You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSA ABLOY<br />

Annual Report 2007<br />

78<br />

Notes 19–23<br />

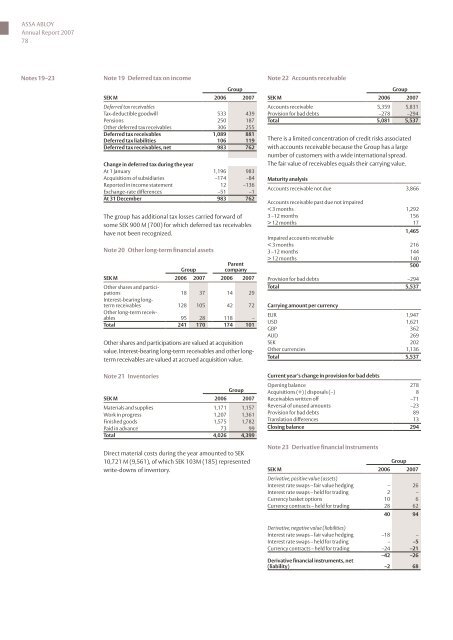

Note 19 Deferred tax on income<br />

Group<br />

SEK M 2006 2007<br />

Deferred tax receivables<br />

Tax-deductible goodwill 533 439<br />

Pensions 250 187<br />

Other deferred tax receivables 306 255<br />

Deferred tax receivables 1,089 881<br />

Deferred tax liabilities 106 119<br />

Deferred tax receivables, net 983 762<br />

Change in deferred tax during the year<br />

At 1 January 1,196 983<br />

Acquisitions of subsidiaries –174 –84<br />

Reported in income statement 12 –136<br />

Exchange-rate differences –51 –1<br />

At 31 December 983 762<br />

The group has additional tax losses carried forward of<br />

some SEK 900 M (700) for which deferred tax receivables<br />

have not been recognized.<br />

Note 20 Other long-term financial assets<br />

Group<br />

Parent<br />

company<br />

SEK M 2006 2007 2006 2007<br />

Other shares and participations<br />

18 37 14 29<br />

Interest-bearing longterm<br />

receivables 128 105 42 72<br />

Other long-term receivables<br />

95 28 118 –<br />

Total 241 170 174 101<br />

Other shares and participations are valued at acquisition<br />

value. Interest-bearing long-term receivables and other longterm<br />

receivables are valued at accrued acquisition value.<br />

Note 21 Inventories<br />

Group<br />

SEK M 2006 2007<br />

Materials and supplies 1,171 1,157<br />

Work in progress 1,207 1,361<br />

Finished goods 1,575 1,782<br />

Paid in advance 73 99<br />

Total 4,026 4,399<br />

Direct material costs during the year amounted to SEK<br />

10,721 M (9,561), of which SEK 103M (185) represented<br />

write-downs of inventory.<br />

Note 22 Accounts receivable<br />

Group<br />

SEK M 2006 2007<br />

Accounts receivable 5,359 5,831<br />

Provision for bad debts –278 –294<br />

Total 5,081 5,537<br />

There is a limited concentration of credit risks associated<br />

with accounts receivable because the Group has a large<br />

number of customers with a wide international spread.<br />

The fair value of receivables equals their carrying value.<br />

Maturity analysis<br />

Accounts receivable not due 3,866<br />

Accounts receivable past due not impaired<br />

< 3 months 1,292<br />

3 –12 months 156<br />

> 12 months 17<br />

1,465<br />

Impaired accounts receivable<br />

< 3 months 216<br />

3 –12 months 144<br />

> 12 months 140<br />

500<br />

Provision for bad debts –294<br />

Total 5,537<br />

Carrying amount per currency<br />

EUR 1,947<br />

USD 1,621<br />

GBP 362<br />

AUD 269<br />

SEK 202<br />

Other currencies 1,136<br />

Total 5,537<br />

Current year’s change in provision for bad debts<br />

Opening balance 278<br />

Acquisitions (+) / disposals (–) 8<br />

Receivables written off –71<br />

Reversal of unused amounts –23<br />

Provision for bad debts 89<br />

Translation differences 13<br />

Closing balance 294<br />

Note 23 Derivative financial instruments<br />

Group<br />

SEK M 2006 2007<br />

Derivative, positive value (assets)<br />

Interest rate swaps – fair value hedging – 26<br />

Interest rate swaps – held for trading 2 –<br />

Currency basket options 10 6<br />

Currency contracts – held for trading 28 62<br />

40 94<br />

Derivative, negative value (liabilities)<br />

Interest rate swaps – fair value hedging –18 –<br />

Interest rate swaps – held for trading – –5<br />

Currency contracts – held for trading –24 –21<br />

–42 –26<br />

Derivative financial instruments, net<br />

(liability) –2 68