Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

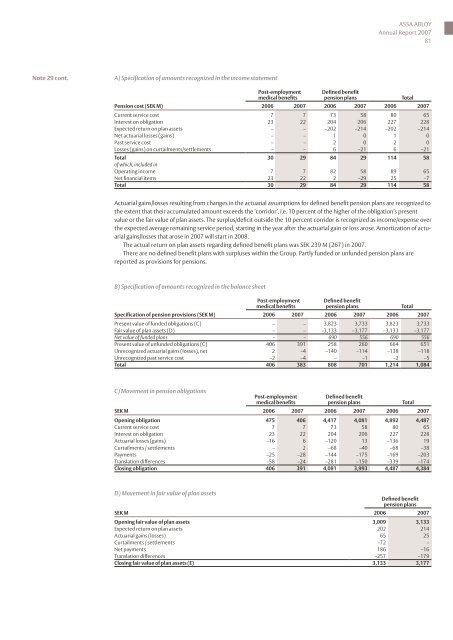

Note 29 cont. A) Specification of amounts recognized in the income statement<br />

Post-employment<br />

medical benefits<br />

ASSA ABLOY<br />

Annual Report 2007<br />

81<br />

Defined benefit<br />

pension plans Total<br />

Pension cost (SEK M) 2006 2007 2006 2007 2006 2007<br />

Current service cost 7 7 73 58 80 65<br />

Interest on obligation 23 22 204 206 227 228<br />

Expected return on plan assets – – –202 –214 –202 –214<br />

Net actuarial losses (gains) – – 1 0 1 0<br />

Past service cost – – 2 0 2 0<br />

Losses (gains) on curtailments/settlements – – 6 –21 6 –21<br />

Total 30 29 84 29 114 58<br />

of which, included in<br />

Operating income 7 7 82 58 89 65<br />

Net financial items 23 22 2 –29 25 –7<br />

Total 30 29 84 29 114 58<br />

Actuarial gains/losses resulting from changes in the actuarial assumptions for defined benefit pension plans are recognized to<br />

the extent that their accumulated amount exceeds the ‘corridor’, i.e. 10 percent of the higher of the obligation’s present<br />

value or the fair value of plan assets. The surplus/deficit outside the 10 percent corridor is recognized as income/expense over<br />

the expected average remaining service period, starting in the year after the actuarial gain or loss arose. Amortization of actuarial<br />

gains/losses that arose in 2007 will start in 2008.<br />

The actual return on plan assets regarding defined benefit plans was SEK 239 M (267) in 2007.<br />

There are no defined benefit plans with surpluses within the Group. Partly funded or unfunded pension plans are<br />

reported as provisions for pensions.<br />

B) Specification of amounts recognized in the balance sheet<br />

Post-employment<br />

medical benefits<br />

Defined benefit<br />

pension plans Total<br />

Specification of pension provisions (SEK M) 2006 2007 2006 2007 2006 2007<br />

Present value of funded obligations (C) – – 3,823 3,733 3,823 3,733<br />

Fair value of plan assets (D) – – –3,133 –3,177 –3,133 –3,177<br />

Net value of funded plans – – 690 556 690 556<br />

Present value of unfunded obligations (C) 406 391 258 260 664 651<br />

Unrecognized actuarial gains (losses), net 2 –4 –140 –114 –138 –118<br />

Unrecognized past service cost –2 –4 – –1 –2 –5<br />

Total 406 383 808 701 1,214 1,084<br />

C) Movement in pension obligations<br />

Post-employment<br />

medical benefits<br />

Defined benefit<br />

pension plans Total<br />

SEK M 2006 2007 2006 2007 2006 2007<br />

Opening obligation 475 406 4,417 4,081 4,892 4,487<br />

Current service cost 7 7 73 58 80 65<br />

Interest on obligation 23 22 204 206 227 228<br />

Actuarial losses (gains) –16 6 –120 13 –136 19<br />

Curtailments / settlements – 2 –68 –40 –68 –38<br />

Payments –25 –28 –144 –175 –169 –203<br />

Translation differences –58 –24 –281 –150 –339 –174<br />

Closing obligation 406 391 4,081 3,993 4,487 4,384<br />

D) Movement in fair value of plan assets<br />

Defined benefit<br />

pension plans<br />

SEK M 2006 2007<br />

Opening fair value of plan assets 3,009 3,133<br />

Expected return on plan assets 202 214<br />

Actuarial gains (losses) 65 25<br />

Curtailments / settlements –72 –<br />

Net payments 186 –16<br />

Translation differences –257 –179<br />

Closing fair value of plan assets (E) 3,133 3,177