Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASSA ABLOY<br />

Annual Report 2007<br />

62<br />

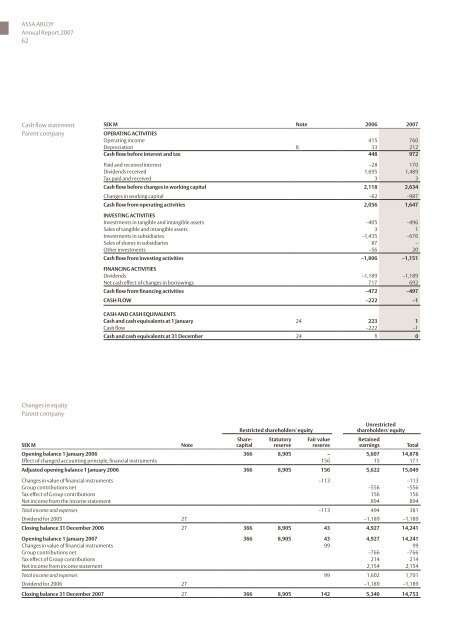

Cash flow statement<br />

Parent company<br />

Changes in equity<br />

Parent company<br />

SEK M Note 2006 2007<br />

OPERATING ACTIVITIES<br />

Operating income 415 760<br />

Depreciation 8 33 212<br />

Cash flow before interest and tax 448 972<br />

Paid and received interest –28 170<br />

Dividends received 1,695 1,489<br />

Tax paid and received 3 3<br />

Cash flow before changes in working capital 2,118 2,634<br />

Changes in working capital –62 –987<br />

Cash flow from operating activities 2,056 1,647<br />

INVESTING ACTIVITIES<br />

Investments in tangible and intangible assets –405 –496<br />

Sales of tangible and intangible assets 3 1<br />

Investments in subsidiaries –1,435 –676<br />

Sales of shares in subsidiaries 87 –<br />

Other investments –56 20<br />

Cash flow from investing activities –1,806 –1,151<br />

FINANCING ACTIVITIES<br />

Dividends –1,189 –1,189<br />

Net cash effect of changes in borrowings 717 692<br />

Cash flow from financing activities –472 –497<br />

CASH FLOW –222 –1<br />

CASH AND CASH EQUIVALENTS<br />

Cash and cash equivalents at 1 January 24 223 1<br />

Cash flow –222 –1<br />

Cash and cash equivalents at 31 December 24 1 0<br />

SEK M Note<br />

Restricted shareholders' equity<br />

Share-<br />

capital<br />

Statutory<br />

reserve<br />

Fair value<br />

reserve<br />

Unrestricted<br />

shareholders' equity<br />

Retained<br />

earnings Total<br />

Opening balance 1 January 2006 366 8,905 – 5,607 14,878<br />

Effect of changed accounting principle, financial instruments 156 15 171<br />

Adjusted opening balance 1 January 2006 366 8,905 156 5,622 15,049<br />

Changes in value of financial instruments –113 –113<br />

Group contributions net –556 –556<br />

Tax effect of Group contributions 156 156<br />

Net income from the income statement 894 894<br />

Total income and expenses –113 494 381<br />

Dividend for 2005 27 –1,189 –1,189<br />

Closing balance 31 December 2006 27 366 8,905 43 4,927 14,241<br />

Opening balance 1 January 2007 366 8,905 43 4,927 14,241<br />

Changes in value of financial instruments 99 99<br />

Group contributions net –766 –766<br />

Tax effect of Group contributions 214 214<br />

Net income from income statement 2,154 2,154<br />

Total income and expenses 99 1,602 1,701<br />

Dividend for 2006 27 –1,189 –1,189<br />

Closing balance 31 December 2007 27 366 8,905 142 5,340 14,753