You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note 15 cont.<br />

ASSA ABLOY<br />

Annual Report 2007<br />

75<br />

Intangible rights consist mainly of licenses and brands. The carrying value of intangible rights with indefinite life amounts<br />

to SEK 763 M (587).<br />

Useful life is taken as indefinite where the time period during which it is judged that an asset will contribute economic<br />

benefits cannot be defined.<br />

Amortization and impairment of intangible rights have mainly been reported as costs of goods sold in the income<br />

statement.<br />

Impairment testing of goodwill and intangible rights with indefinite useful life<br />

Goodwill and intangible rights with indefinite useful life are assigned to the Group’s Cash Generating Units (CGU). The<br />

restructuring currently in process in the Group is leading to significantly greater harmonization of product development, purchasing,<br />

manufacturing and selling between the business units. As one effect of this, the Group’s five divisions constitute Cash<br />

Generating Units from 2007.<br />

For each Cash-Generating Unit, the Group assesses each year whether any write-down of goodwill is needed, in accordance<br />

with the accounting principles described in Note 1. Recoverable amounts for Cash Generating Units have been<br />

established by calculation of value in use. These calculations are based on estimated future cash flows, which in turn are<br />

based on financial budgets approved by the management and covering a three-year period. Cash flows beyond three years<br />

are extrapolated using estimated growth rates according to the principles below.<br />

Main assumptions used to calculate values in use:<br />

• Budgeted operating margin.<br />

• Growth rate for extrapolating cash flows beyond the budgeted three-year period.<br />

• Discount rate after tax used for estimated future cash flows.<br />

The management has established the budgeted operating margin on a basis of previous results and its expectations<br />

about future market development. For extrapolating cash flows beyond the three-year period, a growth rate of 3 percent<br />

is used for all Cash Generating Units. This growth rate is thought to be a conservative estimate. In addition, an average discount<br />

rate in local currency after tax is used for the Group.<br />

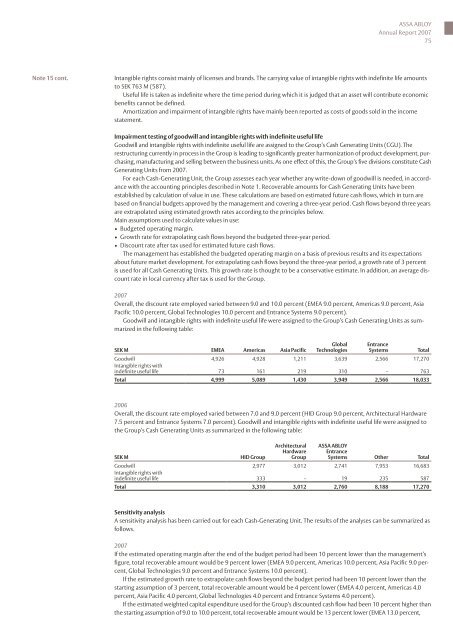

2007<br />

Overall, the discount rate employed varied between 9.0 and 10.0 percent (EMEA 9.0 percent, Americas 9.0 percent, Asia<br />

Pacific 10.0 percent, Global Technologies 10.0 percent and Entrance Systems 9.0 percent).<br />

Goodwill and intangible rights with indefinite useful life were assigned to the Group’s Cash Generating Units as summarized<br />

in the following table:<br />

SEK M EMEA Americas Asia Pacific<br />

Global<br />

Technologies<br />

Entrance<br />

Systems Total<br />

Goodwill 4,926 4,928 1,211 3,639 2,566 17,270<br />

Intangible rights with<br />

indefinite useful life 73 161 219 310 – 763<br />

Total 4,999 5,089 1,430 3,949 2,566 18,033<br />

2006<br />

Overall, the discount rate employed varied between 7.0 and 9.0 percent (HID Group 9.0 percent, Architectural Hardware<br />

7.5 percent and Entrance Systems 7.0 percent). Goodwill and intangible rights with indefinite useful life were assigned to<br />

the Group’s Cash Generating Units as summarized in the following table:<br />

SEK M HID Group<br />

Architectural<br />

Hardware<br />

Group<br />

ASSA ABLOY<br />

Entrance<br />

Systems Other Total<br />

Goodwill 2,977 3,012 2,741 7,953 16,683<br />

Intangible rights with<br />

indefinite useful life 333 – 19 235 587<br />

Total 3,310 3,012 2,760 8,188 17,270<br />

Sensitivity analysis<br />

A sensitivity analysis has been carried out for each Cash-Generating Unit. The results of the analyses can be summarized as<br />

follows.<br />

2007<br />

If the estimated operating margin after the end of the budget period had been 10 percent lower than the management’s<br />

figure, total recoverable amount would be 9 percent lower (EMEA 9.0 percent, Americas 10.0 percent, Asia Pacific 9.0 percent,<br />

Global Technologies 9.0 percent and Entrance Systems 10.0 percent).<br />

If the estimated growth rate to extrapolate cash flows beyond the budget period had been 10 percent lower than the<br />

starting assumption of 3 percent, total recoverable amount would be 4 percent lower (EMEA 4.0 percent, Americas 4.0<br />

percent, Asia Pacific 4.0 percent, Global Technologies 4.0 percent and Entrance Systems 4.0 percent).<br />

If the estimated weighted capital expenditure used for the Group’s discounted cash flow had been 10 percent higher than<br />

the starting assumption of 9.0 to 10.0 percent, total recoverable amount would be 13 percent lower (EMEA 13.0 percent,