You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSA ABLOY<br />

Annual Report 2007<br />

68<br />

Note 1 cont.<br />

Minority interests<br />

Minority interests are based on subsidiaries’ accounts with<br />

application of fair value adjustments resulting from completed<br />

acquisition analysis. Minority participations in subsidiaries’<br />

income are reported in the income statement<br />

with net income divided between the Parent company’s<br />

shareholders and minority interests. Minority participations<br />

in subsidiaries’ equity are reported as a separate item<br />

in the Group’s equity. Transactions with minority shareholders<br />

are accounted for as third-party transactions.<br />

Associates<br />

Associates are defined as companies which are not subsidiaries<br />

but in which the Group has a significant, but not a<br />

controlling, interest. This is usually taken to be companies<br />

where the Group’s shareholding represents between 20<br />

and 50 percent of the voting rights.<br />

Participations in associates are accounted for in accordance<br />

with the equity method. In the consolidated balance<br />

sheet, shareholdings in associates are reported at cost,<br />

adjusted for participation in income after the date of acquisition.<br />

Dividends from associates are reported as a reduction<br />

in the carrying amount of the investment. Participations in<br />

the income of associates are reported in the consolidated<br />

income statement as part of operating income as the investments<br />

are related to business operations.<br />

Segment reporting<br />

The Group’s business operations are split organizationally<br />

into five divisions. Three divisions are based on products<br />

sold in local markets in the respective division: EMEA, Americas<br />

and Asia Pacific. Global Technologies’ and Entrance Systems’<br />

products are sold worldwide. The divisions reflect a<br />

partition of the Group’s operations according to major risks<br />

and returns. The divisions form the operational structure<br />

for internal control and reporting and also constitute the<br />

Group’s segments for external financial reporting. There are<br />

no secondary segments.<br />

Foreign currency translation<br />

Functional currency corresponds to local currency in each<br />

country where Group companies operate. Transactions in<br />

foreign currencies are translated to functional currency by<br />

application of the exchange rates prevailing at the dates of<br />

the transactions. Foreign exchange gains and losses arising<br />

from the settlement of such transactions are normally<br />

reported in the income statement, as are those arising<br />

from translation of monetary balances in foreign currencies<br />

at the closing-day rate. Exceptions are transactions<br />

relating to qualifying cash flow hedges, which are reported<br />

in equity. Receivables and liabilities are valued at the<br />

closing-day rate.<br />

In translating the accounts of foreign subsidiaries,<br />

prepared in functional currencies other than the Group’s<br />

presentation currency, all balance sheet items except<br />

net income are translated at the closing-day rate and net<br />

income is translated at the average rate. The income<br />

statement is translated at the average rate for the period.<br />

Exchange-rate differences arising from the translation of<br />

foreign subsidiaries are reported in the translation reserve<br />

in equity.<br />

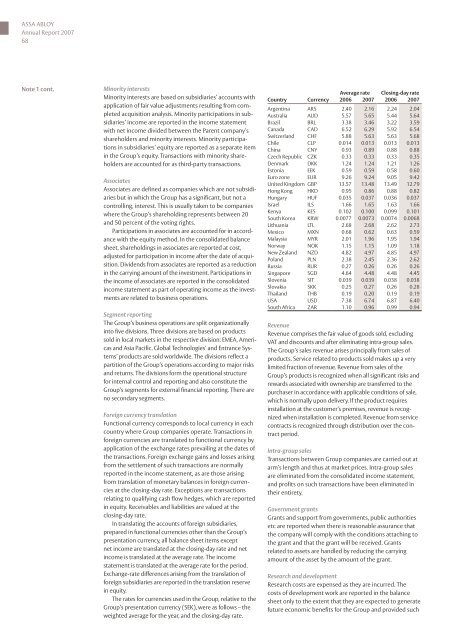

The rates for currencies used in the Group, relative to the<br />

Group’s presentation currency (SEK), were as follows – the<br />

weighted average for the year, and the closing-day rate.<br />

Average rate Closing-day rate<br />

Country Currency 2006 2007 2006 2007<br />

Argentina ARS 2.40 2.16 2.24 2.04<br />

Australia AUD 5.57 5.65 5.44 5.64<br />

Brazil BRL 3.38 3.46 3.22 3.59<br />

Canada CAD 6.52 6.29 5.92 6.54<br />

Switzerland CHF 5.88 5.63 5.63 5.68<br />

Chile CLP 0.014 0.013 0.013 0.013<br />

China CNY 0.93 0.89 0.88 0.88<br />

Czech Republic CZK 0.33 0.33 0.33 0.35<br />

Denmark DKK 1.24 1.24 1.21 1.26<br />

Estonia EEK 0.59 0.59 0.58 0.60<br />

Euro zone EUR 9.26 9.24 9.05 9.42<br />

United Kingdom GBP 13.57 13.48 13.49 12.79<br />

Hong Kong HKD 0.95 0.86 0.88 0.82<br />

Hungary HUF 0.035 0.037 0.036 0.037<br />

Israel ILS 1.66 1.65 1.63 1.66<br />

Kenya KES 0.102 0.100 0.099 0.101<br />

South Korea KRW 0.0077 0.0073 0.0074 0.0068<br />

Lithuania LTL 2.68 2.68 2.62 2.73<br />

Mexico MXN 0.68 0.62 0.63 0.59<br />

Malaysia MYR 2.01 1.96 1.95 1.94<br />

Norway NOK 1.15 1.15 1.09 1.18<br />

New Zealand NZD 4.82 4.97 4.85 4.97<br />

Poland PLN 2.38 2.45 2.36 2.62<br />

Russia RUR 0.27 0.26 0.26 0.26<br />

Singapore SGD 4.64 4.48 4.48 4.45<br />

Slovenia SIT 0.039 0.039 0.038 0.038<br />

Slovakia SKK 0.25 0.27 0.26 0.28<br />

Thailand THB 0.19 0.20 0.19 0.19<br />

USA USD 7.38 6.74 6.87 6.40<br />

South Africa ZAR 1.10 0.96 0.99 0.94<br />

Revenue<br />

Revenue comprises the fair value of goods sold, excluding<br />

VAT and discounts and after eliminating intra-group sales.<br />

The Group’s sales revenue arises principally from sales of<br />

products. Service related to products sold makes up a very<br />

limited fraction of revenue. Revenue from sales of the<br />

Group’s products is recognized when all significant risks and<br />

rewards associated with ownership are transferred to the<br />

purchaser in accordance with applicable conditions of sale,<br />

which is normally upon delivery. If the product requires<br />

installation at the customer’s premises, revenue is recognized<br />

when installation is completed. Revenue from service<br />

contracts is recognized through distribution over the contract<br />

period.<br />

Intra-group sales<br />

Transactions between Group companies are carried out at<br />

arm’s length and thus at market prices. Intra-group sales<br />

are eliminated from the consolidated income statement,<br />

and profits on such transactions have been eliminated in<br />

their entirety.<br />

Government grants<br />

Grants and support from governments, public authorities<br />

etc are reported when there is reasonable assurance that<br />

the company will comply with the conditions attaching to<br />

the grant and that the grant will be received. Grants<br />

related to assets are handled by reducing the carrying<br />

amount of the asset by the amount of the grant.<br />

Research and development<br />

Research costs are expensed as they are incurred. The<br />

costs of development work are reported in the balance<br />

sheet only to the extent that they are expected to generate<br />

future economic benefits for the Group and provided such