Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASSA ABLOY<br />

Annual Report 2007<br />

76<br />

Note 16<br />

Americas 13.0 percent, Asia Pacific 13.0 percent, Global Technologies 13.0 percent and Entrance Systems 13.0 percent).<br />

These calculations are hypothetical and should not be viewed as an indication that these figures are any more or less<br />

likely to be changed. The sensitivity analysis should therefore be treated with caution.<br />

None of the hypothetical cases above would lead to an impairment of goodwill in a particular Cash-Generating Unit.<br />

2006<br />

If the estimated operating margin after the end of the budget period had been 10 percent lower than the management’s<br />

figure, total recoverable amount, and likewise the recoverable amount for HID Group, Architectural Hardware Group and<br />

Entrance Systems, would be 9 percent lower.<br />

If the estimated growth rate to extrapolate cash flows beyond the budget period had been 10 percent lower than the<br />

starting assumption of 3 percent, total recoverable amount, and likewise the recoverable amount for HID Group, Architectural<br />

Hardware Group and Entrance Systems, would be 6 percent lower.<br />

If the estimated weighted capital expenditure used for the Group’s discounted cash flow had been 10 percent higher<br />

than the starting assumption of 7.0 to 9.0 percent, total recoverable amount, and likewise the recoverable amount for HID<br />

Group, Architectural Hardware Group and Entrance Systems, would be 14 percent lower.<br />

These calculations are hypothetical and should not be viewed as an indication that these figures are any more or less<br />

likely to be changed. The sensitivity analysis should therefore be treated with caution.<br />

None of the hypothetical cases above would lead to an impairment of goodwill in a particular Cash-Generating Unit.<br />

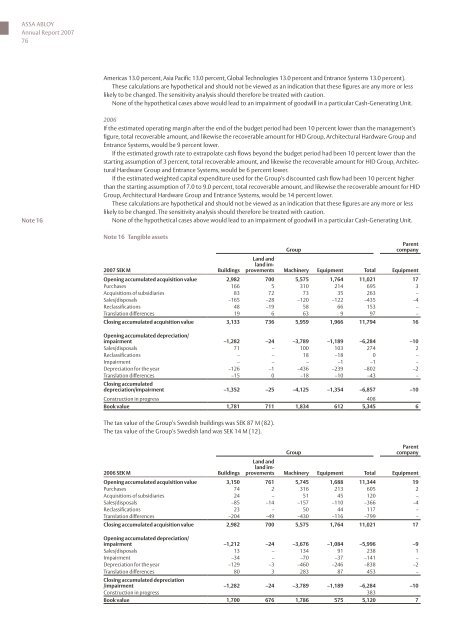

Note 16 Tangible assets<br />

2007 SEK M Buildings<br />

Group<br />

Parent<br />

company<br />

Land and<br />

land im-<br />

provements Machinery Equipment Total Equipment<br />

Opening accumulated acquisition value 2,982 700 5,575 1,764 11,021 17<br />

Purchases 166 5 310 214 695 3<br />

Acquisitions of subsidiaries 83 72 73 35 263 –<br />

Sales/disposals –165 –28 –120 –122 –435 –4<br />

Reclassifications 48 –19 58 66 153 –<br />

Translation differences 19 6 63 9 97 –<br />

Closing accumulated acquisition value 3,133 736 5,959 1,966 11,794 16<br />

Opening accumulated depreciation/<br />

impairment –1,282 –24 –3,789 –1,189 –6,284 –10<br />

Sales/disposals 71 – 100 103 274 2<br />

Reclassifications – – 18 –18 0 –<br />

Impairment – – – –1 –1 –<br />

Depreciation for the year –126 –1 –436 –239 –802 –2<br />

Translation differences –15 0 –18 –10 –43 –<br />

Closing accumulated<br />

depreciation/impairment –1,352 –25 –4,125 –1,354 –6,857 –10<br />

Construction in progress 408<br />

Book value 1,781 711 1,834 612 5,345 6<br />

The tax value of the Group’s Swedish buildings was SEK 87 M (82).<br />

The tax value of the Group’s Swedish land was SEK 14 M (12).<br />

2006 SEK M Buildings<br />

Group<br />

Parent<br />

company<br />

Land and<br />

land im-<br />

provements Machinery Equipment Total Equipment<br />

Opening accumulated acquisition value 3,150 761 5,745 1,688 11,344 19<br />

Purchases 74 2 316 213 605 2<br />

Acquisitions of subsidiaries 24 – 51 45 120 –<br />

Sales/disposals –85 –14 –157 –110 –366 –4<br />

Reclassifications 23 – 50 44 117 –<br />

Translation differences –204 –49 –430 –116 –799 –<br />

Closing accumulated acquisition value 2,982 700 5,575 1,764 11,021 17<br />

Opening accumulated depreciation/<br />

impairment –1,212 –24 –3,676 –1,084 –5,996 –9<br />

Sales/disposals 13 – 134 91 238 1<br />

Impairment –34 – –70 –37 –141 –<br />

Depreciation for the year –129 –3 –460 –246 –838 –2<br />

Translation differences 80 3 283 87 453 –<br />

Closing accumulated depreciation<br />

/impairment –1,282 –24 –3,789 –1,189 –6,284 –10<br />

Construction in progress 383<br />

Book value 1,700 676 1,786 575 5,120 7