You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSA ABLOY<br />

Annual Report 2007<br />

58<br />

Cash flow<br />

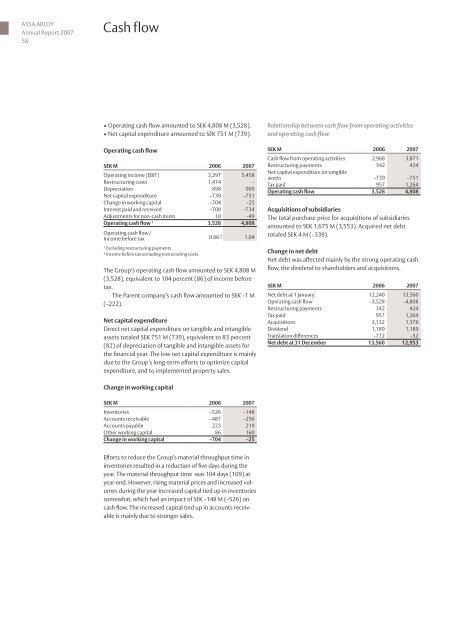

• Operating cash flow amounted to SEK 4,808 M (3,528).<br />

• Net capital expenditure amounted to SEK 751 M (739).<br />

Operating cash flow<br />

SEK M 2006 2007<br />

Operating income (EBIT) 3,297 5,458<br />

Restructuring costs 1,474 –<br />

Depreciation 898 909<br />

Net capital expenditure –739 –751<br />

Change in working capital –704 –25<br />

Interest paid and received –708 –734<br />

Adjustments for non-cash items 10 –49<br />

Operating cash flow 1 3,528 4,808<br />

Operating cash flow /<br />

Income before tax 0.86 2 1.04<br />

1 Excluding restructuring payments.<br />

2 Income before tax excluding restructuring costs.<br />

The Group’s operating cash flow amounted to SEK 4,808 M<br />

(3,528), equivalent to 104 percent (86) of income before<br />

tax.<br />

The Parent company’s cash flow amounted to SEK –1 M<br />

(–222).<br />

Net capital expenditure<br />

Direct net capital expenditure on tangible and intangible<br />

assets totaled SEK 751 M (739), equivalent to 83 percent<br />

(82) of depreciation of tangible and intangible assets for<br />

the financial year. The low net capital expenditure is mainly<br />

due to the Group’s long-term efforts to optimize capital<br />

expenditure, and to implemented property sales.<br />

Change in working capital<br />

SEK M 2006 2007<br />

Inventories –526 –148<br />

Accounts receivable –487 –256<br />

Accounts payable 223 219<br />

Other working capital 86 160<br />

Change in working capital –704 –25<br />

Efforts to reduce the Group’s material throughput time in<br />

inventories resulted in a reduction of five days during the<br />

year. The material throughput time was 104 days (109) at<br />

year-end. However, rising material prices and increased volumes<br />

during the year increased capital tied up in inventories<br />

somewhat, which had an impact of SEK –148 M (–526) on<br />

cash flow. The increased capital tied up in accounts receivable<br />

is mainly due to stronger sales.<br />

Relationship between cash flow from operating activities<br />

and operating cash flow<br />

SEK M 2006 2007<br />

Cash flow from operating activities 2,968 3,871<br />

Restructuring payments 342 424<br />

Net capital expenditure on tangible<br />

assets –739 –751<br />

Tax paid 957 1,264<br />

Operating cash flow 3,528 4,808<br />

Acquisitions of subsidiaries<br />

The total purchase price for acquisitions of subsidiaries<br />

amounted to SEK 1,675 M (3,553). Acquired net debt<br />

totaled SEK 4 M (–339).<br />

Change in net debt<br />

Net debt was affected mainly by the strong operating cash<br />

flow, the dividend to shareholders and acquisitions.<br />

SEK M 2006 2007<br />

Net debt at 1 January 12,240 13,560<br />

Operating cash flow –3,528 –4,808<br />

Restructuring payments 342 424<br />

Tax paid 957 1,264<br />

Acquisitions 3,132 1,376<br />

Dividend 1,189 1,189<br />

Translation differences –772 –52<br />

Net debt at 31 December 13,560 12,953