You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASSA ABLOY<br />

Annual Report 2007<br />

84<br />

Note 35 cont.<br />

Pemko<br />

On 1 January 2007 the Group acquired 100 percent of the<br />

share capital of Pemko Manufacturing Company, a leading<br />

North American producer of door components. The acquisition<br />

of Pemko brings into ASSA ABLOY a well recognized<br />

and highly respected producer of door components. The<br />

Pemko product line is complementary to ASSA ABLOY’s<br />

existing product offerings and distribution channels. The<br />

company has its headquarters in Ventura, California, from<br />

where most of the business is conducted. The brand has<br />

been separately recognized and remaining goodwill is<br />

chiefly related to synergies and other intangible assets not<br />

qualifying for separate recognition.<br />

Aontec<br />

On 3 July 2007 the Group acquired 100 percent of the<br />

share capital of Aontec Teoranta, one of the world’s largest<br />

suppliers of RFID inlays for electronic passports. The acquisition<br />

expanded the customer base, provided ASSA ABLOY<br />

with yet another secure site for our operations and added<br />

complementary manufacturing technologies for RFID<br />

inlays. Aontec designs and manufactures RFID inlays mainly<br />

for European passport printers and security integrators. The<br />

operations are conducted in high-security premises in Ireland.<br />

Intangible assets in the form of customer relationships<br />

and licenses have been separately recognized.<br />

Remaining goodwill is chiefly related to synergies and other<br />

intangible assets not qualifying for separate recognition.<br />

Baodean<br />

On 1 October 2007 the Group acquired 70 percent of Baodean,<br />

a leading Chinese lock company. Baodean manufactures<br />

and distributes anti-theft door locks and cylinders<br />

mainly for the Chinese market. The company leads the market<br />

segment of high-security anti-theft door locks and cylinders<br />

in China and has developed an extensive support<br />

and service network. Baodean is located in the Zhejiang<br />

region, south of Shanghai. Based on a preliminary purchase-price<br />

allocation, the brand has been separately recognized<br />

and remaining goodwill is chiefly related to synergies<br />

and other intangible assets not qualifying for separate<br />

recognition.<br />

iRevo<br />

On 12 October 2007 the Group acquired more than 50<br />

percent of the share capital of iRevo, a Seoul-listed company<br />

and market leader in digital door locks. The acquisition<br />

brings benefits to the ASSA ABLOY Group including a<br />

market-leading position in Korea, access to efficient distribution<br />

channels in the residential sector and ability to leverage<br />

on ASSA ABLOY’s global distribution network. Based<br />

on a preliminary purchase-price allocation, the brand has<br />

been separately recognized and remaining goodwill is<br />

chiefly related to synergies and other intangible assets not<br />

qualifying for separate recognition.<br />

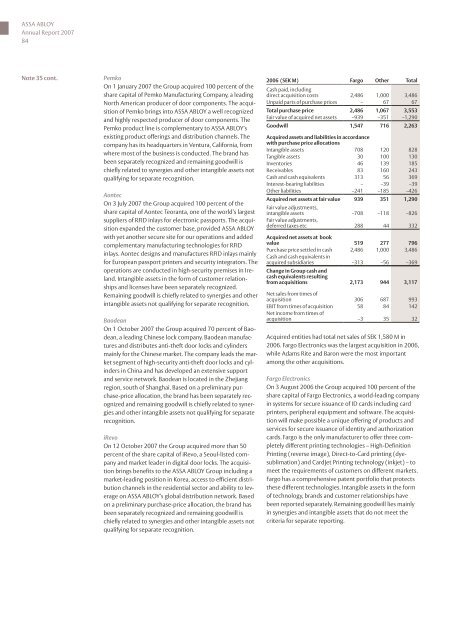

2006 (SEK M) Fargo Other Total<br />

Cash paid, including<br />

direct acquisition costs 2,486 1,000 3,486<br />

Unpaid parts of purchase prices – 67 67<br />

Total purchase price 2,486 1,067 3,553<br />

Fair value of acquired net assets –939 –351 –1,290<br />

Goodwill 1,547 716 2,263<br />

Acquired assets and liabilities in accordance<br />

with purchase price allocations<br />

Intangible assets 708 120 828<br />

Tangible assets 30 100 130<br />

Inventories 46 139 185<br />

Receivables 83 160 243<br />

Cash and cash equivalents 313 56 369<br />

Interest-bearing liabilities – –39 –39<br />

Other liabilities –241 –185 –426<br />

Acquired net assets at fair value 939 351 1,290<br />

Fair value adjustments,<br />

intangible assets –708 –118 –826<br />

Fair value adjustments,<br />

deferred taxes etc 288 44 332<br />

Acquired net assets at book<br />

value 519 277 796<br />

Purchase price settled in cash 2,486 1,000 3,486<br />

Cash and cash equivalents in<br />

acquired subsidiaries –313 –56 –369<br />

Change in Group cash and<br />

cash equivalents resulting<br />

from acquisitions 2,173 944 3,117<br />

Net sales from times of<br />

acquisition 306 687 993<br />

EBIT from times of acquisition 58 84 142<br />

Net income from times of<br />

acquisition –3 35 32<br />

Acquired entities had total net sales of SEK 1,580 M in<br />

2006. Fargo Electronics was the largest acquisition in 2006,<br />

while Adams Rite and Baron were the most important<br />

among the other acquisitions.<br />

Fargo Electronics<br />

On 3 August 2006 the Group acquired 100 percent of the<br />

share capital of Fargo Electronics, a world-leading company<br />

in systems for secure issuance of ID cards including card<br />

printers, peripheral equipment and software. The acquisition<br />

will make possible a unique offering of products and<br />

services for secure issuance of identity and authorization<br />

cards. Fargo is the only manufacturer to offer three completely<br />

different printing technologies – High-Definition<br />

Printing (reverse image), Direct-to-Card printing (dye-<br />

sublimation) and CardJet Printing technology (inkjet) – to<br />

meet the requirements of customers on different markets.<br />

Fargo has a comprehensive patent portfolio that protects<br />

these different technologies. Intangible assets in the form<br />

of technology, brands and customer relationships have<br />

been reported separately. Remaining goodwill lies mainly<br />

in synergies and intangible assets that do not meet the<br />

criteria for separate reporting.