Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ASSA ABLOY<br />

Annual Report 2007<br />

86<br />

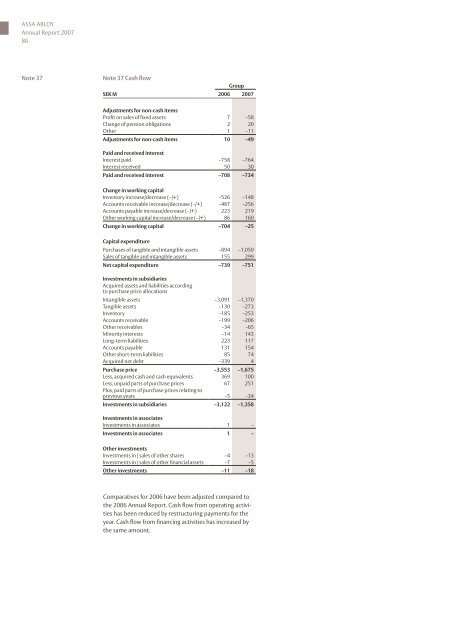

Note 37<br />

Note 37 Cash flow<br />

Group<br />

SEK M 2006 2007<br />

Adjustments for non-cash items<br />

Profit on sales of fixed assets 7 –58<br />

Change of pension obligations 2 20<br />

Other 1 –11<br />

Adjustments for non-cash items 10 –49<br />

Paid and received interest<br />

Interest paid –758 –764<br />

Interest received 50 30<br />

Paid and received interest –708 –734<br />

Change in working capital<br />

Inventory increase/decrease (–/+) –526 –148<br />

Accounts receivable increase/decrease (–/+) –487 –256<br />

Accounts payable increase/decrease (–/+) 223 219<br />

Other working capital increase/decrease (–/+) 86 160<br />

Change in working capital –704 –25<br />

Capital expenditure<br />

Purchases of tangible and intangible assets –894 –1,050<br />

Sales of tangible and intangible assets 155 299<br />

Net capital expenditure –739 –751<br />

Investments in subsidiaries<br />

Acquired assets and liabilities according<br />

to purchase price allocations<br />

Intangible assets –3,091 –1,370<br />

Tangible assets –130 –273<br />

Inventory –185 –253<br />

Accounts receivable –199 –206<br />

Other receivables –34 –65<br />

Minority interests –14 143<br />

Long-term liabilities 223 117<br />

Accounts payable 131 154<br />

Other short-term liabilities 85 74<br />

Acquired net debt –339 4<br />

Purchase price –3,553 –1,675<br />

Less, acquired cash and cash equivalents 369 100<br />

Less, unpaid parts of purchase prices<br />

Plus, paid parts of purchase prices relating to<br />

67 251<br />

previous years –5 –34<br />

Investments in subsidiaries –3,122 –1,358<br />

Investments in associates<br />

Investments in associates 1 –<br />

Investments in associates 1 –<br />

Other investments<br />

Investments in / sales of other shares –4 –13<br />

Investments in / sales of other financial assets –7 –5<br />

Other investments –11 –18<br />

Comparatives for 2006 have been adjusted compared to<br />

the 2006 Annual Report. Cash flow from operating activities<br />

has been reduced by restructuring payments for the<br />

year. Cash flow from financing activities has increased by<br />

the same amount.