Annual Report and Accounts 2012/13 - Royal Bournemouth Hospital

Annual Report and Accounts 2012/13 - Royal Bournemouth Hospital

Annual Report and Accounts 2012/13 - Royal Bournemouth Hospital

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

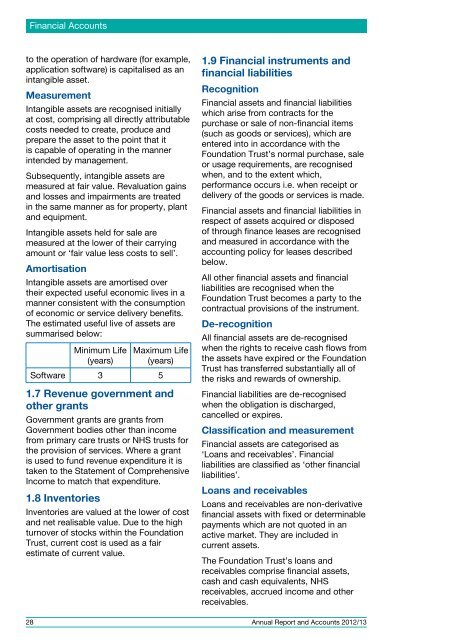

Financial <strong>Accounts</strong>to the operation of hardware (for example,application software) is capitalised as anintangible asset.MeasurementIntangible assets are recognised initiallyat cost, comprising all directly attributablecosts needed to create, produce <strong>and</strong>prepare the asset to the point that itis capable of operating in the mannerintended by management.Subsequently, intangible assets aremeasured at fair value. Revaluation gains<strong>and</strong> losses <strong>and</strong> impairments are treatedin the same manner as for property, plant<strong>and</strong> equipment.Intangible assets held for sale aremeasured at the lower of their carryingamount or ‘fair value less costs to sell’.AmortisationIntangible assets are amortised overtheir expected useful economic lives in amanner consistent with the consumptionof economic or service delivery benefits.The estimated useful live of assets aresummarised below:Minimum Life(years)Maximum Life(years)Software 3 51.7 Revenue government <strong>and</strong>other grantsGovernment grants are grants fromGovernment bodies other than incomefrom primary care trusts or NHS trusts forthe provision of services. Where a grantis used to fund revenue expenditure it istaken to the Statement of ComprehensiveIncome to match that expenditure.1.8 InventoriesInventories are valued at the lower of cost<strong>and</strong> net realisable value. Due to the highturnover of stocks within the FoundationTrust, current cost is used as a fairestimate of current value.1.9 Financial instruments <strong>and</strong>financial liabilitiesRecognitionFinancial assets <strong>and</strong> financial liabilitieswhich arise from contracts for thepurchase or sale of non-financial items(such as goods or services), which areentered into in accordance with theFoundation Trust’s normal purchase, saleor usage requirements, are recognisedwhen, <strong>and</strong> to the extent which,performance occurs i.e. when receipt ordelivery of the goods or services is made.Financial assets <strong>and</strong> financial liabilities inrespect of assets acquired or disposedof through finance leases are recognised<strong>and</strong> measured in accordance with theaccounting policy for leases describedbelow.All other financial assets <strong>and</strong> financialliabilities are recognised when theFoundation Trust becomes a party to thecontractual provisions of the instrument.De-recognitionAll financial assets are de-recognisedwhen the rights to receive cash flows fromthe assets have expired or the FoundationTrust has transferred substantially all ofthe risks <strong>and</strong> rewards of ownership.Financial liabilities are de-recognisedwhen the obligation is discharged,cancelled or expires.Classification <strong>and</strong> measurementFinancial assets are categorised as‘Loans <strong>and</strong> receivables’. Financialliabilities are classified as ‘other financialliabilities’.Loans <strong>and</strong> receivablesLoans <strong>and</strong> receivables are non-derivativefinancial assets with fixed or determinablepayments which are not quoted in anactive market. They are included incurrent assets.The Foundation Trust’s loans <strong>and</strong>receivables comprise financial assets,cash <strong>and</strong> cash equivalents, NHSreceivables, accrued income <strong>and</strong> otherreceivables.28<strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2012</strong>/<strong>13</strong>