previously existed was <strong>in</strong> this way elim<strong>in</strong>ated,and only six tariffs were established.Theseamendments simplified considerably <strong>the</strong> procedure for <strong>the</strong> calculationand collection of custom duties.However, <strong>the</strong>se amendments were still far beh<strong>in</strong>d <strong>the</strong> requirements of <strong>the</strong> GATTand this situation, toge<strong>the</strong>r with <strong>the</strong> fact that custom authorities use very discretionalvaluation methods, resulted <strong>in</strong> <strong>the</strong> country hav<strong>in</strong>g <strong>the</strong> highest customduties of <strong>the</strong> region.That is <strong>the</strong> reason why a customs duties reform was passed by way of Law 146-00 of 27 December 2000, which sets new duty rates of 0.3%, 8%, 14% and 20%,thus reduc<strong>in</strong>g <strong>the</strong> top 35% exist<strong>in</strong>g before. Fur<strong>the</strong>rmore, duty exemptions forstrategic economic sectors have been ma<strong>in</strong>ta<strong>in</strong>ed and re<strong>in</strong>forced.In this regard, duties were reduced for a series of raw materials, equipment andhigh technology accessories used for <strong>the</strong>se sectors, some of which are even subjectto a zero rate <strong>in</strong> order to make <strong>the</strong>m more competitive.The Bill for CustomDuties Rectification submitted to Congress re<strong>in</strong>forces <strong>the</strong>se measures, enlarg<strong>in</strong>g<strong>the</strong> number of products that will benefit from reduced duties with <strong>the</strong> aim toimprove competitiveness of <strong>the</strong> national <strong>in</strong>dustry.On <strong>the</strong> o<strong>the</strong>r hand,from July 2001,Article VII of <strong>the</strong> GATT as method of valuationof merchandises entered <strong>in</strong>to effect, as provided <strong>in</strong> Law 146-00 (as amended byLaw 12-01 of 17 January 2001).The WTO has authorized <strong>the</strong> Dom<strong>in</strong>ican <strong>Republic</strong>to exempt 24 items from be<strong>in</strong>g subject to <strong>the</strong> GATT valuation method for a tran-

<strong>Pellerano</strong> & <strong>Herrera</strong>Attorneys at lawsition period of two years.These <strong>in</strong>clude milk, milled rice, cl<strong>in</strong>ker, used tires, airconditioners, fridges, laundry mach<strong>in</strong>es, ceramic, used vehicles, tractors, etc.Custom duties are calculated and paid <strong>in</strong> Dom<strong>in</strong>ican pesos.The conversion <strong>in</strong>topesos of <strong>the</strong> value of <strong>the</strong> goods is made accord<strong>in</strong>g to <strong>the</strong> official exchange rateapplicable at <strong>the</strong> time of payment. In addition to custom duties, <strong>the</strong> importer hasto pay <strong>the</strong> follow<strong>in</strong>g:1. The selective consumption tax charged on certa<strong>in</strong> products, which rangesfrom 10% to 80%, calculated on <strong>the</strong> CIF price of <strong>the</strong> good plus custom duties,and;2. The tax on <strong>the</strong> transfer of <strong>in</strong>dustrialized goods and services (ITBIS), whichaccounts for 16% of <strong>the</strong> CIF price of <strong>the</strong> product plus duties and selectiveconsumption tax if applicable.Apart from free zones, <strong>the</strong>re are very few exemptions to <strong>the</strong> payment of importtaxes.These are limited to some basic products, agricultural products like <strong>in</strong>secticidesand herbicides, articles to be used by <strong>in</strong>ternational organizations or <strong>the</strong>diplomatic corps, articles to be used for religious worship and samples for exhibitionat <strong>in</strong>ternational fairs.IMPORT DOCUMENTSIn some cases, such as for chemical and pharmaceutical products, import licensesare required. Fur<strong>the</strong>rmore, certa<strong>in</strong> permits are required for <strong>the</strong> import of agriculturalproducts. Some of <strong>the</strong>se products, like rice, sugar, corn, onions, garlic andchicken parts, are subject to import quotas.On <strong>the</strong> o<strong>the</strong>r hand, a consular <strong>in</strong>voice that approves <strong>the</strong> transaction must accompanyall imports. It may be obta<strong>in</strong>ed at <strong>the</strong> Dom<strong>in</strong>ican consulate closest to <strong>the</strong>port of load<strong>in</strong>g. Generally considered by exporters to <strong>the</strong> Dom<strong>in</strong>ican <strong>Republic</strong> asan unnecessary h<strong>in</strong>drance to trade, <strong>the</strong> possibility of its elim<strong>in</strong>ation and substitutionby a fixed value stamp has been <strong>the</strong> object of much debate.2EXPORTS39The preferential rights that <strong>the</strong> Dom<strong>in</strong>ican <strong>Republic</strong> enjoys <strong>in</strong> order to export itsproducts to <strong>the</strong> United States and Europe, toge<strong>the</strong>r with <strong>the</strong> progress of trade liberalizationwith its neighbors of Lat<strong>in</strong> America and <strong>the</strong> Caribbean, make exportsan attractive sector with good perspectives of growth. Fur<strong>the</strong>rmore, legal measuresare be<strong>in</strong>g taken <strong>in</strong> order to <strong>in</strong>crease <strong>the</strong> competitiveness of <strong>the</strong> sector.In fact, accord<strong>in</strong>g to a report of <strong>the</strong> Center for Central American Studies,Dom<strong>in</strong>ican exports to <strong>the</strong> United States dur<strong>in</strong>g <strong>the</strong> year 2003 amounted to 45.5%of all of <strong>the</strong> country's exports, which reached around 473 billion pesos. Dur<strong>in</strong>g<strong>the</strong> last years, exports to <strong>the</strong> United States have always kept a dynamic rhythm,grow<strong>in</strong>g at an average rate of 6.2%.An analysis of commercial flows between <strong>the</strong> United States and <strong>the</strong> Dom<strong>in</strong>ican<strong>Republic</strong> shows that La Florida is <strong>the</strong> largest Importer State of Dom<strong>in</strong>ican prod-