You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSA ABLOY<br />

Annual Report 2007<br />

56<br />

Financial position<br />

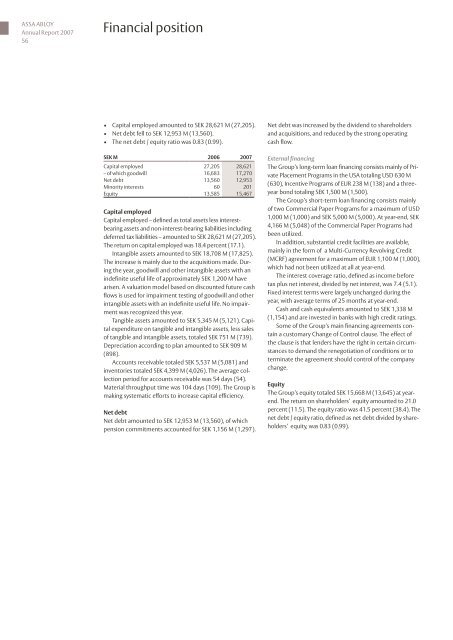

• Capital employed amounted to SEK 28,621 M (27,205).<br />

• Net debt fell to SEK 12,953 M (13,560).<br />

• The net debt / equity ratio was 0.83 (0.99).<br />

SEK M 2006 2007<br />

Capital employed 27,205 28,621<br />

– of which goodwill 16,683 17,270<br />

Net debt 13,560 12,953<br />

Minority interests 60 201<br />

Equity 13,585 15,467<br />

Capital employed<br />

Capital employed – defined as total assets less interest-<br />

bearing assets and non-interest-bearing liabilities including<br />

deferred tax liabilities – amounted to SEK 28,621 M (27,205).<br />

The return on capital employed was 18.4 percent (17.1).<br />

Intangible assets amounted to SEK 18,708 M (17,825).<br />

The increase is mainly due to the acquisitions made. During<br />

the year, goodwill and other intangible assets with an<br />

indefinite useful life of approximately SEK 1,200 M have<br />

arisen. A valuation model based on discounted future cash<br />

flows is used for impairment testing of goodwill and other<br />

intangible assets with an indefinite useful life. No impairment<br />

was recognized this year.<br />

Tangible assets amounted to SEK 5,345 M (5,121). Capital<br />

expenditure on tangible and intangible assets, less sales<br />

of tangible and intangible assets, totaled SEK 751 M (739).<br />

Depreciation according to plan amounted to SEK 909 M<br />

(898).<br />

Accounts receivable totaled SEK 5,537 M (5,081) and<br />

inventories totaled SEK 4,399 M (4,026). The average collection<br />

period for accounts receivable was 54 days (54).<br />

Material throughput time was 104 days (109). The Group is<br />

making systematic efforts to increase capital efficiency.<br />

Net debt<br />

Net debt amounted to SEK 12,953 M (13,560), of which<br />

pension commitments accounted for SEK 1,156 M (1,297).<br />

Net debt was increased by the dividend to shareholders<br />

and acquisitions, and reduced by the strong operating<br />

cash flow.<br />

External financing<br />

The Group’s long-term loan financing consists mainly of Private<br />

Placement Programs in the USA totaling USD 630 M<br />

(630), Incentive Programs of EUR 238 M (138) and a threeyear<br />

bond totaling SEK 1,500 M (1,500).<br />

The Group’s short-term loan financing consists mainly<br />

of two Commercial Paper Programs for a maximum of USD<br />

1,000 M (1,000) and SEK 5,000 M (5,000). At year-end, SEK<br />

4,166 M (5,048) of the Commercial Paper Programs had<br />

been utilized.<br />

In addition, substantial credit facilities are available,<br />

mainly in the form of a Multi-Currency Revolving Credit<br />

(MCRF) agreement for a maximum of EUR 1,100 M (1,000),<br />

which had not been utilized at all at year-end.<br />

The interest coverage ratio, defined as income before<br />

tax plus net interest, divided by net interest, was 7.4 (5.1).<br />

Fixed interest terms were largely unchanged during the<br />

year, with average terms of 25 months at year-end.<br />

Cash and cash equivalents amounted to SEK 1,338 M<br />

(1,154) and are invested in banks with high credit ratings.<br />

Some of the Group’s main financing agreements contain<br />

a customary Change of Control clause. The effect of<br />

the clause is that lenders have the right in certain circumstances<br />

to demand the renegotiation of conditions or to<br />

terminate the agreement should control of the company<br />

change.<br />

Equity<br />

The Group’s equity totaled SEK 15,668 M (13,645) at yearend.<br />

The return on shareholders’ equity amounted to 21.0<br />

percent (11.5). The equity ratio was 41.5 percent (38.4). The<br />

net debt / equity ratio, defined as net debt divided by shareholders’<br />

equity, was 0.83 (0.99).