Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Convertible debentures for personnel<br />

ASSA ABLOY has issued several convertible debentures to<br />

employees in the Group.<br />

The first debenture was issued in 1995 and approximately<br />

400 employees participated in the issue. The<br />

debenture amounted to approximately SEK 75 M and<br />

expired in 2000. The second debenture was issued in 1997.<br />

A total of 1,400 employees participated in this issue. The<br />

debenture amounted to SEK 250 M and expired in 2002.<br />

In 2001, a convertible debenture amounting to EUR<br />

100 M was issued. This program expired in November<br />

2006 and no conversion took place.<br />

In 2004, it was decided to launch an incentive program,<br />

Incentive 2004. This program amounts to a total of EUR 100<br />

M and is based on four series of convertible bonds, each<br />

series having a par value of EUR 25 M. The only difference<br />

between the series of bonds is the conversion price. On full<br />

conversion, at a conversion price of EUR 10.20 for Series 1,<br />

EUR 12.20 for Series 2, EUR 14.30 for Series 3 and EUR 16.30<br />

for Series 4, an additional 7,782,155 shares would be created.<br />

Any conversion of Incentive 2004 will take place in a<br />

90-day period between March and June 2009.<br />

In 2006, it was decided to launch an incentive program<br />

for senior managers, Incentive 2006. This program<br />

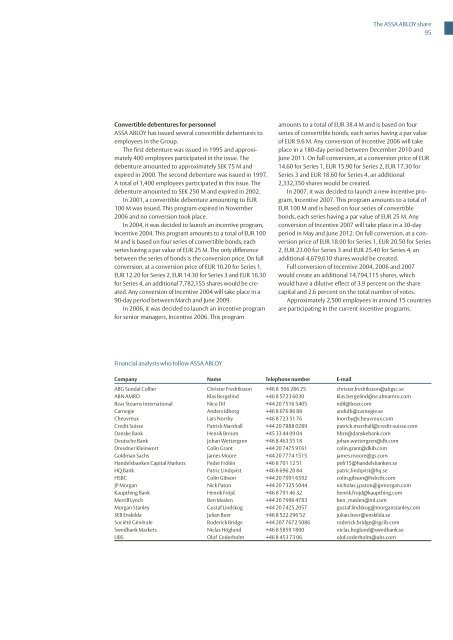

Financial analysts who follow ASSA ABLOY<br />

Company Name Telephone number E-mail<br />

The ASSA ABLOY share<br />

95<br />

amounts to a total of EUR 38.4 M and is based on four<br />

series of convertible bonds, each series having a par value<br />

of EUR 9.6 M. Any conversion of Incentive 2006 will take<br />

place in a 180-day period between December 2010 and<br />

June 2011. On full conversion, at a conversion price of EUR<br />

14.60 for Series 1, EUR 15.90 for Series 2, EUR 17.30 for<br />

Series 3 and EUR 18.60 for Series 4, an additional<br />

2,332,350 shares would be created.<br />

In 2007, it was decided to launch a new incentive program,<br />

Incentive 2007. This program amounts to a total of<br />

EUR 100 M and is based on four series of convertible<br />

bonds, each series having a par value of EUR 25 M. Any<br />

conversion of Incentive 2007 will take place in a 30-day<br />

period in May and June 2012. On full conversion, at a conversion<br />

price of EUR 18.00 for Series 1, EUR 20.50 for Series<br />

2, EUR 23.00 for Series 3 and EUR 25.40 for Series 4, an<br />

additional 4,679,610 shares would be created.<br />

Full conversion of Incentive 2004, 2006 and 2007<br />

would create an additional 14,794,115 shares, which<br />

would have a dilutive effect of 3.9 percent on the share<br />

capital and 2.6 percent on the total number of votes.<br />

Approximately 2,500 employees in around 15 countries<br />

are participating in the current incentive programs.<br />

ABG Sundal Collier Christer Fredriksson +46 8 566 286 25 christer.fredriksson@abgsc.se<br />

ABN AMRO Klas Bergelind +46 8 5723 6030 klas.bergelind@se.abnamro.com<br />

Bear Stearns International Nico Dil +44 20 7516 5405 ndil@bear.com<br />

Carnegie Anders Idborg +46 8 676 86 88 andidb@carnegie.se<br />

Cheuvreux Lars Norrby +46 8 723 51 76 lnorrby@cheuvreux.com<br />

Credit Suisse Patrick Marshall +44 20 7888 0289 patrick.marshall@credit-suisse.com<br />

Danske Bank Henrik Breum +45 33 44 09 04 hbre@danskebank.com<br />

Deutsche Bank Johan Wettergren +46 8 463 55 18 johan.wettergren@db.com<br />

Dresdner Kleinwort Colin Grant +44 20 7475 9161 colin.grant@dkib.com<br />

Goldman Sachs James Moore +44 20 7774 1515 james.moore@gs.com<br />

Handelsbanken Capital Markets Peder Frölén +46 8 701 12 51 pefr15@handelsbanken.se<br />

HQ Bank Patric Lindqvist +46 8 696 20 84 patric.lindqvist@hq.se<br />

HSBC Colin Gibson +44 20 7991 6592 colin.gibson@hsbcib.com<br />

JP Morgan Nick Paton +44 20 7325 5044 nicholas.j.paton@jpmorgan.com<br />

Kaupthing Bank Henrik Fröjd +46 8 791 46 32 henrik.frojd@kaupthing.com<br />

Merrill Lynch Ben Maslen +44 20 7996 4783 ben_maslen@ml.com<br />

Morgan Stanley Gustaf Lindskog +44 20 7425 2057 gustaf.lindskog@morganstanley.com<br />

SEB Enskilda Julian Beer +46 8 522 296 52 julian.beer@enskilda.se<br />

Société Générale Roderick Bridge +44 207 7672 5086 roderick.bridge@sgcib.com<br />

Swedbank Markets Niclas Höglund +46 8 5859 1800 niclas.hoglund@swedbank.se<br />

UBS Olof Cederholm +46 8 453 73 06 olof.cederholm@ubs.com