You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

62<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Jan 94<br />

US$/MT<br />

Apr 94<br />

Jun 94<br />

Sep 94<br />

Dec 94<br />

Mar 95<br />

In all, forty-six new ships were ordered this year, rather<br />

meagre sales for shipbuilders, whose building prices are<br />

nonetheless at rock bot<strong>to</strong>m. Another fac<strong>to</strong>r influencing<br />

the strong growth in the fleet is the near <strong>to</strong>tal absence of<br />

scrapping; only five vessels displacing a <strong>to</strong>tal of 0.1 million<br />

<strong>to</strong>ns went <strong>to</strong> the scrapyards in the first ten months of the<br />

year, despite the bad freight market. In 1997, eight vessels<br />

were scrapped and only three in 1998.<br />

It is improbable that scrapping will increase massively<br />

over the next six months, but even if it were <strong>to</strong> occur, the<br />

world fleet would continue <strong>to</strong> grow in 2000. Current<br />

projections indicate fleet growth at 9% this year and<br />

shipowners will have <strong>to</strong> wait for 2001 or 2002 before<br />

observing a substantial slowing of the supply of new<br />

ships. It is interesting <strong>to</strong> note that the largest shipowners,<br />

in an effort <strong>to</strong> compensate for the overall weakness of<br />

the market, are continuing the trend of associations,<br />

mergers and the purchase of smaller well-established<br />

niche markets opera<strong>to</strong>rs.<br />

Simultaneously, we are witnessing large-scale mergers<br />

involving the big petroleum and chemical groups, including<br />

Mobil/Exxon, BP Amoco/Arco and TotalFina/Elf. With this<br />

type of shuffling occurring and showing little sign of<br />

abating, the future will be marked by progressively fewer<br />

players in both the shipowner and charterer areas.<br />

The chemical and small product carrier<br />

second-hand market<br />

May 95<br />

The chemical carrier second-hand market was also in the<br />

doldrums. The <strong>to</strong>tal number of transactions recorded in<br />

1999 was between 30 and 35 units, including small refined<br />

product carriers. This represents, in terms of number of<br />

sales, a decrease of 30% on 1998 and 50% on 1997.<br />

Another feature of this market is the near <strong>to</strong>tal au<strong>to</strong>nomy<br />

between Far East and Europe/US markets. Only two<br />

Aug 95<br />

Nov 95<br />

Feb 96<br />

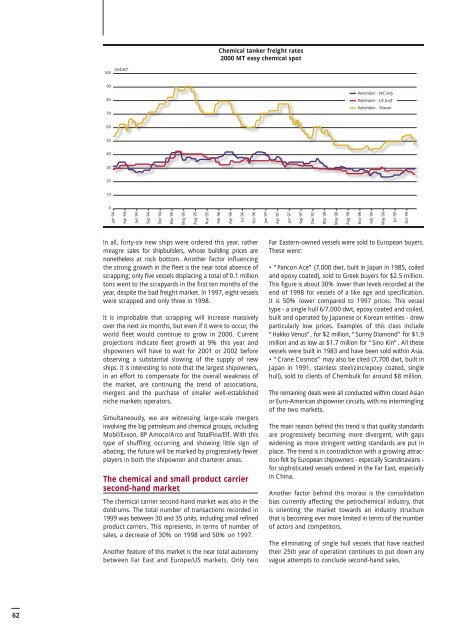

Chemical tanker freight rates<br />

2000 MT easy chemical spot<br />

Apr 96<br />

Jul 96<br />

Oct 96<br />

Jan 97<br />

Apr 97<br />

Jun 97<br />

Sep 97<br />

Dec 97<br />

Mar 98<br />

May 98<br />

Aug 98<br />

Rotterdam - WC Italy<br />

Rotterdam - US Gulf<br />

Rotterdam - Taiwan<br />

Far Eastern-owned vessels were sold <strong>to</strong> European buyers.<br />

These were:<br />

• “Pancon Ace” (7,000 dwt, built in Japan in 1985, coiled<br />

and epoxy coated), sold <strong>to</strong> Greek buyers for $2.5 million.<br />

This figure is about 30% lower than levels recorded at the<br />

end of 1998 for vessels of a like age and specification.<br />

It is 50% lower compared <strong>to</strong> 1997 prices. This vessel<br />

type - a single hull 6/7,000 dwt, epoxy coated and coiled,<br />

built and operated by Japanese or Korean entities - drew<br />

particularly low prices. Examples of this class include<br />

“Hakko Venus”, for $2 million, “Sunny Diamond” for $1.9<br />

million and as low as $1.7 million for “Sino Kin”. All these<br />

vessels were built in 1983 and have been sold within Asia.<br />

• “Crane Cosmos” may also be cited (7,700 dwt, built in<br />

Japan in 1991, stainless steel/zinc/epoxy coated, single<br />

hull), sold <strong>to</strong> clients of Chembulk for around $8 million.<br />

The remaining deals were all conducted within closed Asian<br />

or Euro-American shipowner circuits, with no intermingling<br />

of the two markets.<br />

The main reason behind this trend is that quality standards<br />

are progressively becoming more divergent, with gaps<br />

widening as more stringent vetting standards are put in<br />

place. The trend is in contradiction with a growing attraction<br />

felt by European shipowners - especially Scandinavians -<br />

for sophisticated vessels ordered in the Far East, especially<br />

in China.<br />

Another fac<strong>to</strong>r behind this morass is the consolidation<br />

bias currently affecting the petrochemical industry, that<br />

is orienting the market <strong>to</strong>wards an industry structure<br />

that is becoming ever more limited in terms of the number<br />

of ac<strong>to</strong>rs and competi<strong>to</strong>rs.<br />

The eliminating of single hull vessels that have reached<br />

their 25th year of operation continues <strong>to</strong> put down any<br />

vague attempts <strong>to</strong> conclude second-hand sales.<br />

Nov 98<br />

Feb 99<br />

May 99<br />

Jul 99<br />

Oct 99