You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

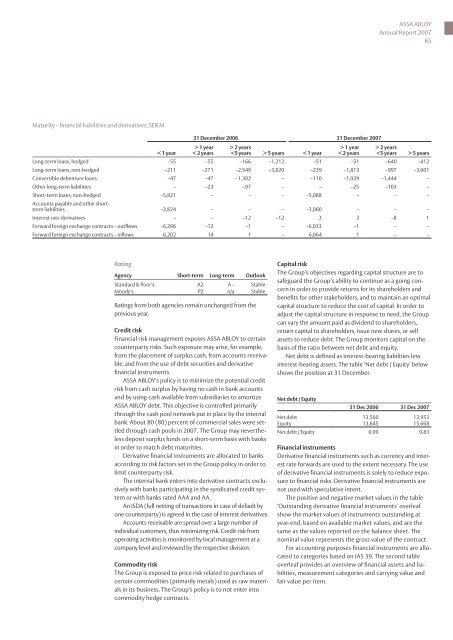

Maturity – financial liabilities and derivatives, SEK M<br />

Rating<br />

< 1 year<br />

Agency Short-term Long-term Outlook<br />

Standard & Poor’s A2 A – Stable<br />

Moody’s P2 n/a Stable<br />

Ratings from both agencies remain unchanged from the<br />

previous year.<br />

Credit risk<br />

Financial risk management exposes ASSA ABLOY to certain<br />

counterparty risks. Such exposure may arise, for example,<br />

from the placement of surplus cash, from accounts receivable,<br />

and from the use of debt securities and derivative<br />

financial instruments.<br />

ASSA ABLOY’s policy is to minimize the potential credit<br />

risk from cash surplus by having no cash in bank accounts<br />

and by using cash available from subsidiaries to amortize<br />

ASSA ABLOY debt. This objective is controlled primarily<br />

through the cash pool network put in place by the internal<br />

bank. About 80 (80) percent of commercial sales were settled<br />

through cash pools in 2007. The Group may nevertheless<br />

deposit surplus funds on a short-term basis with banks<br />

in order to match debt maturities.<br />

Derivative financial instruments are allocated to banks<br />

according to risk factors set in the Group policy in order to<br />

limit counterparty risk.<br />

The internal bank enters into derivative contracts exclusively<br />

with banks participating in the syndicated credit system<br />

or with banks rated AAA and AA.<br />

An ISDA (full netting of transactions in case of default by<br />

one counterparty) is agreed in the case of interest derivatives.<br />

Accounts receivable are spread over a large number of<br />

individual customers, thus minimizing risk. Credit risk from<br />

operating activities is monitored by local management at a<br />

company level and reviewed by the respective division.<br />

Commodity risk<br />

The Group is exposed to price risk related to purchases of<br />

certain commodities (primarily metals) used as raw materials<br />

in its business. The Group’s policy is to not enter into<br />

commodity hedge contracts.<br />

31 December 2006 31 December 2007<br />

> 1 year<br />

< 2 years<br />

> 2 years<br />

5 years < 1 year<br />

ASSA ABLOY<br />

Annual Report 2007<br />

65<br />

Capital risk<br />

The Group’s objectives regarding capital structure are to<br />

safeguard the Group’s ability to continue as a going concern<br />

in order to provide returns for its shareholders and<br />

benefits for other stakeholders, and to maintain an optimal<br />

capital structure to reduce the cost of capital. In order to<br />

adjust the capital structure in response to need, the Group<br />

can vary the amount paid as dividend to shareholders,<br />

return capital to shareholders, issue new shares, or sell<br />

assets to reduce debt. The Group monitors capital on the<br />

basis of the ratio between net debt and equity.<br />

Net debt is defined as interest-bearing liabilities less<br />

interest-bearing assets. The table ‘Net debt / Equity’ below<br />

shows the position at 31 December.<br />

Net debt / Equity<br />

> 1 year<br />

< 2 years<br />

> 2 years<br />

5 years<br />

Long-term loans, hedged –55 –55 –166 –1,212 –51 –51 –640 –412<br />

Long-term loans, non-hedged –211 –271 –2,549 –3,820 –239 –1,813 –997 –3,601<br />

Convertible debenture loans –47 –47 – 1,302 – –110 –1,029 –1,444 –<br />

Other long-term liabilities – –23 –97 – – –25 –103 –<br />

Short-term loans, non-hedged –5,821 – – – –5,088 – – –<br />

Accounts payable and other shortterm<br />

liabilities –2,824 – – – –3,060 – – –<br />

Interest rate derivatives – – –12 –12 3 3 –8 1<br />

Forward foreign exchange contracts – outflows –6,206 –12 –1 – –6,033 –1 – –<br />

Forward foreign exchange contracts – inflows 6,202 14 1 – 6,064 1 – –<br />

31 Dec 2006 31 Dec 2007<br />

Net debt 13,560 12,953<br />

Equity 13,645 15,668<br />

Net debt / Equity 0.99 0.83<br />

Financial instruments<br />

Derivative financial instruments such as currency and interest<br />

rate forwards are used to the extent necessary. The use<br />

of derivative financial instruments is solely to reduce exposure<br />

to financial risks. Derivative financial instruments are<br />

not used with speculative intent.<br />

The positive and negative market values in the table<br />

‘Outstanding derivative financial instruments’ overleaf<br />

show the market values of instruments outstanding at<br />

year-end, based on available market values, and are the<br />

same as the values reported on the balance sheet. The<br />

nominal value represents the gross value of the contract.<br />

For accounting purposes financial instruments are allocated<br />

to categories based on IAS 39. The second table<br />

overleaf provides an overview of financial assets and liabilities,<br />

measurement categories and carrying value and<br />

fair value per item.