You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

42<br />

Demand<br />

• Traffic<br />

For the first eleven months of 1999, blast furnace iron<br />

production output (roughly 491 million <strong>to</strong>nnes) fell by 0.6%<br />

over 1998. This fall was in line with the 2% drop in shipped<br />

iron ore <strong>to</strong>nnage occurring in the first half of 1999, although<br />

traffic picked up again in the second half.<br />

The same trend occurred in the coking coal transport<br />

market. The market is and will be further affected by<br />

Australia’s newfound dominance in market shares in<br />

Asia <strong>to</strong> the detriment of the United States (the country<br />

accounted for nearly 50% of world production in 1999).<br />

The US have lost market share in an effort <strong>to</strong> meet<br />

domestic demand, with the result of a lowering of the<br />

<strong>to</strong>nne/miles ratio.<br />

In steam coal, optimistic forecasts at the end of 1998 were<br />

revised downward and growth in this traffic will not exceed<br />

2% at the end of 1999. In France, the massive imports of<br />

1998 were not renewed, with nuclear electricity production<br />

proceeding without incident; the 12 million <strong>to</strong>nnes in 1998<br />

gave way <strong>to</strong> 6.5 million planned through the end of 1999.<br />

Australia and Indonesia <strong>to</strong>ok the largest parts of lost US<br />

market share.<br />

With the prospects of growth recovery mainly centered in<br />

Asia, energy demand - and therefore demand for steam coal<br />

that would result from this recovery - will probably not<br />

have any considerable impact in terms of <strong>to</strong>nne/miles ratios.<br />

Grain trade is as always a key fac<strong>to</strong>r for the freight market.<br />

In 1999, Asia <strong>to</strong>ok advantage of extremely low prices <strong>to</strong> buy<br />

massively in the US and in South America, which sparked<br />

a recovery in the Atlantic market and which benefited<br />

the Panamax sec<strong>to</strong>r the most. The 1999-2000 harvest<br />

should exceed the 1998-1999 harvest by 4%.<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Jan 96<br />

US$/day<br />

Apr 96<br />

Jul 96<br />

Oct 96<br />

Jan 97<br />

Apr 97<br />

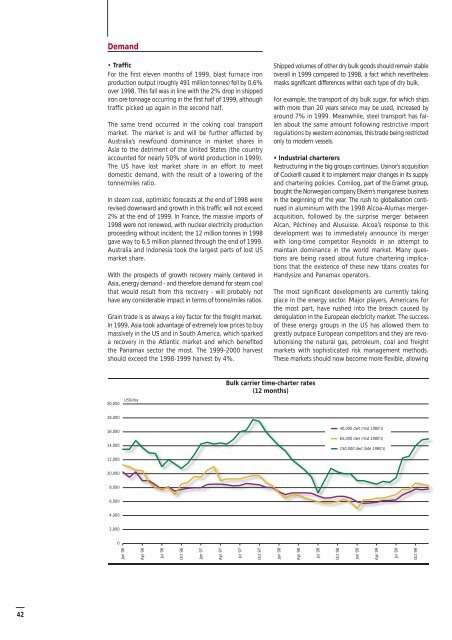

Bulk carrier time-charter rates<br />

(12 months)<br />

Jul 97<br />

Oct 97<br />

Shipped volumes of other dry bulk goods should remain stable<br />

overall in 1999 compared <strong>to</strong> 1998, a fact which nevertheless<br />

masks significant differences within each type of dry bulk.<br />

For example, the transport of dry bulk sugar, for which ships<br />

with more than 20 years service may be used, increased by<br />

around 7% in 1999. Meanwhile, steel transport has fallen<br />

about the same amount following restrictive import<br />

regulations by western economies, this trade being restricted<br />

only <strong>to</strong> modern vessels.<br />

• Industrial charterers<br />

Restructuring in the big groups continues. Usinor’s acquisition<br />

of Cockerill caused it <strong>to</strong> implement major changes in its supply<br />

and chartering policies. Comilog, part of the Eramet group,<br />

bought the Norwegian company Elkem’s manganese business<br />

in the beginning of the year. The rush <strong>to</strong> globalisation continued<br />

in aluminium with the 1998 Alcoa-Alumax mergeracquisition,<br />

followed by the surprise merger between<br />

Alcan, Péchiney and Alusuisse. Alcoa’s response <strong>to</strong> this<br />

development was <strong>to</strong> immediately announce its merger<br />

with long-time competi<strong>to</strong>r Reynolds in an attempt <strong>to</strong><br />

maintain dominance in the world market. Many questions<br />

are being raised about future chartering implications<br />

that the existence of these new titans creates for<br />

Handysize and Panamax opera<strong>to</strong>rs.<br />

The most significant developments are currently taking<br />

place in the energy sec<strong>to</strong>r. Major players, Americans for<br />

the most part, have rushed in<strong>to</strong> the breach caused by<br />

deregulation in the European electricity market. The success<br />

of these energy groups in the US has allowed them <strong>to</strong><br />

greatly outpace European competi<strong>to</strong>rs and they are revolutionising<br />

the natural gas, petroleum, coal and freight<br />

markets with sophisticated risk management methods.<br />

These markets should now become more flexible, allowing<br />

Jan 98<br />

Apr 98<br />

Jul 98<br />

Oct 98<br />

40,000 dwt (mid 1980's)<br />

65,000 dwt (mid 1980's)<br />

150,000 dwt (late 1980's)<br />

Jan 99<br />

Apr 99<br />

Jul 99<br />

Oct 99